Dipping below 1,500

Market Review

Malaysia:. The FBM KLCI (-1.0%) sank for the seventh consecutive session to close below the 1,500 psychological level as the key index slipped -2.9% WoW. The lower liners also extended their slide, while all 13 major sectors on the broader market were painted in red with the healthcare sector (-2.5%) taking the worst hit.

Global markets:. Wall Street was affected negatively by heightened volatility as the Dow (-2.7%) tumbled after inflation rate in May 2022 rose 8.6% YoY; the biggest jump since December 1981. The European stock markets extended their slide, while Asia stock markets closed mostly in red.

The Day Ahead

The FBM KLCI posted steep losses last Friday amid regional pullback except for China stock markets; net foreign selling in the past 5 sessions stood at RM446.2m. Global stock market undertone could remain negative as the blistering inflation in the US may fan investors’ worries on further interest rate hikes and more quantitative tightening going forward. We believe the global weakness will spill over to the local front with limited bargain hunting activities as investors trade cautiously ahead of US Fed’s and UK Bank of England’s interest rate decision this week. The crude oil price was supported above USD120, while the CPO price slid, closing above RM5,900.

Sector focus:. We believe investors may step further away from growth stocks especially technology counters given the risks arising from a global inflationary environment. On the other hand, beneficiaries under the inflationary environment may include banking and O&G sectors should remain on investors’ radar screen.

FBMKLCI Technical Outlook

The FBM KLCI tumbled below the critical 1,500 level. Technical indicators remained negative as the MACD Histogram has extended a negative bar, while the RSI fell below the 30 oversold level. Next support is pegged around 1,450-1,475, while the resistance is pegged along 1,500-1,530.

Company Brief

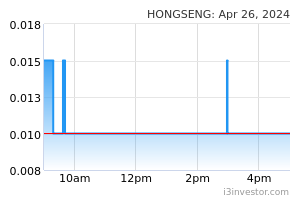

Hong Seng Consolidated Bhd has entered into a memorandum of understanding (MoU) with EoCell Inc to develop a regional manufacturing hub in Malaysia, to manufacture batteries for electric vehicles (EV) and progress to energy storage solutions (ESS). The MoU is a non-binding statement of the parties’ current intentions. Over the next 90 days, subject to the negotiation of a mutually acceptable definitive agreement, the parties intend to enter into a joint venture agreement and set up a new joint venture company. (The Star)

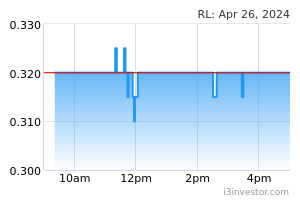

Reservoir Link Energy Bhd’s 60.0%-owned subsidiary Reservoir Link Solutions Sdn Bhd has secured a contract from SEA Hibiscus Sdn Bhd for the provision of well services pumping and specialty chemicals. The scope of work includes supplying equipment, chemicals and technical support team, as well as providing a laboratory facility to conduct laboratory testing, studies and expert interpretative services as required by SEA Hibiscus to identify opportunities for wells’ production enhancement and rejuvenation. The duration of the contract is for 3 years effective from 18th April 2022, to 17th April 2025. (The Star)

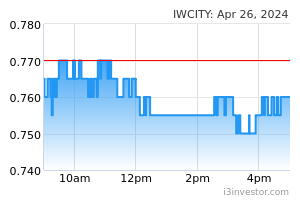

Iskandar Waterfront City Bhd (IWCity) has decided not to appeal to Bursa Malaysia Securities Bhd’s rejection of the company’s relief application but instead will focus on improving its business operations within the 12-month regularisation period. IWCity believes it would be able to rectify its Paragraph 8.03A affected listed issuer status within the said regularisation period. (The Star)

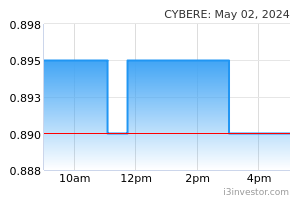

Minda Global Bhd, via its wholly-owned unit UOC Sdn Bhd (UOCSB) has proposed to acquire a freehold land measuring 174,461 sqf in Cyberjaya and the buildings erected thereon from Persada Mewah Sdn Bhd for RM180.0m. Pursuant to the SPA, the proposed corporate exercise would be satisfied in 2 ways, namely RM155.0m in cash and RM25.0m through issuance of 357.1m new Minda Global shares at an issue price of 7.0 sen apiece. Subject to all relevant approvals being obtained, the proposals are expected to be completed in 2H22. (The Star)

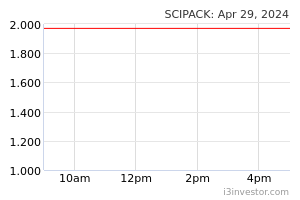

Scientex Packaging (Ayer Keroh) Bhd's 3QFY22 net profit was flat at RM10.3m due to the increase in raw material costs and other operating costs. Revenue for the quarter, however, grew 38.2% YoY to RM207.4m. (The Edge)

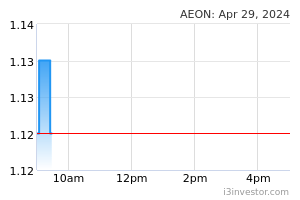

AEON Co (M) Bhd has reported that its managing director and chief executive officer Shafie Shamsuddin will resign from the posts effective 30th June 2022 to pursue new challenges. He will be succeeded by Ono Keiji, an executive with 27 years’ experience serving various roles within the AEON Group globally. (The Edge)

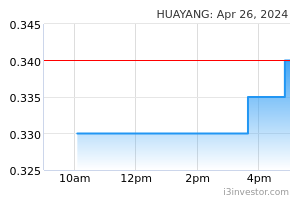

Hua Yang Bhd has proposed to undertake a renounceable rights issue of up to 88.0m new shares with free warrants to raise up to RM17.6m. It is seeking an exemption from the Securities Commission Malaysia to relieve major shareholder Heng Holdings Sdn Bhd from its mandatory offer obligation as a result of the cash call. The rights issue with warrants entails the issuance of 1 rights share for every 4 existing Hua Yang shares held. The warrants will be issued on the basis of 1 warrant for every 1 rights share subscribed for by entitled shareholders. (The Edge)

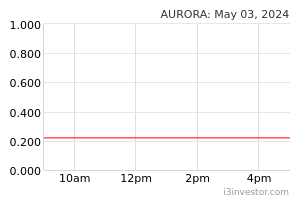

Aurora Italia International Bhd is seeking to withdraw its listing from the LEAP Market of Bursa Malaysia. The rationale for the proposed withdrawal is to facilitate the proposed listing of and quotation for the entire issued share capital of the company on the ACE Market. (The Edge)

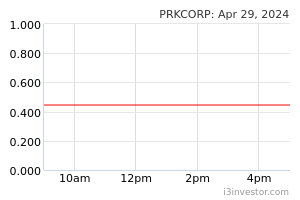

Perak Corp Bhd has rejected the commercial crime allegations against the group by its former director Chong Zhemin in relation to deviation of assets declaration between the group’s scheme of arrangement and the 2021 annual report. Perak Corp has also lodged another police report against the DAP State Assemblyman for Keranji in Perak. (The Edge)

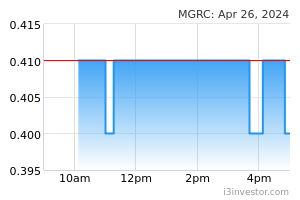

Malaysian Genomics Resources Bhd (MGRC) has received a waiver from Bursa Malaysia Securities Bhd to exempt it from submitting its regularisation plan to the relevant authorities. Following the waiver, Bursa Securities has uplifted MGRC from being classified as a Paragraph 8.03A company effective 13th June 2022. (The Edge)

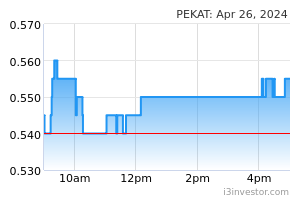

Pekat Group Bhd has secured a contract to supply 185.3kWp grid connected photovoltaic system in Port Klang. The contract worth RM0.7m was awarded by Hextar Chemical Sdn Bhd. (The Edge)

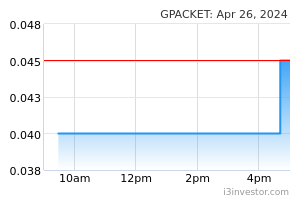

Digital solutions provider Green Packet Bhd announced the retirement of Tan Sri Omar Abdul Rahman as its non-independent and non-executive chairman. Omar has held the post for 18 years since 25th June 2004. (The Edge)

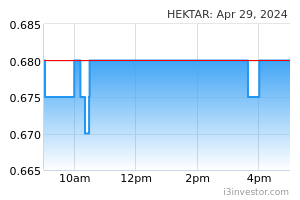

Hektar Real Estate Investment Trust (REIT) chief executive officer (CEO) Datuk Hisham Othman, 60, is retiring from his position Johari Shukri Jamil will take over as the CEO from 11th June 2022. (The Edge)

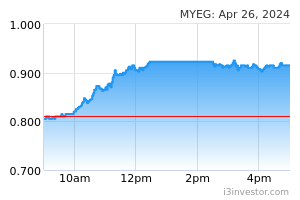

MyEG Services Bhd’s unit is partnering with the Philippines’ tourism authority to implement an online payment portal designed to facilitate payment for travel taxes. The group 40.0%-owned unit I-Pay MYEG Philippines Inc has entered into a memorandum of agreement to partner Tourism Infrastructure and Enterprise Zone Authority to make payment of travel taxes more effortless. (The Edge)

Source: Mplus Research - 13 Jun 2022