Dour trend persisted

Market Review

Malaysia:. The FBM KLCI (-0.2%) extended its decline with more than half of the key index constituents closed in the red yesterday. Both the lower liners and the broader market ended mixed with the energy sector (-2.7%) underperformed the latter after crude oil prices skid lower.

Global markets:. Wall Street rebounded as the Dow (+1.3%) recovered all its previous session losses in anticipation of softer labour data and that may provide some cushion to the concern over inflationary pressure. The European stock markets ended mostly upbeat, but Asia stock markets closed mostly weaker.

The Day Ahead

The FBM KLCI declined marginally into the negative territory as cautious sentiment persisted on the local bourse. Nevertheless, we expect to see bargain hunting activities across the sectors given the strong rebound on Wall Street overnight. We believe crude oil price to remain elevated for the near term on the back of reduced Russian output and larger-than-expected drawdown in the US inventories, thus inflationary pressure may not abate anytime soon. Both the CPO and Brent crude oil prices were on the rise, with the former trading around RM6,500, while the latter trading above USD117 per barrel.

Sector focus:. We noticed increased trading interest in the poultry sector and we believe the sector will continue to gain traction prior to the removal of price caps on chickens and eggs in July 2022. Meanwhile, the overnight rally in Nasdaq should boost further recovery in the technology sector. Also, we believe energy stocks could be traded actively with the rebound in oil price.

FBMKLCI Technical Outlook

The FBM KLCI fell below its daily EMA9 level on the back of mild profit taking activities. Technical indicators were mixed as the MACD Histogram extended a positive bar, while the RSI is hovering below the 50 level. The next support level remained at 1,500-1,530, while the resistance is pegged around 1,570-1,580.

Company Brief

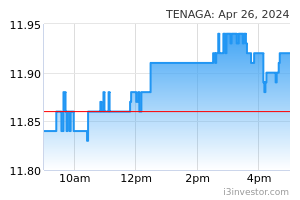

Tenaga Nasional Bhd’s (TNB) wholly-owned subsidiary TNB Power Generation Sdn Bhd (TPGSB) has issued RM1.50bn worth of Sustainability Sukuk Wakalah under its Islamic medium-term notes programme of up to RM10.00bn in nominal value. The sukuk was issued in three tranches, comprising RM150.0m (with a tenure of 10 years), RM750.0m (15 years), and RM600.0m (20 years). The periodic distribution rate for each of the tranches are 4.7%, 5.1% and 5.2% per annum, respectively. Proceeds from the issuance will be utilised by TPGSB for the Nenggiri Hydroelectric Power Plant Project as set out in the TPGSB Sustainability Sukuk Framework. (The Star)

Six lenders are said to have arrived at a settlement with Serba Dinamik Holdings Bhd and four of its subsidiaries with regards to the scheme of arrangement and restraining order sought by the oil and gas-related companies. The winding-up petition against the Serba Dinamik companies is on hold provided that there is no default on the payment of debts as agreed in the proposed scheme of arrangement. (The Edge)

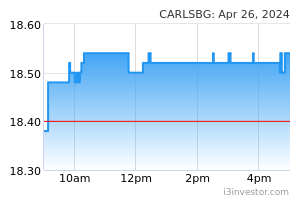

Carlsberg Brewery Malaysia Bhd will increase the prices of its beer, stout and cider from 1st July 2022 due to rising input costs. Despite its cost-mitigation efforts, the group had to adjust the prices of the products because of the increasing input costs worsened by the Russia-Ukraine conflict. (The Edge)

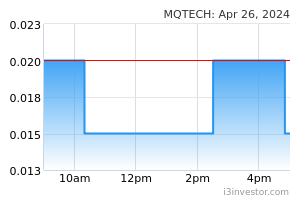

MQ Technology Bhd has appointed Datuk Nurul Hidayah Ahmad Zahid, the daughter of UMNO president Datuk Seri Dr Ahmad Zahid Hamidi as its vice chairman effective 2nd June 2022. The group also announced the appointment of Chean Meng Hee as its new chief executive officer and redesignation of its chief operating officer, Tong Sian Shyen as its Managing Director. (The Edge)

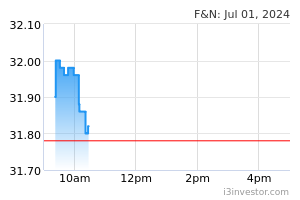

Trading in the shares of Cocoaland Holdings Bhd and its second-largest shareholder Fraser & Neave Holdings Bhd (F&N) will be suspended at the request of both companies on 3rd June 2022 pending an announcement. The co-founding brothers of Cocoaland intend to let go of their family-owned business at the right price. (The Edge)

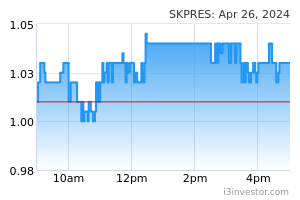

SKP Resources Bhd has reported that an independent consultant has found out that the company’s practices do not amount to systemic forced labour after it took steps to address allegations of such practices. This came following allegations that SKP Resources and its subsidiaries were involved in practices that may be considered to be among the 11 indicators of forced labour, as defined by the International Labour Organization. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) has indicated that the revision of the operating agreement as well as the land lease agreement that it is currently negotiating with the government is in the final stage to be concluded. The current OA allows MAHB to run the 39 airports including KLIA and klia2 until 2069. (The Edge)

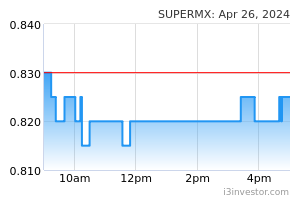

Supermax Corporation Bhd has completed refurbishment work to upgrade dormitories to provide better living conditions to workers as part of its foreign worker management policy to meet international compliance standards. The company said it had also completed the first batch of former foreign workers’ payout under its revised eligibility outreach programme. (The Edge)

Boustead Holdings Bhd unit Boustead Naval Shipyard Sdn Bhd (BNS) and the Ministry of Defence have entered into a supplementary contract to remobilise the RM9.00bn contract for delivery of 6 littoral combat ships. The remobilisation of the project will see a resumption of payment to BNS creditors, namely original equipment manufacturers, vendors, and financial institutions. (The Edge)

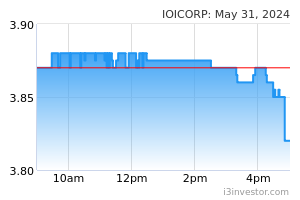

IOI Corporation Bhd joint venture in Sarawak, IOI Pelita Plantation which owns jointly with Sarawak State Land Custody and Development Authority has signed a landmark final settlement agreement with eight local communities, whereby it will relinquish or excise 4,615-ha of land from its provisional lease. The Sarawak government will subsequently gazette that excised land as native communal reserves for agricultural use by the affected communities, effectively giving these communities an ownership title to the land. (The Edge)

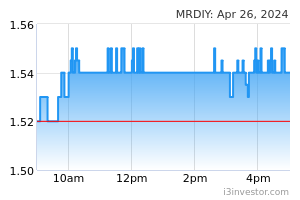

MR DIY Group (M) Bhd’s substantial shareholder Creador has disposed of 86.7m shares in the home improvement retailer. Following the disposal, which took place on 31st May 2022, the private equity fund is left with 540.8m shares or an 8.6% stake in MR DIY. (The Edge)

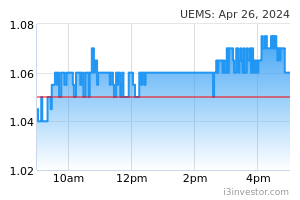

UEM Sunrise Bhd has partnered with Affin Bank in the “Home Step Fast/i” campaign which is specially tailored for fresh graduates, young homebuyers and property investors to allow purchasers to pay low monthly repayments for the first five years upon completion of the project without a lock-in period and no early settlement fee for buyers. Purchasers can also convert the loan into a savings scheme for those who need access to emergency funds. (The Edge)

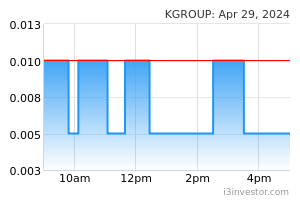

Key Alliance Group Bhd (KAG) announced that its subsidiary Agrocloud Sdn Bhd had entered into a Memorandum of Understanding with Koperasi Peserta-Peserta Rancangan Felcra Seberang Perak Bhd to collaborate on the development and implementation of the Rice Information System at the estate of Felcra Bhd Seberang Perak in Kg Gajah, Perak. The proposed collaboration aims to increase the yield of rice cultivation through the Internet of things technology and decision support system via the Rice Information System. (The Edge)

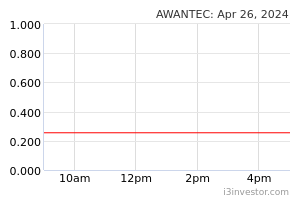

Awanbiru Technology Bhd’s unit Awantec Systems Sdn Bhd inked an MoU with Halal Development Corp Bhd on 2nd June 2022 to create an online halal skills repository and platform. This will include online and physical training programs to promote and drive awareness in the halal economy to a wider global market, providing globally recognised and professionally guided training courses and programs in the halal economy. (The Edge)

Source: Mplus Research - 3 Jun 2022