End of low interest rate environment

Market Review

Malaysia:. The FBM KLCI (+0.1%) managed to eke out mild gains, mainly driven by gains in selected banking heavyweights following Bank Negara’s move to increase OPR by 25 basis points. The lower liners and the broader market, however, ended mixed.

Global markets:. Wall Street turned volatile again as the Dow (-1.0%) erased all its intraday gains after the higher-than-expect inflation rate at 8.3% in April 2022 may prompt further tightening measures by the US Federal Reserve. The European stock markets, however, remained upbeat, but Asia stock markets ended mixed.

The Day Ahead

The FBM KLCI rebounded with the bargain hunting activities in the plantation and banking sector; the latter propelled following the BNM’s announcement to increase the overnight policy rate by 25 basis points. We believe investors should brace for heightened volatility across global markets as Wall Street tumbled overnight in anticipation on a faster pace of interest rate hike and potential further tightening in monetary policies after the higher-than-expected inflation data was released. Nevertheless, recovery-themed and commodities related sectors may be favourable ahead of the quarterly reporting season. Both the CPO and crude oil rebounded, hovering around RM6,500 and USD107.

Sector focus:. We expect the increased OPR will continue to attract buyers in the banking sector and high net cash companies. Besides, the energy stocks may gain traction as the crude oil price swung higher. Also, investors may focus on stocks with decent earnings prospects ahead of the earnings season.

FBMKLCI Technical Outlook

The FBM KLCI booked marginal gains and remained supported above the SMA200 level. Technical indicators, however remains negative with the MACD Histogram expanded negatively below zero and the RSI is hovering below the 50 level. The resistance is set around 1,570-1,580, while the support is pegged around 1,545.

Company Brief

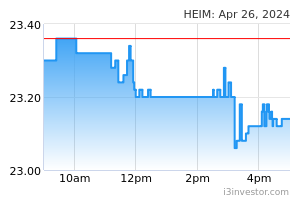

Heineken Malaysia Bhd’s 1QFY22 net profit jumped 54.2% YoY to RM113.4m, mainly due to higher sales driven by easing of Covid-19 restrictions and effective commercial execution during Chinese New Year. Revenue for the quarter grew 27.4% YoY to RM698.3m. (The Star)

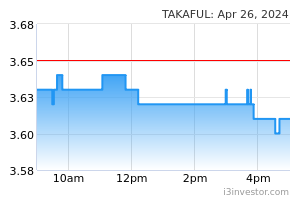

Syarikat Takaful Malaysia Keluarga Bhd’s 1QFY22 net profit fell 14.2% YoY to RM86.8m, after having recognised fair value losses under its family takaful business of RM35.6m as compared to fair value gains of RM1.2m in the previous corresponding quarter. Revenue for the quarter, however, rose 8.9% YoY to RM997.4m. (The Edge)

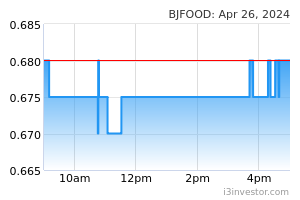

Berjaya Food Bhd’s 3QFY22 net profit jumped 172.0% YoY to RM31.6m, due to higher same-store-sales growth, particularly from Starbucks cafe outlets as a result of the improved mobility upon the resumption of domestic tourism and further relaxation of the Covid-19 standard operating procedures. Revenue for the quarter rose 35.4% YoY to RM246.0m. A single-tier third interim dividend of 1.5 sen, payable on 23rd June 2022 was declared. (The Edge)

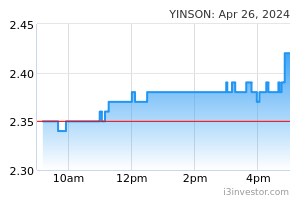

Yinson Holdings Bhd has fixed its rights issue price at RM1.41 apiece on an entitlement basis of 2 rights shares for every 5 existing shares held, to raise gross proceeds of up to RM1.21bn. The rights issue comes with free detachable warrants, on the basis of 3 warrants for every 7 rights shares subscribed, with an exercise price of RM2.29 apiece. Of the proceeds, over RM770.0m will be allocated for upcoming FPSO projects, over RM320.0m for loan repayments, RM44.0m for renewable energy and green technology business expansion, and RM55.0m for working capital. (The Edge)

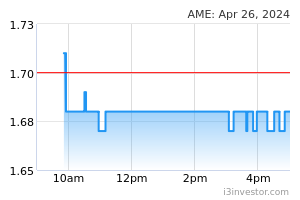

AME Elite Consortium Bhd has secured its shareholders’ approval for the proposed listing of AME Real Estate Investment Trust (REIT) on the Main Market of Bursa Malaysia Securities Bhd, at an extraordinary general meeting held on yesterday. The proposed offering comprises up to 156.6m Restricted Offer For Sale (ROFS) units to entitled AME Elite shareholders on the basis of 1 ROFS unit for every 5 ordinary shares held in AME Elite on the entitlement date, 7.8m units to eligible employees and directors of AME Elite and subsidiaries, and 10.4m units to the Malaysian public. (The Edge)

UMW Toyota Motor Sdn Bhd, a subsidiary of UMW Holdings Bhd, achieved a total of 6,868 units sold in April 2022, down 18.1% MoM from the 8,386 recorded in March 2022. (The Edge)

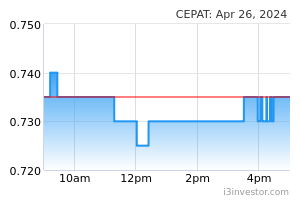

Cepatwawasan Group Bhd's 1QFY22 net profit jumped 171.5% YoY to RM15.2m, mainly due to higher average selling price and improved production of crude palm oil (CPO), palm kernel (PK), fresh fruit bunch (FFB) and empty fruit bunch (EFB) oil. Revenue for the quarter expanded 87.1% YoY to RM94.6m. (The Edge)

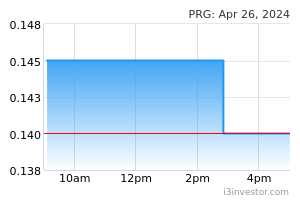

Soon-to-be new Securities Commission Malaysia (SC) executive chairman Datuk Dr Awang Adek Hussin has announced his resignation from PRG Holdings Bhd as its independent non-executive chairman. Awang Adek was appointed as independent non-executive chairman of PRG on 18th August 2017. (The Edge)

Source: Mplus Research - 12 May 2022