Still downbeat

Market Review

Malaysia:. The FBM KLCI (-0.6%) extended its losses as sentiment remain marred by the geopolitical tension between Russia and Ukraine yesterday. The lower liners trended lower, while the financial services (+0.3%) and transportation & logistics (+0.01%) outperformed the negative broader market.

Global markets:. Wall Street advanced as the Dow (+1.8%) rallied on the back of the easing concern over the inflationary pressure after crude oil prices continue to retreat. The European stockmarkets, however, ended mixed, while and Asia stockmarkets finished mostly negative.

The Day Ahead

The FBM KLCI sank further on the back of unresolved conflict between Ukraine and Russia, coupled with the rising Covid-19 cases in China. However, we believe the strong rebound on Wall Street could spill over to the local front, but the normalising commodity prices may weigh on the commodity related stocks. Meanwhile, the increasing foreign inflows may push the stocks on Bursa. At the point of writing, the crude oil price has fallen below USD100 per barrel mark, while the CPO price retreated further as investors kept a close watch on Indonesia’s permits addition.

Sector focus:. Given the pullback in crude oil and CPO prices, we reckon the energy and plantation counters may turn weak after the rally earlier on. Investors may turn their focus to technology stocks after the rebound in Nasdaq overnight. Meanwhile, talks over completion of MRT3 by 2030 may lift the construction related counters, but earnings wise may register in later stage. At this moment, the high building material prices could erode their margins.

FBMKLCI Technical Outlook

The FBM KLCI is trading below the daily EMA60 and the key index booked losses for the third session. Technical indicator remained negative as the MACD Histogram is still below zero, while RSI hovered below 50. The resistance is set around 1,570-1,580, while the support is located at 1,550, followed by 1,540.

Company Brief

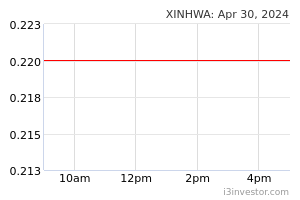

Xin Hwa Holdings Bhd (Xin Hwa) has invested approximately RM100.0m to establish an e-fulfilment centre in Shah Alam. The e-fulfilment centre is a purpose built building, specially designed to facilitate e-commerce logistics and to support the booming e-commerce market, which entails high volume and smaller-sized packages in general. The centre comprises a 7 storey office and a 3 storey warehouse with a total built-up of 300,000 sqf. (The Star)

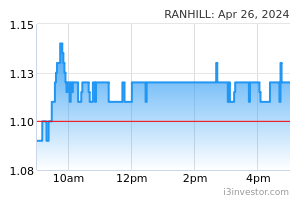

Ranhill Utilities Bhd’s indirect wholly-owned subsidiary, Ranhill Water Services Berhad (RWS) has secured a RM61.5m contract from Pengurusan Aset Air Bhd (PAAB) to replace old/ageing pipes with new pipes for OP3-19 in Kelantan. The project is expected to commence on 29th March 2022 and it is scheduled to be completed within 24 months on 28th March 2024. (The Star)

Former Dagang NeXchange Bhd (DNeX) managing director (MD) Zainal Abidin Abd Jalil, who still sits on the company's board, has been appointed as an independent non-executive director of TH Heavy Engineering Bhd, effective 15th March 2022. Zainal is currently an executive director of DNeX and has held the post since February 2019, after serving as the group's MD for about five years, and is also the group MD of Ping Petroleum Ltd, a 90.0%-owned subsidiary of DNeX. (The Edge)

Allianz Malaysia Bhd has appointed former Federal Court judge Tan Sri Zainun Ali as an independent and non-executive director of the group, effective 15th March 2022. Zainun retired from the Malaysian judiciary in 2018. (The Edge)

HLT Global Bhd's wholly-owned subsidiary HL Advance Technologies (M) Sdn Bhd (HLA) is suing WRP Asia Pacific Sdn Bhd, WRP Specialty Products Sdn Bhd (the first and second defendants) and three others over RM16.4m owed for equipment, goods and services provided by HLA. The three others named in the writ summons and statements of claim filed at the High Court are Michael Sng Beng Hock (third defendant), Loong Mei Yin (fourth defendant) and Abinash Majhi (fifth defendant). (The Edge)

Samaiden Group Bhd has bagged a RM56.6m engineering, procurement, construction and commissioning (EPCC) contract in relation to the development of a 15.0MW large scale solar photovoltaic power plant in Kamunting, Perak. Its wholly-owned subsidiary Samaiden Sdn Bhd has entered into a contract with Green RE Sdn Bhd to undertake works in relation to the power plant. (The Edge)

Advancecon Holdings Bhd has bagged a construction project worth RM42.5m in Klang. The group wholly-owned unit, Advancecon Infra Sdn Bhd (AISB) has accepted the letter of acceptance from Sime Darby Property (Bukit Raja) Sdn Bhd for the appointment as the contractor for the proposed construction and completion of earthworks and other related works for the development of Phase 2 (R6, R8, R9, and C5) in Bandar Bukit Raja 2, Kapar district. (The Edge)

AYER Holdings Bhd has proposed a first and final dividend of 10.0 sen per share for the financial year ended 31st December 2021. This is subject to its shareholders' approval at the forthcoming annual general meeting. (The Edge)

JAKS Resources Bhd wholly-owned subsidiary JAKS Nibong Tebal Sdn Bhd was granted financing from AmBank Islamic Bhd and United Overseas Bank (Malaysia) Bhd for its Large Scale Solar 4 (LSS4) project in Seberang Perai, Pulau Pinang. (The Edge)

Majuperak Holdings Bhd has terminated the subscription agreement it has with the Perak State Agricultural Development Corp (PPPNP). In October 2021, PPPNP proposed to subscribe 56.9m new shares in Majuperak, representing 20.0% of the existing shares, for RM19.1m. The cancellation agreement is aimed at reviewing all its fundraising proposals as it is an interim measure to meet the group's immediate funding purposes prior to Majuperak's regularisation plan. (The Edge)

Source: Mplus Research - 16 Mar 2022