Muted performance

Market Review

Malaysia:. The FBM KLCI ended on a flattish mode after see-sawing between mild gains and losses yesterday. The lower liner, however, ended mixed, while the broader market closed mostly negative with the energy sector (-1.1%) underperformed after Brent oil prices hovered around the USD110.

Global markets:. Wall Street advanced as the Dow (+0.6%) rose on higher risk appetite for equities following the decline in treasury yields. The European stock markets, however, remained downbeat after reversing all their intraday gains, while Asia stock markets closed mostly higher.

The Day Ahead

The FBM KLCI finished little changed amid positive-bias regional performances. While the overnight gains on Wall Street may spill over to the local bourse, we reckon any gains should be short-lived on the back of mounting concerns over potential recession as well as the inflationary pressure that may hit corporate earnings going forward. Commodity wise, the Brent oil prices continued to retreat, settled around USD110 per barrel mark, while the CPO price saw mild improvement around RM4,750. Nevertheless, the surging fertiliser cost and worker shortages may be several challenges that is facing by the farmers.

Sector focus:. The energy and plantation stocks are likely to remain volatile over the near term, as selling pressure arising from declining commodity prices interspersed with the bargain hunting activities. On the other hand, we still favour defensive sectors such as the consumer, banking and REITs sectors.

FBMKLCI Technical Outlook

The FBM KLCI continued to hover along its 52-week low amid lacklustre trading. Technical indicators remained negative the MACD Histogram extended a negative bar, while the RSI remained below the oversold 30 level. Support is set along 1,400- 1,420, while the resistance is located at 1,450-1,480.

Company Brief

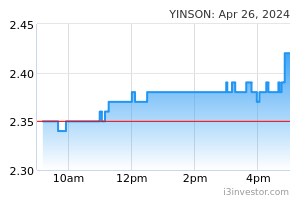

Yinson Holdings Bhd’s net profit grew 7.1% YoY to RM120.0m, mainly due to the commencement of engineering, procurement, construction, installation and commission (EPCIC) business activities for floating production storage and offloading (FPSO) Maria Quitéria and higher contribution from FPSO operations. Revenue for the quarter rose 0.8% YoY to RM1.00bn. (The Star)

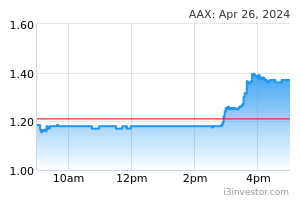

AirAsia X Bhd (AAX) has appointed Farouk Kamal as an independent non-executive director, effective immediately, following the company’s recent confirmation of a new strategy to transform low-cost, long-haul air travel. Farouk is currently the chief investment officer of Urusharta Jamaah Sdn Bhd (UJ). He is part of UJSB’s pioneer team responsible for the management of assets worth over RM10.0bn. (The Star)

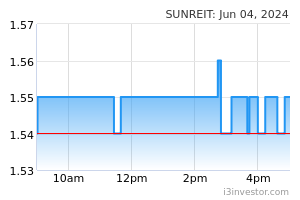

Sunway REIT Management Sdn Bhd, the manager of Sunway Real Estate Investment Trust (Sunway REIT) has proposed to acquire 2 contiguous parcels of land together with the existing buildings erected thereon in Petaling Jaya for RM60.1m. The property sits on a 3.6-ac. freehold industrial land which consists of a double-storey building and a five-storey building, with a total gross floor area (GFA) of 497,487 sqf. The proposed acquisition will be fully funded by Sunway REIT’s existing debt programme and is expected to be completed in 2H22. (The Star)

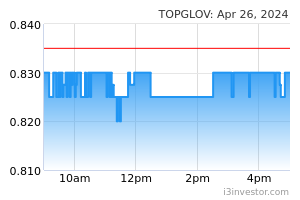

Top Glove Corp Bhd is deferring its rubber glove output capacity expansion and is focusing instead on vertical and horizontal integration initiatives which include ownership of a gamma sterilisation facility, nitrile butadiene rubber latex plant and glove former factory, all of which will cater for Top Glove's internal consumption. (The Edge)

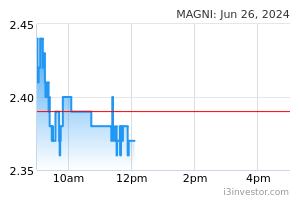

Magni-Tech Industries Bhd’s 4QFY22 net profit fell 12.2% YoY to RM26.9m, as revenue declined on lower sales orders received in both its garment and packaging segments. Revenue for the quarter dropped 13.2% YoY to RM258.3m. A third interim dividend of 2.5 sen per share, payable on 20th July 2022 was declared. (The Edge)

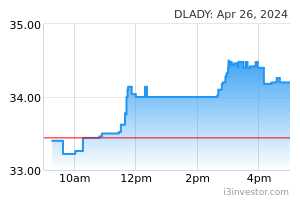

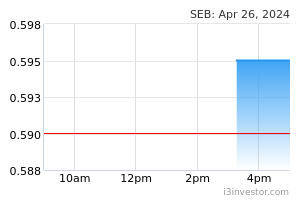

Seremban Engineering Bhd (SEB) has won a contract to undertake civil, structural and architectural, as well as mechanical, electrical and plumbing, works for Dutch Lady Milk Industries Bhd’s manufacturing plant in Nilai, Negeri Sembilan. The contract is worth RM172.6m. (The Edge)

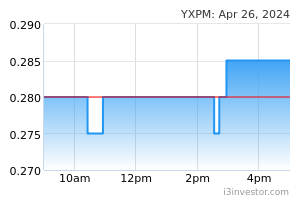

Global interest rate hike-driven recession concerns appeared to have taken the glitter off YX Precious Metals Bhd (YXPM) as its share price closed below its initial public offering (IPO) price of 28.0 sen on its first day of trading on Bursa Malaysia's ACE Market. (The Edge)

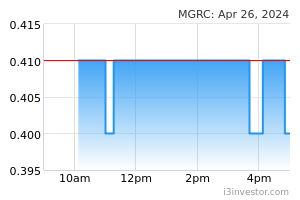

Malaysian Genomics Resource Centre Bhd (MGRC) is acquiring a 51.0% stake in Aquahealth Sdn Bhd, a kidney dialysis operator, from Rinani Renal Bhd. The genomics and biopharmaceutical specialist will now become the operator of the dialysis centre. (The Edge)

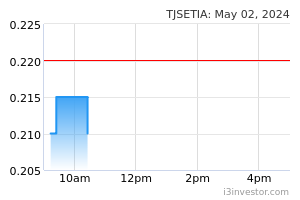

Tuju Setia Bhd is tendering for RM2.80bn worth of projects to build high-rise and industrial buildings, as well as hospitals and healthcare facilities. Despite the higher prices of building materials such as steel and concrete, there are still active tenders for essential buildings. (The Edge)

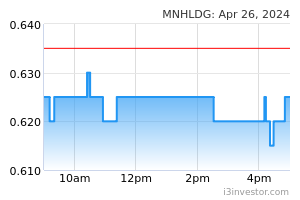

MN Holdings Bhd has bagged 4 new contracts for its substation engineering and underground utilities services and solutions business segments worth a combined RM27.0m. One of contracts secured by its unit MN Power Transmission Sdn Bhd was to carry out design and construction works for the extension of 2 air insulated substations in Raub, Pahang for RM16.9m. (The Edge)

Source: Mplus Research - 24 Jun 2022