Rebound may be short-lived

Market Review

Malaysia:. The FBM KLCI (+0.8%) staged a strong recovery, taking cue from the positive performance on Wall Street overnight as concern over the rising interest rates subsides. The lower liners also extended their lead, while the broader market closed mostly higher, anchored by the technology sector (+3.0%).

Global markets:. Wall Street turned volatile as the Dow (-1.2%) reversed all its previous session gains on expectations over the imposition of fresh sanctions to Russia by US and its allies. The European stockmarkets were also downbeat, but Asia stockmarkets finished mostly higher.

The Day Ahead

The FBM KLCI swung higher as returned buying interest was noticed in banking and plantation heavyweights in the anticipation of the reopening of borders and firmer FCPO price. With the Wall Street taking a pause after a recent strong rebound, we expect the profit taking activities may spill over to the local front, especially the technology stocks. We think investors may stay cautious in the anticipation of further sanction against Russia, which may lift commodity prices another round. Crude oil jumped above USD121 per barrel mark as the disruptions to the crude export via the Caspian pipeline fuelled worries over tighter global supplies. Meanwhile, CPO is traded above RM6,300.

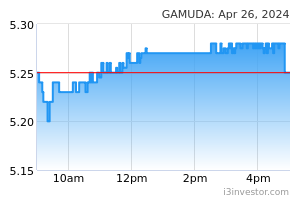

Sector focus:. The soaring crude oil and CPO prices may trigger buying interest in the O&G and plantation sector. Besides, traders may look into aviation stocks amid the reopening of travel borders. Meanwhile, we do expect traders to focus on construction stocks following the release of GAMUDA’s result.

FBMKLCI Technical Outlook

The FBM KLCI saw a rebound after two declining session as the key index holding firmly above the daily EMA9 level. Technical indicators remained positive as the MACD Histogram extended a positive bar, while the RSI hovered above 50. Sustained buying interest may push the key index towards the resistance around 1,600-1,620 zone. Meanwhile, support is set at 1,550.

Company Brief

Gamuda Bhd’s 2QFY22 net profit rose 43.7% YoY to RM177.1m, supported by the better earnings in the construction and property divisions. Revenue for the quarter increased 44.1% YoY to RM1.29bn. (The Star)

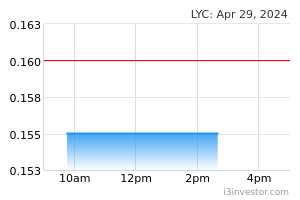

LYC Healthcare Bhd has proposed to acquire 3 dental clinics in Klang Valley for a total of RM3.2m. LYC wholly-owned subsidiary LYC Dental Group Sdn Bhd had entered into a conditional share purchase agreement with Dr Beh Wee Ren to acquire 100.0% shareholding in KL Dental which owns and operates the outlets in Kiara 163, SS15 Courtyard and Taman Connaught. The healthcare group said the total purchase consideration would be satisfied in a mixture of cash and shares in LYC Dental. (The Star)

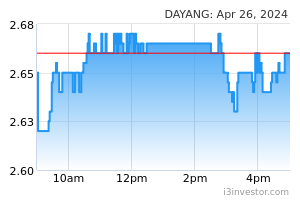

Dayang Enterprise Holdings Bhd has been awarded a contract for the provision of maintenance, construction and modification (MCM) for Vestigo Petroleum Sdn Bhd. The value of the contract is based on work orders issued by Vestigo throughout the contract duration. The contract is effective from 25th February 2022 until 16th July 2023. (The Star)

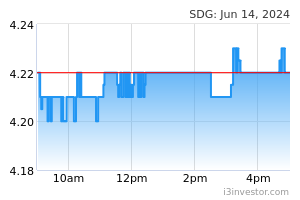

Sime Darby Plantation Bhd and 5 of its subsidiaries are being sued for 5.88trn Rupiah (RM1.72bn) over the disposals of two plantation units. A civil claim has been filed by Indonesian company PT Asa Karya Multi Pratama which had wanted to acquire PT Ladangrumpun Suburabadi and PT Sajang Heulang from Sime Darby Plantation's units. (The Edge)

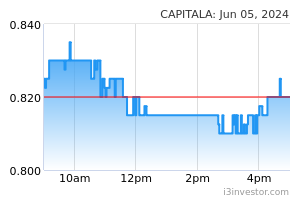

AirAsia Aviation Group Ltd (AAAGL), the airline holding company under Capital A Bhd, has announced the formation of a new board of directors along with four fresh appointments. The new directors are Suvabha Charoenying, Lim Serh Ghee, Francisco Ed. Lim and Tan Sri Mohamad Norza Zakaria. (The Edge)

TH Heavy Engineering Bhd's independent non-executive chairman Datuk Abd Aziz Sheikh Fadzir has resigned from the post after serving for less than a year, due to a personal commitment. (The Edge)

Ranhill Utilities Bhd's major shareholder and executive chairman, Tan Sri Hamdan Mohamad, has pared his equity interest in the utility group to 34.3%, after disposing of a 9.1% stake in an off-market transaction. Lambang Optima Sdn Bhd, in which Hamdan has deemed interest, disposed of the 9.1% stake comprising 116.6m shares on 18th March 2022. (The Edge)

SMTrack Bhd is purchasing a Bombardier Challenger 601-3A aircraft for US$1.8m (RM7.6m) as part of its move to venture into cargo carriage services. The company has entered into an aircraft purchase agreement with Fairway Logistic (M) Sdn Bhd for the purchase of the aircraft. (The Edge)

Destini Bhd wholly-owned subsidiary Destini Oil Services Sdn Bhd has bagged a contract from EnQuest Petroleum Production Malaysia Ltd for the provision of tubular handling services off the coast of Terengganu. It, however, did not disclose the value of the contract. (The Edge)

Ni Hsin Group Bhd has inked an original equipment manufacturing agreement with Dongguan Tailing Motor Vehicle Co Ltd to manufacture the eBixon EV Bike. Its unit, Ni Hsin EV Tech Sdn Bhd will assemble and test as well as run quality control and commission the electric two-wheelers in Malaysia. (The Edge)

Source: Mplus Research - 24 Mar 2022