Market Review

Malaysia:. The FBM KLCI (-0.2%) retreated on quick profit taking activities with more than half of the key index components ended in the red yesterday. Both the lower liners and broader market, however, turned mixed with the latter saw the healthcare sector (+2.6%) outperformed amid rising Covid cases across the globe.

Global markets:. Wall Street ended mixed as the Dow (+0.3%) rose, but the S&P 500 (-0.1%) and Nasdaq (-0.03%) edged mildly lower after US Federal Reserve Chairman Jerome Powell announced that US economy is well position to withstand tighter monetary policy. Both the European and Asia stock markets closed in the red. The Day Ahead The FBM KLCI dipped following three straight winning sessions, taking cue from the negative regional markets. The local bourse may see further volatility amid the quarter-end rebalancing activities. Meanwhile, new ceiling price for chicken to be set at RM9.40 per kg may be mildly positive for the poultry players, albeit the capping price is RM0.50 higher than the previous level. Commodities wise, the crude oil price dropped to USD116 per barrel mark, while the gold price extended its decline amid firmer US Dollar.

Sector focus:. We expect further volatility in risky sectors such as technology amid the rebalancing activities. Meanwhile, traders may focus on the healthcare sector due to the rising daily Covid-19 cases. Also, there might be some trading interest within the poultry related stocks as government set higher ceiling price for chicken.

FBMKLCI Technical Outlook

The FBM KLCI booked marginal losses after a choppy session, closing just around its daily EMA9 level. Technical indicators remained mixed as the MACD Histogram has extended a positive bar, while the RSI hovered below the 50 level. Resistance is set along 1,480-1,500, while the next support level is pegged at 1,400-1,430.

Company Brief

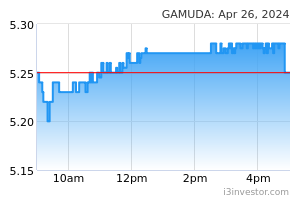

Gamuda Bhd’s 3QFY22 net profit surged 56.1% YoY to RM221.5m, attributable to better performance from its construction and property divisions. Revenue for the quarter rose 21.5% YoY to RM1.18bn. (The Star)

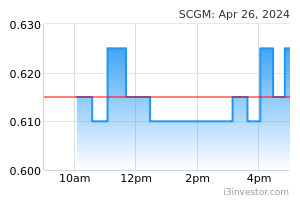

SCGM Bhd’s 4QFY22 net profit rose 11.1% YoY to RM8.5m on upward adjustment in selling prices. Revenue for the quarter climbed 8.8% YoY to RM71.5m. A fourth interim dividend of 1.32 sen per share, payable on 29th July 2022 was declared. (The Star)

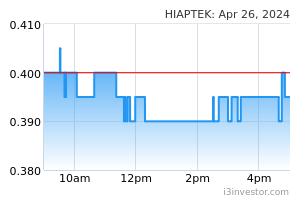

Hiap Teck Venture Bhd’s 3QFY22 net profit contracted 51.1% YoY to RM32.2m, on lower share of profit from its joint venture (JV) entity and lower profit margin for the downstream operating subsidiaries as a result of higher costs of inventories. Revenue for the quarter, however, grew 38.6% YoY to RM457.0m. (The Star)

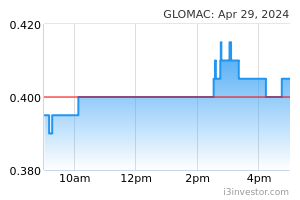

Glomac Bhd's 4QFY22 net profit jumped 176.7% YoY to RM15.1m, on improved project margins. Revenue for the quarter, however, fell 36.6% YoY to RM73.6m. A dividend of 1.5 sen per share for the quarter was proposed. (The Edge)

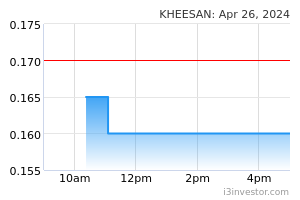

Khee San Bhd and 9 of the candy maker’s directors have been publicly reprimanded by Bursa Malaysia Securities Bhd for the late disclosure of its April 2019 default payments, baseless solvency representation, and non-disclosure of the executive role played by its then-non-executive chairman Datuk Seri Liew Yew Chung in 2017-2019. In addition to the bourse operator’s public reprimand, a total of RM885,000 in fines have been imposed on the 9 directors. (The Edge)

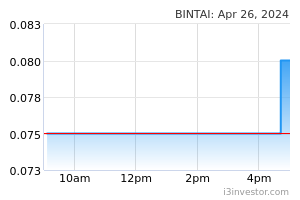

Bintai Kinden Corp Bhd is partnering with Marafie Industrial Co to supply piping materials to oil and gas (O&G) related companies in Saudi Arabia. Marafie is a company providing total solutions to complicated fabrication projects, from the sales and bidding of the project, to construction engineering, scheduling, quality assurance, logistics, and follow-ups with customers. (The Edge)

Source: Mplus Research - 30 Jun 2022