Recovery tone setting up

Market Review

Malaysia:. The FBM KLCI (+0.6%) took cue from gains on Wall Street overnight, driven by gains in Petronas-related, telco and plantation heavyweights. The lower liners also advanced, while all the 13 major sectors on the broader market closed in green, led by the technology sector (+2.1%) on bargain hunting activities.

Global markets:. US stock markets edged higher as the Dow (+0.2%) rose on solid corporate earnings from Netflix, Tesla and Alcoa. The European stock markets retreated after the Italian government is in brink of collapse as Prime Minister Mario Draghi fell short in a confidence vote, while Asia stock markets ended higher.

The Day Ahead

The FBM KLCI climbed in line with the broadly-positive sentiment from the regional markets. Investors should see a positive-bias trading tone on the local bourse following the extension of rebound on Wall Street, supported by bargain hunting activities on significantly oversold stocks over the past few weeks. For commodities, the Brent crude oil is still trading above its SMA200 and USD100 zone around the USD106-107 level, while the CPO price was little changed around RM3,900. Nevertheless, we foresee the CPO price to remain under pressure for 2H22 after Indonesia’s government ramped up export.

Sector focus:. The technology sector should see further improvement in trading activities after another positive session in Nasdaq following the release of earnings reports from several corporates. Besides, the energy sector should remain upbeat as oil price stabilised along USD106.

FBMKLCI Technical Outlook

The FBM KLCI rallied and the key index remained above its daily EMA9. Technical indicators are on a recovering tone. The MACD Indicator has extended another positive bar, while the RSI is recovering towards 50. Resistance is located at 1,460- 1,480, while the support is set along 1400-1,420.

Company Brief

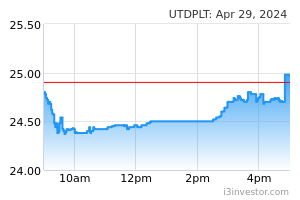

United Plantations Bhd’s 2QFY22 net profit grew 36.0% YoY to RM184.6m, amid elevated crude palm oil (CPO) prices. Revenue for the quarter increased 45.5% YoY to RM701.3m. (The Star)

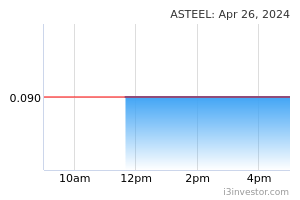

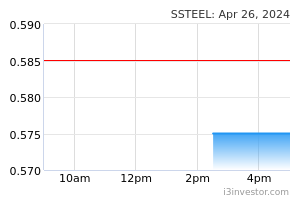

Southern Steel Bhd (SSB) has been affirmed by the Singapore Court of Appeal (COA) to receive RM82.6m from Italian plant maker Danieli & C Officine Meccaniche, but the COA set aside the RM176.3m in damages awarded by a Singapore Tribunal. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) saw its total domestic passenger movements recorded 6.8x YoY surge to 20.3m passengers in 1H22. For June 2022, Malaysia’s total passenger traffic movements came in at 4.5m passengers, making up 63.0% of the group’s total passenger movements of 7.2m, which included Istanbul Sabiha Gokcen International Airport (SGIA). (The Edge)

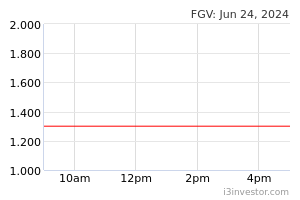

FGV Holdings Bhd will proceed with the recruitment of 1,210 workers from Indonesia as part of the company's earlier arrangement, despite Indonesia imposing a temporary freeze on sending migrant workers to Malaysia. (The Edge)

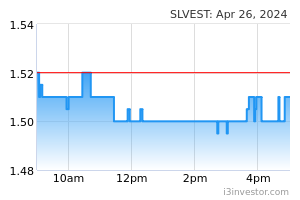

Solarvest Holdings Bhd has inked a Memorandum of Understanding (MoU) with property developer NCT Land Sdn Bhd to jointly develop 1,000 units of solar-ready factories and warehouses in Selangor Smart Industrial Park to reduce industrial and commercial carbon footprints. (The Edge)

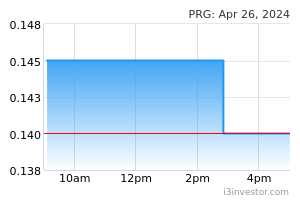

PRG Holdings Bhd’s 54.2%-owned subsidiary Furniweb Holdings Ltd has entered into an MoU with NCT Land Sdn Bhd to explore the viability of a smart energy efficiency solution for the latter’s development project in Kuala Langat, Selangor. (The Edge)

YKGI Holdings Bhd plans to raise up to RM5.5m in a proposed private placement of up to 48.1m shares or 10.0% of the total number of issued shares, at an issue price to be determined later. Proceeds will be used for working capital, with an estimated 70.0% of proceeds to be spent on raw materials and payment to suppliers, while the balance 30.0% will be for general operating and other administrative expenses. (The Edge)

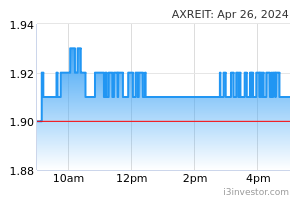

Axis Real Estate Investment Trust's (Axis REIT) 2QFY22 net property income rose 18.3% YoY to RM63.2m, owing mainly to higher property and profit income. Revenue for the quarter added 20.1% YoY to RM72.5m. A second interim income distribution of 2.55 sen per unit, payable on 30th August 2022 was declared. (The Edge)

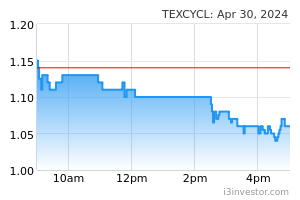

Tex Cycle Technology (M) Bhd's joint venture unit EFS MySolar (Thailand) Co Ltd has inked a 20-year solar power purchase agreement with Thailand-based Bothong Rubber Fund Cooperative Ltd. EFS MySolar will design, construct, install, own, operate and maintain a solar photovoltaic energy generating system with capacity of 999.2-kw of electricity at the premises of Bothong Rubber Fund. (The Edge)

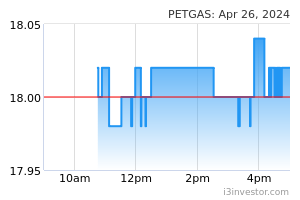

Petronas Gas Bhd's (PetGas) wholly owned subsidiary Regas Terminal (Sg Udang) Sdn Bhd (RGTSUSB) is seeking expressions of interest from shipping licensees for regasification capacity at RGTSUSB's Melaka regasification facility, to gauge potential demand in 2023 for regasification, which converts liquefied natural gas to natural gas. (The Edge)

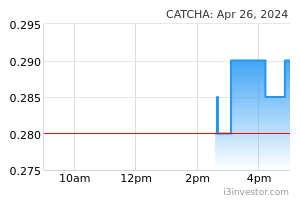

Catcha Digital Bhd has received approval from shareholders for its long-awaited regularisation plan. Upon the completion of the regularisation plan, the group will have its Guidance Note 2 status lifted and will begin to execute its strategic plan in the digital and technology industry in Southeast Asia. (The Edge)

Malaysian Genomics Resource Centre Bhd (MGRC) and UCrest Bhd have signed a collaborative agreement to integrate genomic testing services into digital health platform iMedic. Under the agreement, a virtual genome service centre will be developed on iMedic, enabling the genomic testing services of MGRC to be made available to hospitals and clinics, widening its market access in both Malaysia and globally. (The Edge)

Sapura Resources Bhd's independent director Ahmad Jauhari Yahaya, 68, has been redesignated as its new chairman effective 20th July 2022, replacing Tan Sri Datuk Amar Dr Hamid Bugo who has helmed the group since April 2016 and has been redesignated as non-independent and non-executive director. (The Edge)

Eonmetall Group Bhd expects demand for steel racking systems to be robust on the back of soaring e-commerce growth propelled by the Covid-19 pandemic as such businesses would need to set up more warehouses. (The Edge)

Source: Mplus Research - 21 Jul 2022