Onto better footing

Market Review

Malaysia:. The FBM KLCI (+0.4%) edged higher, boosted by gains in selected banking heavyweights yesterday. The lower liners ended mixed, while the broader market also closed mostly higher with the technology sector (+2.3%) leading the winners list on bargain hunting activities.

Global markets:. Wall Street extended its recovery as the Dow (+1.6%) rose after the latest Federal Reserve report suggests that the inflationary pressure may be temporary, while the USD retreated against a basket of currencies. The European stock markets also advanced, while the Asia stockmarkets closed mostly higher.

The Day Ahead

The FBM KLCI closed higher amid buying interest within telco and banking heavyweights. Given the strong rebound and follow through interest on Wall Street, we expect the spillover of buying support may emerge on the technology stocks on the local front and traders may focus on the recent bashed down technology leaders as some of their earnings have stabilised in the recent reporting season. However, we expect the upside to be limited given the unresolved Ukraine and Russia tension. Nevertheless, we are optimistic on both the energy and plantation sectors with the elevated Brent oil price hovering above USD115, while the CPO is trading above RM6,500.

Sector focus:. With the strong rebound on Wall Street, technology will be the main focus for the session. Also, the commodity markets are still elevated, traders may favour the energy and plantation stocks. Meanwhile, for the recovery theme play, we will look into the consumer, utilities or REITs sectors.

FBMKLCI Technical Outlook

The FBM KLCI rebounded mildly but still hovering below the SMA200. Technical indicators is still negative with the Histogram extended a negative bar, while the RSI is still hovering below 50. Support is pegged around 1,500-1,530, while the resistance is located at 1,570-1,

Company Brief

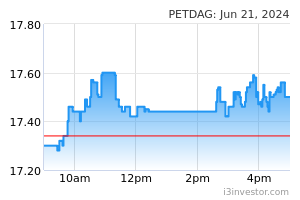

Petronas Dagangan Bhd’s (PetDag) 1QFY22 net profit tumbled 38.0% YoY to RM118.5m, on higher operating expenditure. Revenue for the quarter, however, rose 48.2% YoY to RM7.62bn. An interim dividend of 5.0 sen per share, payable on 24th June 2022 was declared. (The Star)

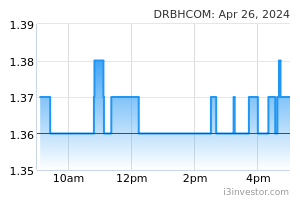

DRB-Hicom Bhd's 1QFY22 net loss widened RM25.7m, from net loss of RM17.0m recorded in the previous corresponding quarter, on lower contribution from the automotive, postal, logistics and catering services and properties sectors. Revenue for the quarter fell 12.6% YoY to RM3.07bn. A final dividend of 2.0 sen per share, subject to shareholders' approval at its 22nd June 2022 annual general meeting was proposed. (The Star)

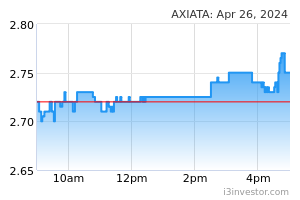

Permodalan Nasional Bhd is among a group of shareholders which is believed to also include the Employees Provident Fund (EPF) that has voted against Axiata Group Bhd's proposed acquisition of a 66.0% stake in Indonesia's PT Link Net Tbk (LinkNet) for 8.72trn rupiah (RM2.55bn). Nevertheless, the resolution for the investment was passed as the telco managed to garner 57.8% of the votes of those present and voting at the extraordinary general meeting, while 42.2% was against it. (The Edge)

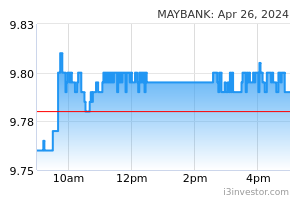

Malayan Banking Bhd’s (Maybank) 1QFY22 net profit dropped 14.6% YoY to RM2.04bn, as overhead expenses rose at a time when geopolitical tensions and market volatility impacted the operating environment. Revenue for the quarter fell 2.5% YoY to RM11.91bn. (The Edge)

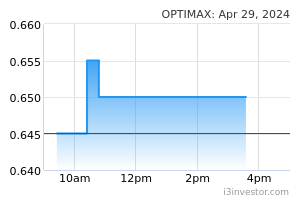

Optimax Holdings Bhd has announced that it would transfer its listing to the Main Market of Bursa Securities from the ACE Market. The company stated that it has met the requirements for the transfer of its listing as set out in the Equity Guidelines issued by the Securities Commission Malaysia and the Main Market Listing Requirements of Bursa Securities. (The Edge)

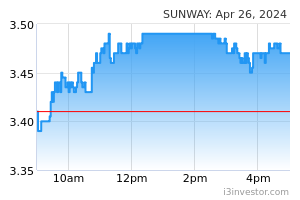

Sunway Bhd’s 1QFY22 net profit soared 139.7% YoY to RM140.1m, on the back of higher revenue due to stronger operating performance from most business segments, except trading and manufacturing. Revenue for the quarter grew 31.5% YoY to RM1.11bn. (The Edge)

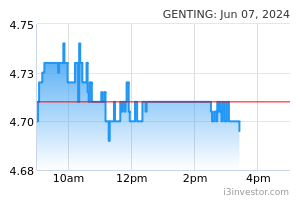

Genting Bhd's 1QFY22 net loss narrowed to RM199.7m, from net loss of RM331.8m, on higher contributions from the leisure and hospitality divisions. Revenue for the quarter rose 87.1% YoY to RM4.21bn. (The Edge)

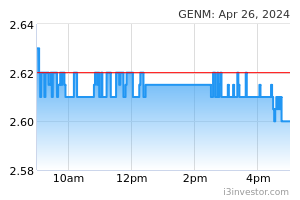

Genting Malaysia Bhd’s 1QFY22 net loss narrowed to RM126.5m, from net loss of RM483.6m recorded in the previous corresponding quarter a year ago, due to higher business volume from the gaming and non-gaming segments, as a result of the easing of travel restrictions. Revenue for the quarter soared 175.9% YoY to RM1.72bn. (The Edge)

Malaysia Building Society Bhd’s (MBSB) 1QFY22 net profit fell 8.2% YoY to RM58.2m, on the back of lower non-funded income and higher operating expenditure. Revenue for the quarter declined 2.4% YoY to RM664.5m. (The Edge)

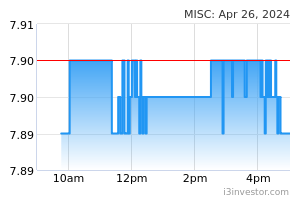

MISC Bhd’s 1QFY22 net profit declined of RM376.4m, on higher finance costs and lower share of profits from joint venture entities. Revenue for the quarter, however, grew 12.9% YoY to RM2.86bn. (The Edge)

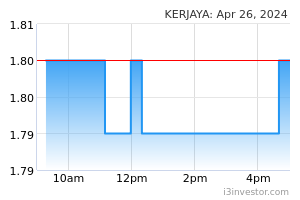

Kerjaya Prospek Group Bhd's 1QFY22 net profit increased 9.4% YoY to RM28.9m, on the back of higher revenue. Revenue for the quarter increased 11.9% YoY to RM300.6m. An interim dividend of 2.0 sen per share, payable on 8th July 2022 was declared. (The Edge)

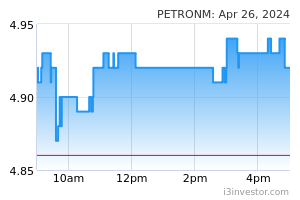

Petron Malaysia Refining & Marketing Bhd’s 1QFY22 net profit improved 3.3% YoY to RM106.4m, underpinned by strong sales performance, favourable product prices and refining margins. Revenue for the quarter jumped by 90.0% YoY to RM3.80bn. (The Edge)

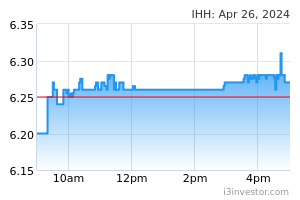

IHH Healthcare Bhd’s 1QFY22 net profit rose 31.3% YoY to RM493.3m, on higher revenue that offset by higher operating costs. Revenue for the quarter rose 5.6% YoY to RM4.16bn. (The Edge)

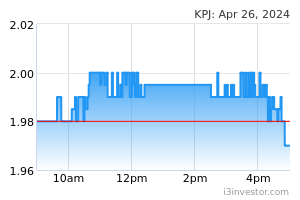

KPJ Healthcare Bhd’s 1QFY22 net profit grew by 71.0% YoY to RM22.2m, as inpatient visits and bed occupancy rate increased. Revenue for the quarter increased 7.4% YoY to RM651.0m. An interim dividend of 0.25 sen per share, payable on 29th July 2022 was declared. (The Edge)

YTL Corp Bhd’s 3QFY22 net profit surged 18.5x YoY to RM414.6m, mainly due to a one-off gain from the disposal of its investment in ElectraNet Pty. Revenue for the quarter expanded 46.2% YoY to RM6.17bn. (The Edge)

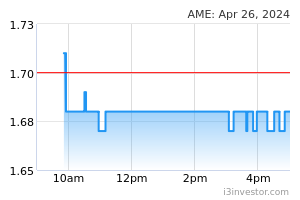

AME Elite Consortium Bhd’s 4QFY22 net profit fell 3.4% YoY to RM20.9m, on lower revenue from the property development segment. Revenue for the quarter decreased 14.4% YoY to RM139.7m. An interim dividend of 2.5 sen per share, payable on 7th July 2022 was declared. (The Edge)

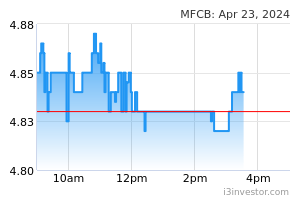

Mega First Corp Bhd (MFCB) has further expanded its exposure in the booming semiconductor space, following its acquisition of a 28.8% stake in Integrated Smart Technology Sdn Bhd (IST) for RM5.6m. IST, which is involved in automated test machines for the semiconductor sector, is expected to generate around RM10.0m per year or around RM2.9m for MFCB’s equity portion. (The Edge)

Source: Mplus Research - 27 May 2022