Trudging lower

Market Review

Malaysia:. The FBM KLCI (-1.1%) reversed all its previous session gains, taking cue from weakness on Wall Street overnight as the key index slipped -2.5% WoW. The lower liners sank lower, while the construction sector (+1.7%) was the sole winner on the negative broader market.

Global markets:. Wall Street ended mixed as the Dow (-0.1%) edged mildly lower on a choppy trading session, but the S&P 500 (+0.2%) and Nasdaq (+1.4%) advanced on bargain hunting activities in beaten down technology stocks. The European stock markets ended mixed, but Asia stock markets closed mostly negative.

The Day Ahead

The FBM KLCI extended its whipsaw moves on Friday in a broad sell-off amid growing worries on inflationary pressure and recession fears. As sentiment on Wall Street remained fragile following the mixed performance overnight, we foresee investors to remain cautious in the near future. Any of the rebound move is likely to be short-lived as traders might be adopting a selling-into-strength strategy for now. The head of NATO warned of a long Russia-Ukraine war, which may prolong inflation and further derail global economic recovery. On the commodities market, the Brent oil price traded below USD115, while the CPO price hovered below RM5,500.

Sector focus:. Investors may stay defensive to invest within the REITs and consumer stocks as volatility continue to strike the market. Meanwhile, we expect traders to pick up based down stocks within the technology sector given the overnight rebound on Nasdaq.

FBMKLCI Technical Outlook

The FBM KLCI reached a new 52-week low on Friday on the back of heightened selling pressure. Technical indicators remained negative as the MACD Histogram has extended a negative bar, while the RSI hovered below the oversold 30 level. Support is located along 1,430-1,450, while the resistance is set at 1,500-1,530.

Company Brief

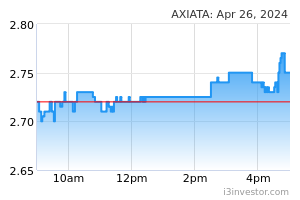

Axiata Group Bhd and Digi.com Bhd have mutually agreed to extend the long stop date of their share purchase agreement (SPA) for the proposed merger of Celcom Axiata Bhd and Digi. The new date is on 31st December 2022, from 21st June 2022 all other terms and conditions of the SPA remain unchanged. (The Star)

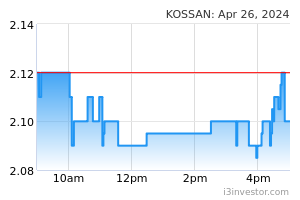

Kossan Rubber Industries Bhd founder Tan Sri Lim Kuang Sia had in recent days raised his indirect stake in the rubber glove manufacturer after buying 7.1m shares in his first Kossan share buy in about three months after the Employees Provident Fund (EPF) sold Kossan shares on the open market as investors evaluated the impact of the Covid-19 vaccine-led economic recovery on the rubber glove manufacturing sector. (The Edge)

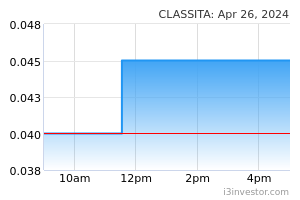

Datuk Jovian Mandagie has reported that Caely Holdings Bhd made a false announcement to Bursa Malaysia on 14th June 2022 regarding his alleged appointment as the executive vice chairman (EVC) of the company because there were no agreements indicating his acceptance of the appointment. Mandagie, however, admitted that he attended a meeting with Caely representative Datuk Loh Ming Choon on 20th June 2022 to discuss a potential collaboration with Caely. Notably, Jovian is the son-in-law of Prime Minister Datuk Seri Ismail Sabri Yaakob. (The Edge)

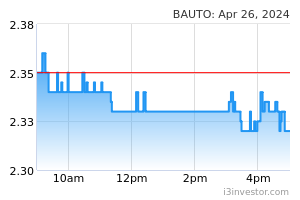

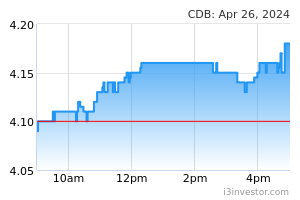

Bermaz Auto Bhd issued a fourth tranche of sukuk wakalah totalling RM100.0m, under its RM500.0m Islamic Commercial Papers (ICPs) programme, with the sukuk having a tenure of 6 months from the date of issuance. The proceeds raised may be used for refinancing existing financing or debt obligations (including any maturing sukuk wakalah) as well as for working capital and investment purposes. (The Edge)

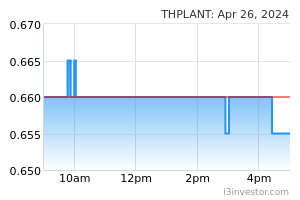

TH Plantations Bhd has completed the lodgement of a sukuk wakalah programme of up to RM1.08bn in nominal value with the Securities Commission Malaysia. The programme will have a perpetual tenure, with the proceeds of each sukuk wakalah issued under the programme utilised to finance or refinance any existing or future Islamic financing of the issuer. The proceeds will also be used to finance TH Plantations group's shariah-compliant business operation and for working capital purposes. (The Edge)

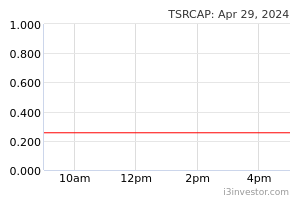

TSR Capital Bhd is disposing of a property in Port Dickson to Malaysia's McDonald's licensee Gerbang Alaf Restaurants Sdn Bhd. TSR Capital is selling part of a land measuring 36,617 sqf together with a McDonald's restaurant erected on it for RM6.0m. (The Edge)

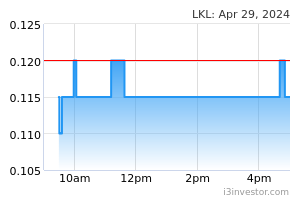

LKL International Bhd has proposed to undertake a renounceable rights issue with free warrants to raise up to RM58.3m to fund its diversification into the pharmacy business. It is also planning a share consolidation exercise by consolidating every 10 existing shares into 1 share. (The Edge)

Source: Mplus Research - 20 Jun 2022