Heads turning towards Malaysia 2Q22 GDP

Market Review

Malaysia:. The FBM KLCI (+0.9%) staged a sharp recovery on gains in more than two-thirds of the key index components as investors breathe a sigh of relief from the cool down of inflation rate in the US. The lower liners advanced, while the healthcare sector (-0.7%) was the sole underperformer on the broader market

Global markets:. Wall Street turned wobbly as the Dow (+0.1%) managed to hold onto its intraday gains, but the S&P 500 (-0.1%) and Nasdaq (-0.6%) fell after the Producer Price Index for July 2022 unexpectedly fell -0.5% MoM. The European stock markets ended mixed, while the Asia stock markets closed mostly higher.

The Day Ahead

The FBM KLCI climbed above the psychological 1,500 level amid positive regional market sentiment as investors cheered that the inflation is cooling off in the US for June. Whilst the market has stabilised along 1,500, we believe the profit taking activities may pick up with the mixed trading tone on Wall Street overnight, following a drop in PPI data. Hence, broader market may take a breather for the short term; especially the technology sector. Commodities wise, the Brent oil is trading higher towards the USD100 mark, while the CPO price headed above RM4,290.

Sector focus:. The energy sector may see some positive move along with the higher Brent crude oil prices. Meanwhile, the technology sector might see mild profit taking following yesterday’s strong surge. Ahead of the earnings season, traders may position within the consumer, banking, furniture and plantation sectors.

FBMKLCI Technical Outlook

The FBM KLCI surged above the key 1,500 level as the key index rallied above its daily EMA9. Technical indicators were mixed as the MACD Histogram formed a negative bar, while the RSI hovered above 50. Next resistance is pegged along 1,530-1,560, while the support is located at 1,460-1,480.

Company Brief

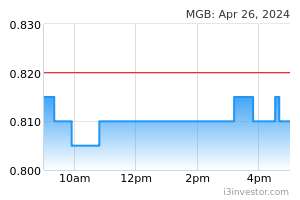

MGB Bhd’s wholly owned subsidiary, MGB Construction & Engineering Sdn Bhd has secured a construction contract worth RM172.3m in Dengkil, Selangor. The contract is for the construction of two blocks of 24-storey service apartments comprising 843 units and 211 affordable units. (The Star)

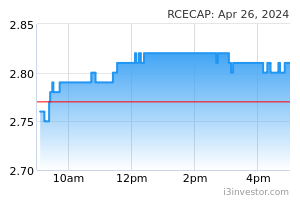

RCE Capital Bhd’s 1QFY23 net profit declined 8.9% YoY to RM32.3m, due to higher allowances for impairment loss on receivables. Revenue for the quarter fell 0.5% YoY to RM77.7m. (The Star)

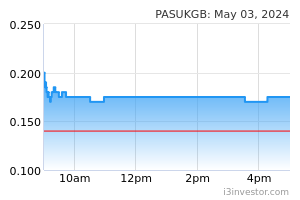

Pasukhas Group Bhd has secured a contract worth RM7.1m for concrete substructure works for the head building of Dexcom Malaysia Factory 3 Project, Penang. The date of commencement of the work is on 31st August 2022 and the final acceptance date is on 9th January 2023. (The Edge)

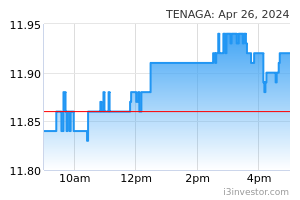

KPower Bhd has secured a 4-year extension of its power purchase agreement with Tenaga Nasional Bhd relating to the development of a 50.0-MW solar photovoltaic plant in Pekan, Pahang. The extension of the tenure to 25 years from 21 years was informed by the Energy Commission in a letter to the renewable energy group's 95.0%-owned subsidiary PKNP KPower Suria Sdn Bhd. (The Edge)

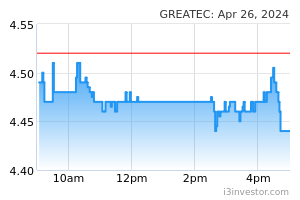

Greatech Technology Bhd has entered into a Memorandum of Understanding (MoU) in relation to the proposed acquisition of a 60.0% equity interest in Irish automation specialist Kaon Automation Ltd. (The Edge)

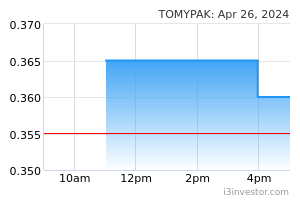

Tomypak Holdings Bhd has proposed to acquire a Johor-based packaging manufacturer, EB Packaging Sdn Bhd for RM120.0m to bolster its packaging manufacturing capacity which was affected by a fire incident. (The Edge)

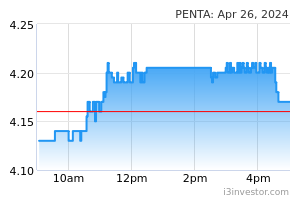

Pentamaster Corp Bhd’s 2QFY22 net profit 2022 rose 7.1% YoY to RM19.2m, underpinned by higher contribution from its automated test equipment and factory automation solutions segments. Revenue for the quarter added 15.8% YoY to RM151.3m. (The Edge)

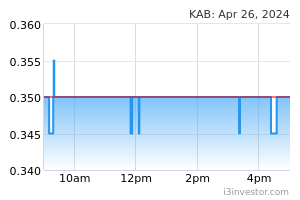

Kejuruteraan Asastera Bhd has secured a Letter of Intent for a RM16.7m subcontract to undertake electrical services installation works for the proposed 44- storey Bon Kiara condominium project in Mont Kiara. It secured the LOI from Land Marker Sdn Bhd, a subsidiary of Bon Estates Sdn Bhd. (The Edge)

Malaysia Pacific Corp Bhd has announced that trading of its shares will be suspended with effect from 19th August 2022, following Bursa Securities' rejection of its request for a further extension of time to submit its regularisation plan. The property group faces the risk of being delisted on 23rd August 2022 unless it files an appeal against the delisting by 18th August 2022. (The Edge)

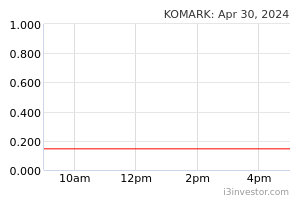

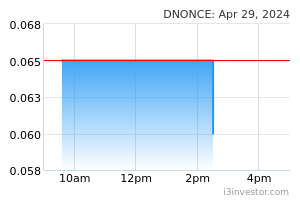

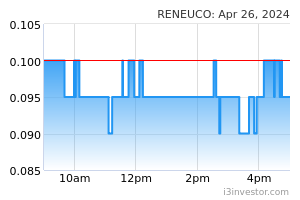

D'nonce Technology Bhd is buying a loss-making self-adhesive labels manufacturing unit from Komarkcorp Bhd for RM9.1m to diversify into the labelling business. The group also proposed to undertake a 1-for-1 rights issue, with 1 free five-year warrant for every rights share, raising up to RM43.5m based on an indicative issue price of 10 sen per rights share. (The Edge)

Source: Mplus Research - 12 Aug 2022