Small steps of recovery

Market Review

Malaysia:. The FBM KLCI (+0.3%) resumed trading from the extended break with more than half of the key index components ended in the positive tone. The lower liners also extended their lead, while the broader market ended mostly higher, led by the energy sector (+6.6%) that was reacting to the surging oil prices.

Global markets:. Wall Street marched higher as the Dow (+1.3%) was spurred by the solid retail sales data in April 2022 that expanded 8.2% YoY; suggesting that consumer spending remain robust despite the high inflation. The European stock markets also advanced, while the Asia stock markets ended on a positive note.

The Day Ahead

The FBM KLCI extended its gains on the back of returned buying interest in selected commodity-related heavyweights led by PMETAL. We are expecting that the broad-based recovery on the local bourse could extend in tandem with the (i) rebound on Wall Street overnight following the release of retail sales data in April and (ii) optimism on China’s announcement on easing lockdowns. On the commodity markets, the crude oil has taken some pullback, but hovering above USD110. Meanwhile, the CPO is priced around RM6,150. Do note that Indonesian farmers protested against export sales ban on palm oil, which may potentially cause an impact on CPO price.

Sector focus:. We expect further buying interest in the technology sector following Nasdaq’s strong rally overnight. Meanwhile, we remain optimistic on the energy sector given the firm crude oil price.

FBMKLCI Technical Outlook

The FBM KLCI marched higher as the key index made another attempt to retest its SMA 200 level. Technical indicators, however, remained negative as the MACD Histogram is still negative, while the RSI is hovering below the 50 level. Resistance is envisaged around 1,570-1,580, while the support is pegged around 1,500-,1,510.

Company Brief

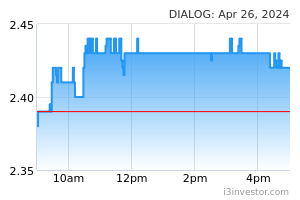

Dialog Group Bhd's 3QFY22 net profit slipped 2.3% YoY to RM133.1m, mainly due to higher project cost. Revenue for the quarter, however, rose 46.5% YoY to RM593.4m. An interim dividend of 1.30 sen per share, payable on 28th June 2022. (The Star)

Dagang Nexchange Bhd (DNeX) and Big Innovation Holdings Limited (BIH), a wholly-owned subsidiary of Hon Hai Precision Industry Co Ltd (Foxconn), plan to set up a joint venture company to build and operate a new 12-inch wafer fabrication plant in Malaysia. The new fabrication plant is expected to produce 40,000 wafers per month, encompassing the manufacturing of 28-nanometer and 40-nanometer technologies. (The Star)

Petronas Chemicals Group Bhd (PetChem) is acquiring the entire equity interest in leading specialty chemicals group Perstorp Holdings AB from Financière Forêt SARL for a base purchase of €1.54bn (RM7.02bn) cash. The acquisition marks the creation of a significant specialty chemicals portfolio, while enhancing its overall earnings in its unit Petronas Chemicals International BV (PCIBV) that has entered into a conditional securities purchase agreement with the seller for the proposed acquisition. (The Edge)

Duopharma Biotech Bhd’s 1QFY22 net profit grew 15.2% YoY to RM20.3m, bolstered by higher sales to the consumer healthcare and private ethical sectors. Revenue for the quarter rose 11.7% YoY to RM185.9m. (The Edge)

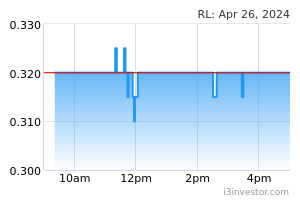

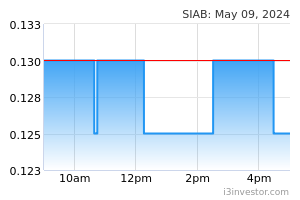

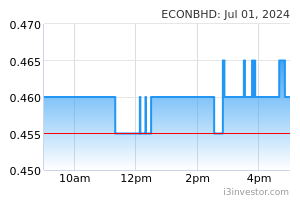

Yong Tai Bhd has entered into debt settlement agreements with 19 creditors which include, amongst others, Bursa-listed companies Econpile Holdings Bhd and Siab Holdings Bhd to pay off RM46.0m owed by issuing 92.0m new shares at 50 sen per share. Econpile is to receive 8.0m Yong Tai shares to settle the RM4.0m debt owed by Yong Tai, while Siab will be issued 12.0m shares for the RM6.0m owed to it. The debt settlements, as well as the listing of and quotation for the new settlement shares will be implemented after the share consolidation of every 5 existing shares into 1 share, and the bonus issue of warrants of up to 103.1m new warrants on the basis of 1 free warrant for every 4 consolidated Yong Tai shares. (The Edge)

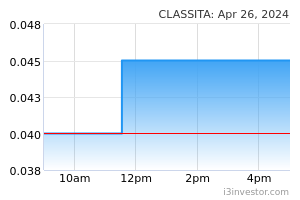

Caely Holdings Bhd's former executive director Wong Siaw Puie has been redesignated as executive chairman of the company effective 17th May 2022. Wong takes over the chairman post of Caely from the company’s ex-chairman Datuk Wira Ng Chun Hau, who resigned to pursue other personal opportunities. Caely also announced the appointment of Koo Chen Yang as the company’s new executive director. (The Edge)

Reservoir Link Energy Bhd has executed a joint venture (JV) and shareholders’ agreement with ADS Asset Holdings Sdn Bhd (AAH) to jointly co-fund, construct and develop energy storage solutions. Reservoir Link and AAH will hold the JV on a 51:49 basis. (The Edge)

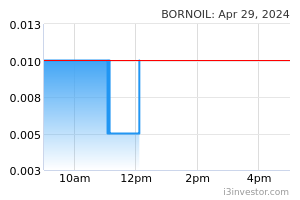

Borneo Oil Bhd has entered into a sale share agreement with MT 23 Resources Ltd to acquire a 22.5% stake or 28.4m shares in Sabah-based clinker and cement products manufacturer Makin Teguh Sdn Bhd (MTSB) for RM73.6m by way of treasury share transfer and cash from internally generated funds. MT 23 is the legal and beneficial owner of 28.8% of the equity in MTSB, represented by 36.3m shares of the issued and paid-up share capital of the company. (The Edge)

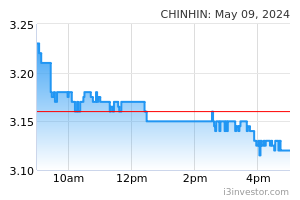

Chin Hin Group Bhd is disposing its remaining 19.3% stake in Solarvest Holdings Bhd for RM103.3m cash or 80 sen per share to Divine Inventions Sdn Bhd in a related party transaction (RPT). Divine Inventions is controlled by the Chiau family, which also owns 36.6% in Chin Hin. Bulk of the proceeds has been earmarked for the repayment of bank borrowings. (The Edge)

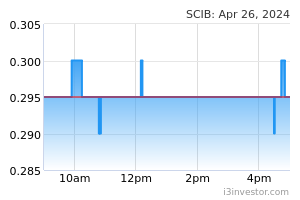

Sarawak Consolidated Industries Bhd (SCIB)’s unit SCIB Properties Sdn Bhd has accepted a letter of award for an engineering, procurement, construction and commissioning contract worth RM36.0m from Masama Sdn Bhd for road infrastructure projects in Sarawak. The contract is expected to span from May 2022 to April 2023. (The Edge)

Source: Mplus Research - 18 May 2022