Still inching higher

Market Review

Malaysia:. The FBM KLCI (+0.2%) managed to eke out marginal gains at the eleventh hour of the trading session, spurred by gains in selected banking and Petronas-related heavyweights. The lower liners, however, retreated, while the broader market ended mixed with the technology sector (-1.9%) underperformed.

Global markets:. Wall Street rebounded from a choppy session as the Dow (+0.3%) rose ahead of the earnings release by the mega-cap technology stocks like Apple, Amazon, Microsoft and Meta later this week. The European stock markets ended mostly higher, but Asia stock markets closed mostly negative.

The Day Ahead

The FBM KLCI outperformed the regional peers as the key index gained momentum in the final trading hour, supported by influx of foreign funds. Although the market sentiment has been improving over the past few sessions, we reckon that the investors may remain cautious ahead of the US Fed’s interest rate decision and could take a breather in view of the mixed performances on Wall Street overnight. Commodities wise, both the crude oil and CPO prices trended mildly higher, trading above USD105 and RM3,700 respectively.

Sector focus:. We expect trading activities to revolve around the sectors such as consumer and banking stocks due to its defensive characteristic as well as the interest up-cycle environment. Besides, the healthcare sector may see some buying interest after Singapore reported more cases on monkeypox. On the flip side, selected technology stocks may pullback following the performance in Nasdaq.

FBMKLCI Technical Outlook

The FBM KLCI climbed for the fourth straight session and the key index formed a hammer candle. Technical indicators remained positive as the MACD Histogram has extended a positive bar, while the RSI hovered above 50. Resistance is envisaged along 1,480-1,500, while the support is pegged around 1,400-1,410.

Company Brief

Cycle & Carriage Bintang Bhd’s (C&C) 2QFY22 net profit stood at RM6.5m vs. a net loss of RM1.8m recorded in the previous corresponding quarter, owing to the reopening of the domestic economy as the group saw increased vehicle unit sales and notably, after sales volume. Revenue for the quarter grew 32.6% YoY to RM320.6m. (The Star)

Comintel Corp Bhd wholly-owned subsidiary, Total Package Work Sdn Bhd has secured a construction contract worth RM52.8m from Mightyprop Sdn Bhd. The contract covers the construction and completion of piling, pile cap and lowest basement works in respect of a proposed development. The contract shall commence on 1st August 2022 and to be completed within 9 months from the commencement date. (The Star)

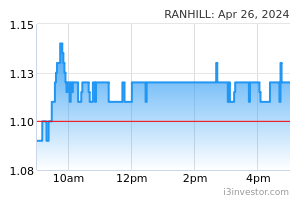

Ranhill Utilities Bhd announced that its subsidiary, Ranhill Worley Sdn Bhd (RWSB), has secured a RM18.0m contract from Malaysia Marine and Heavy Engineering Sdn Bhd (MMHE) unit, Perunding Ranhill Worley Sdn Bhd (PRW) to perform front end engineering design (FEED) for Kasawari carbon capture and storage project (CCS). Duration of work is 7 months with the winner of FEED phase to be selected by Petronas at the end of 2022. (The Star)

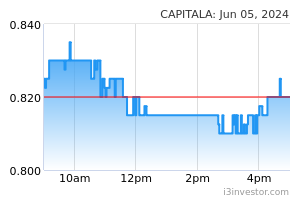

Capital A Bhd carried 5.6m passengers in 2Q22 (+48.0% QoQ), supported by growing domestic demand and the resumption of international travel in Southeast Asia as Malaysia and its neighbouring countries in the region reopened their international borders. (The Edge)

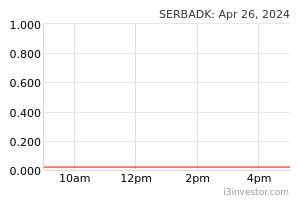

Serba Dinamik Holdings Bhd has announced that its creditors have approved the scheme of arrangement proposed by the group and its four subsidiaries, with between 83.0-100.0% creditors voting in support of it. Under the scheme of arrangement, creditors will get 15.0% of what is owed by Serba Dinamik, Serba Dinamik Group Bhd, Serba Dinamik Sdn Bhd, with the balance to be worked out in another scheme of arrangement possibly by the end-2022. (The Edge)

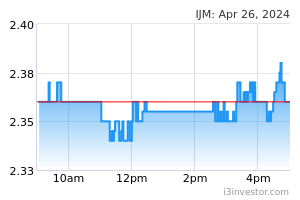

IJM Corp Bhd clarified that it has no intention to dispose of its portfolio of highway concession assets to private, not-for-profit entity Amanat Lebuhraya Rakyat. Nonetheless, IJM is in advanced discussions with the government to restructure its toll highway concessions. (The Edge)

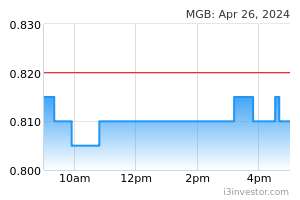

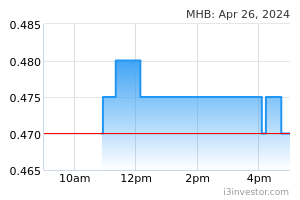

MGB Bhd has secured a RM225.0m contract from Akitek Akiprima Sdn Bhd (AASB) for a housing development project in Bandar Putra Permai, Petaling, Selangor. With this latest contract, MGB outstanding order book now stands at RM2.08bn. (The Edge)

Berjaya Assets Bhd (BAssets) has inked an option agreement with Extreme Broadband Sdn Bhd (EBSB) for the latter to acquire 72 units in Menara MSC Cyberport, Johor Bahru for RM69.6m. The option is part of a rent-cum-option to purchase agreement signed between the two parties, which also entails BAssets leasing out of 42 units to EBSB for RM250,000 per month. Meanwhile, the remaining 30 out of the 72 units are already leased out. (The Edge)

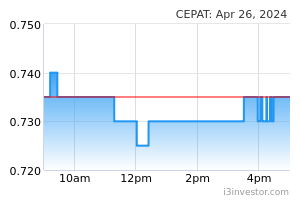

Cepatwawasan Group Bhd’s 2QFY22 net profit rose 66.9% YoY to RM15.8m, due to a substantial increase in average fresh fruit bunch (FFB) selling price which outweighed the impact of a decrease in its plantation segment's FFB production. Revenue for the quarter grew 31.8% YoY to RM107.3m. (The Edge)

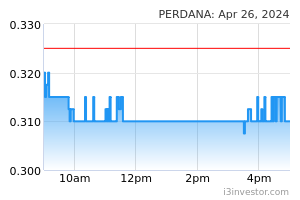

Perdana Petroleum Bhd has bagged a vessel chartering contract worth about RM2.6m for the provision of a unit of accommodation work barge (AWB) for an offshore project. The contract with Two Offshore Marine Sdn Bhd commenced on 4th July 2022 is for a duration of up to 39 days, with an option to extend up to 30 days. (The Edge)

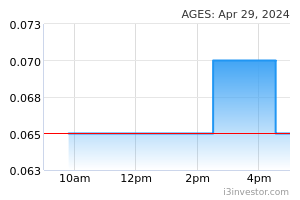

Ageson Bhd, whose share price surged 67.0% in the last two weeks, told Bursa Malaysia that it is not aware of any corporate development relating to the group's business and affairs that would have caused the sharp rise in price and volume of the company's shares recently. (The Edge)

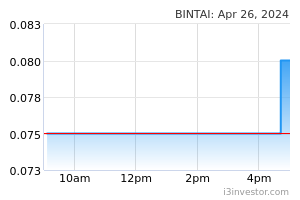

Bintai Kinden Corp Bhd has inked a Memorandum of Understanding (MOU) with Medical Renewable Care Company under the trade name Nouveta to explore collaboration providing mechanical and engineering solutions and services to the healthcare industry of Saudi Arabia. (The Edge)

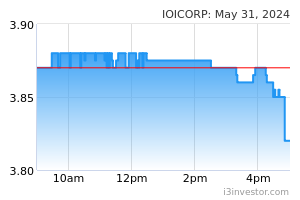

IOI Corp Bhd has obtained a green trade finance facility from United Overseas Bank (Malaysia) Bhd that will help the group to promote sustainable palm oil and strengthen the global sustainable palm oil supply chain. The facility will be channelled towards IOI’s sourcing of certified palm oil to support its downstream resource-based manufacturing business as well as its business partners’ activities. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) has appointed the interim chairman of Malaysian Communications and Multimedia Commission (MCMC) Tan Sri Mohamad Salim Fateh Din as its independent and non-executive director, together with former Deloitte Southeast Asia's director Cheryl Khor Hui Peng. (The Edge)

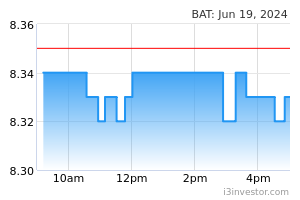

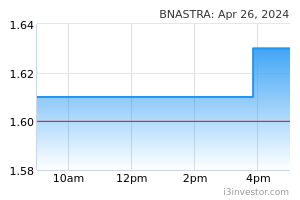

British American Tobacco (Malaysia) Bhd (BAT Malaysia) has announced that the Ministry of Health's (MOH) proposed generational smoking ban is a prohibitive way to reduce the health impact of smoking in the country and will only fuel the illicit tobacco market which already accounts for almost 60.0% of tobacco sold in Malaysia. (The Edge)

Source: Mplus Research - 26 Jul 2022