Looking into 1,600

Market Review

Malaysia:. The FBM KLCI (+0.02%) edged mildly higher to record its third straight winning streak, boosted by the eleventh hour buying support amongst selected index heavyweights on the quadruple witching day. The lower liners and the broader market, however, ended mixed.

Global markets:. Wall Street continues to ascend as the Dow (+0.8%) advanced after Russia avoided default by making coupon payments on dollar-denominated sovereign bonds. The European markets also turned upbeat after recovering from their intraday lows, while the Asia stockmarkets ended mostly positive.

The Day Ahead

The FBM KLCI finished almost unchanged as investors stayed cautious prior to the Biden-Xi call to discuss about the conflict between Ukraine and Russia. As Wall Street advanced on Friday after the talk ended without big surprises, we expect optimism to return on the regional bourses. Meanwhile, investors may focus on the increasing prospect of an early general election in Malaysia. Commodity wise, oil price traded above USD100 per barrel amid the unresolved Russia-Ukraine tension, while the CPO price hovered around RM5,600.

Sector focus:. O&G counters may extend their gains as crude oil prices remained firm above the USD100 per barrel mark. Besides, investors may put construction stocks on radar following the anticipation of an early election in Malaysia towards 2H22.

FBMKLCI Technical Outlook

The FBM KLCI erased all its earlier losses and booked marginal gains as the key index held above the daily EMA9 level. Technical indicators remained positive as the MACD Histogram moved higher above the zero level, while the RSI hovered above 50. The next resistance is pegged around 1,600-1,620, while the support is located at 1,550.

Company Brief

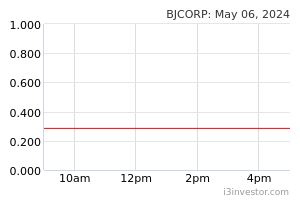

Berjaya Corp Bhd (BCorp) has identified a new chief executive officer (CEO) after it is learnt that Abdul Jalil Rasheed will be leaving the position of CEO roughly a year after he was appointed. This came after Abdul Jalil was reportedly stepping down from his role to pursue his personal interests. Abdul Jalil has just completed his one year at BCorp following his appointment on 16th March 2021. (The Star)

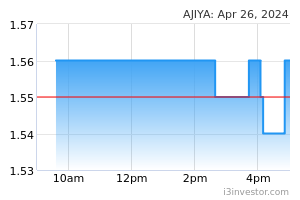

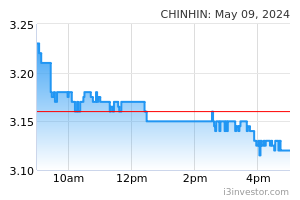

Chin Hin Group Bhd has emerged as the single largest shareholder in Ajiya Bhd following a deal to acquire 72.0m or about 24.7% equity interest in the building materials manufacturer for a total consideration of RM104.4m. The construction and property group penned a conditional share sale agreement with Ajiya’s existing largest shareholder and managing director Datuk Chan Wah Kiang and Avia Kapital Sdn Bhd to acquire the shares, which are valued at RM1.45 a share. The purchase price represents a 23.13% premium to the five-day volume weighted average market price of Ajiya shares. (The Star)

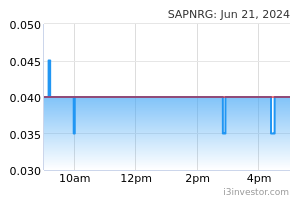

Sapura Energy Bhd’s 4QFY22 net loss ballooned to RM6.61bn vs. a loss of RM216.0m recorded in the previous corresponding quarter, as it booked an impairment on goodwill worth RM3.29bn, and an impairment on property, plant and equipment worth RM2.10bn. Revenue for the quarter dropped 68.6% YoY to RM453.1m. (The Edge)

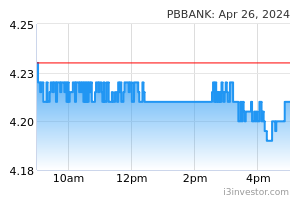

Public Bank Bhd and Carsome have inked a Memorandum of Understanding (MoU) to collaborate on car financing. Public Bank will be able to provide stock-financing and end-financing arrangements for the vehicles to its member Car Dealers and individual purchasers who have won the bids through Carsome’s online platform, as well as to extend wholesome financial products/or services to Carsome’s customers. (The Edge)

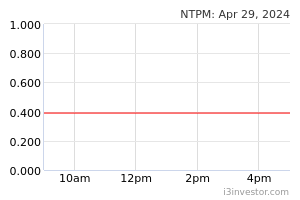

NTPM Holdings Bhd’s 3QFY22 net profit slumped 81.1% YoY to RM5.6, due to a RM12.6m gain from the disposal of a subsidiary, and lower profit to a significant increase in costs of raw materials, packaging materials and freight, higher utility and energy costs, lower foreign exchange gain, and higher selling and distribution expenses. Revenue for the quarter, however, rose 8.5% YoY to RM209.5m. (The Edge)

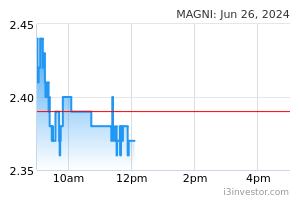

Magni-Tech Industries Bhd's 3QFY22 net profit dropped 45.5% YoY to RM26.7m, on lower contributions from its garment and packaging businesses, as well as the absence of a one-off disposal gain on property of RM6.9m recorded in the previous corresponding quarter. Revenue for the quarter fell 15.0% YoY to RM312.8m. (The Edge)

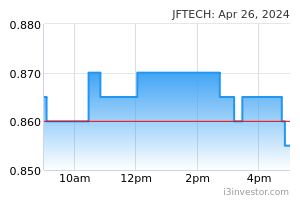

JF Technology Bhd's (JF Tech) chief executive officer (CEO) Dillon Atma Singh has resigned from his position in the high-performance test contacting solutions manufacturer to pursue other opportunities. The resignation will take effect on 21st March 2022. (The Edge)

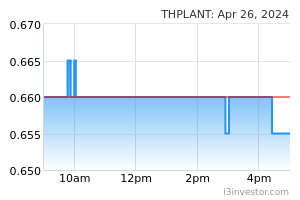

TH Plantations Bhd has appointed Datuk Dr Ahmad Kushairi Din as the palm oil company’s independent and non-executive director, effective 18th March 2022. Ahmad Kushairi is currently an independent non-executive director of Bank Pertanian Malaysia Bhd (Agrobank). (The Edge)

Eastland Equity Bhd is planning to acquire 92 commercial units in Bandar Tun Razak Business Park in Jengka, Pahang, as well as undertake a capital reduction exercise and business diversification to improve its financial position. The purchase of commercial units for RM24.8m will be satisfied via the issuance of 381.5m new shares at 6.5 sen apiece.

Meanwhile, the group’s proposed capital reduction exercise is aimed at eliminating its accumulated losses. This will involve the reduction of its entire capital reserve account of RM110.2m as well as the cancellation of RM66.1m of its issued share capital. The hospitality and property development company also proposed a diversification of its operations to include renewable energy and energy efficiency related technology and businesses, in a bid to diversify its earnings stream as its existing operations. (The Edge)

Source: Mplus Research - 21 Mar 2022