More of the same

Market Review

Malaysia:. The FBM KLCI (-0.02%) erased all its intraday gains in the eleventh trading hour to close marginally lower on last Friday. The lower liners, however rebounded, while the broader market closed mostly higher, led by the energy sector (+2.6%) as Brent oil prices sustained above USD100/bbl.

Global markets:. Wall Street recorded marginal gains after recovering all their intraday losses as the Dow (+0.03%, -2.9% WoW) rose amid bargain hunting activities, but marked its 8th weekly decline. The European stock markets rebounded, while the Asia stock markets closed mostly positive.

The Day Ahead

The FBM KLCI underperformed its regional peers, due largely to final hour selldown in selected banking and commodity related heavyweights. Given the buying into the dip move on Wall Street, we expect some bargain hunting activities may emerge on the local front, especially in the technology stocks. Investors may watch out for Malaysia’s inflation rate and the US FOMC meeting minutes this week. The crude oil traded around USD112 per barrel, while the CPO was priced around RM6,100 after trending downwards in the past two weeks. On Friday, Indonesia reimposed a domestic sales requirement on palm oil after reversing the export ban.

Sector focus:. We remained positive on the recovery-themed sector despite worries over inflation. Besides, the energy sector should remain robust, supported by the elevated crude oil price. Technology stocks may see potential rebound amid the bargain hunting on Wall Street.

FBMKLCI Technical Outlook

The FBM KLCI finished the week marginally lower, threading below its 200-day moving average and the short term daily EMA9. Technical indicators remained mixed as the MACD Histogram expanded further above zero, while the RSI is hovering below the 50 level. Support is located at 1,500-1,530, while the resistance is set around 1,570-1,580.

Company Brief

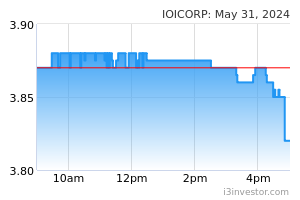

IOI Corp Bhd’s 3QFY22 net profit rose 2.5% YoY to RM411.2m, due to higher contribution from the plantation segment. Revenue for the quarter gained 43.3% YoY to RM4.10bn. (The Star)

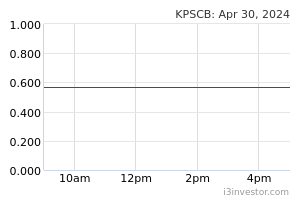

KPS Consortium Bhd’s wholly-owned subsidiary, Hai Ming Marketing Sdn Bhd (HMMSB) has received the Money Lending Licence issued by the Registrar of Moneylenders of Housing and Local Government Ministry. The approval allows HMMSB to undertake any business of those relating to the money lending activities. (The Star)

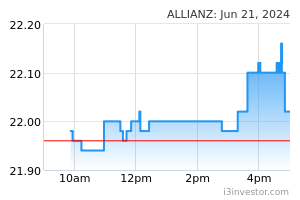

Allianz Malaysia Bhd’s 1QFY22 net profit rose 60.2% YoY to RM101.3m, contributed by higher profit from both of its insurance segments. Revenue for the quarter increased 6.3% YoY to RM1.71bn. (The Edge)

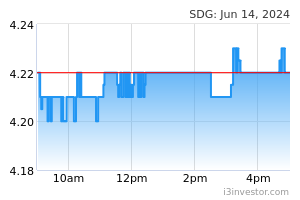

Sime Darby Plantation Bhd’s 1QFY22 net profit grew 27.8% YoY to RM718.0m, driven by higher crude palm oil (CPO) and palm kernel (PK) prices in the upstream segment and improved downstream performance. Revenue for the quarter increased 19.3% YoY to RM4.38bn. (The Edge)

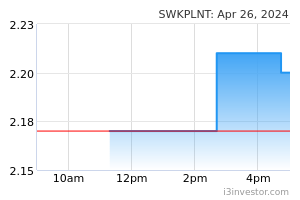

Sarawak Plantation Bhd’s 1QFY22 net profit surged 82.4% YoY to RM43.3m, on the back of higher operating profit and higher gain arising from changes in fair value of biological assets of RM17.6m. Revenue for the quarter added 23.4% YoY to RM183.9m. (The Edge)

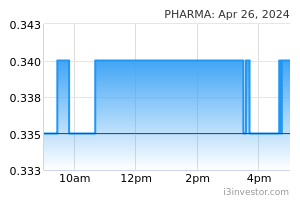

Pharmaniaga Bhd’s 1QFY22 net profit grew 20.0% YoY to RM27.7m, on higher contribution from its logistics and distribution division, while the Indonesian division returning to the black. Revenue for the quarter rose 21.3% YoY to RM962.2m. A first interim dividend of 0.8 sen per share, payable on 6th July 2022 was declared. (The Edge)

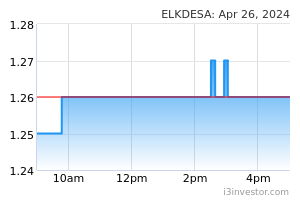

ELK-Desa Resources Bhd's 4QFY22 net profit dropped 60.9% YoY to RM5.5m, due to lower contribution from its hire purchase segment as a result of high impairment allowance. Revenue for the quarter declined by 7.2% YoY to RM36.0m. (The Edge)

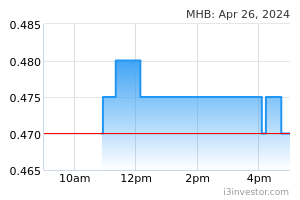

Malaysia Marine and Heavy Engineering Holdings Bhd’s (MHB) 1QFY22 net profit stood at RM2.7m vs. a net loss of RM104.4m recorded in the previous corresponding quarter, on the back of improved earnings from all its divisions. Revenue for the quarter grew 21.6% YoY to RM417.8m. (The Edge)

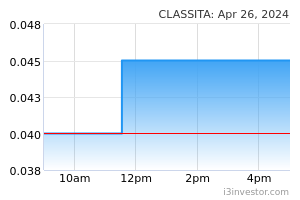

Caely Holdings Bhd’s 4QFY22 shrank 60.4% YoY to RM9.3m, due to an improvement in property development cost on account of lower provision of impairment amounting to RM7.2m. Revenue for the quarter slipped 17.0% YoY to RM10.7m. (The Edge)

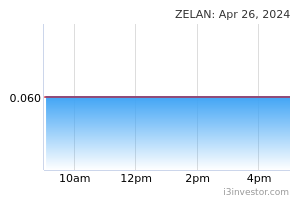

Zelan Bhd has received a notice in writing from Messrs Afrizan Tarmili Khairul Azhar PLT (AFTAAS) of the latter’s decision to resign as its external auditor. This came two days after AFTAAS expressed an unqualified opinion with material uncertainty related to going concern of Zelan’s audited financial statements for the financial year ended 31st December 2021 (FY21). (The Edge)

YB Ventures Bhd has appointed Messrs UHY as the company’s external auditor effective 20th May 2022, following the resignation of its current external auditor Messrs Grant Thornton Malaysia PLT. (The Edge)

Gets Global Bhd has received a notice in writing on the resignation of its external auditor Messrs PKF, which will take effect upon the appointment of a new external auditor. The company’s board had approved the Audit Committee’s recommendation to appoint Messrs Deloitte PLT after assessing their capabilities, independence and proposed audit fees. (The Edge)

Messrs CAS Malaysia PLT has resigned as China Automobile Parts Holdings Ltd’s (CAP) external auditor with immediate effect. CAS Malaysia was first appointed as CAP’s external auditor on 24th July 2020. (The Edge)

SC Estate Builder Bhd (SCBuild) has received a requisition from three shareholders, who collectively hold at least 10.0% of the company's shares, to call for an extraordinary general meeting (EGM) to remove 11 existing directors and any director appointed between 13th May 2022 and the EGM, as well as appoint 6 new directors. (The Edge)

ManagePay Systems Bhd (MPay) has received a letter from Bank Negara Malaysia which denotes that the Central Bank has no objection regarding the company’s unit ManagePay Services Sdn Bhd to cross-sell financial services offered by QuicKash Malaysia Sdn Bhd on MPay's e-money platform. (The Edge)

Source: Mplus Research - 23 May 2022