Volatility remains a feature

Market Review

Malaysia:. The FBM KLCI (-0.8%) was grappled with renewed volatility, taking cue from the weakness on Wall Street overnight as the key index slipped -2.2% WoW. The lower liners, however, advanced after recovering from their intraday lows, but the broader market ended mostly lower with the exception of technology (+2.0%) and property (+0.1%) sectors.

Global markets:. Wall Street stayed choppy as the Dow (-0.7%) fell as there were no progress over the Ukraine and Russia talks, while Michigan consumer sentiment in March 2022 fell to 59.7; the weakest since November 2011. The European stockmarkets were upbeat, but and Asia stockmarkets ended mostly lower.

The Day Ahead

The day ahead:. The FBM KLCI retreated amidst the mixed regional market, as the sentiment remained negative, tracking the performance on Wall Street overnight. Moving forward, we expect market to consolidate over the near term given the (i) unresolved Russia-Ukraine tension and (ii) monetary policy decision from the US Federal Reserve this week will be watched closely. Should the Fed turn less hawkish in the upcoming meeting that may push the market higher going forward. Commodities wise, the crude oil hovered around USD110, while the CPO staged a pullback after recent rallies, hovering around RM6,700.

Sector focus:. We believe market will be focusing on recovery theme moving forward, as Malaysia will reopen the border to international visitors starting from 1st April 2022, which may benefit banking and consumer sectors. Meanwhile, selected glove stocks might trade on a positive note with the Shenzhen caught in a lockdown mode again.

FBMKLCI Technical Outlook

The FBM KLCI retraced after two sessions of rebound and the key index is below the daily EMA20 level. Technical indicator is weak as the MACD Histogram still below zero, while RSI is below 50. The resistance is pegged around 1,570-1,580, while the support is located at 1,550, followed by 1,540

Company Brief

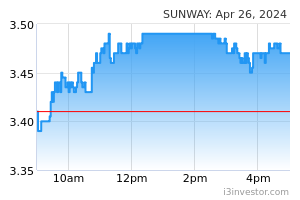

Sunway Bhd has won yet another accolade in its effort to be compliant with environmental, social and governance (ESG) requirements when it received an upgrade in the Morgan Stanley Capital International (MSCI) ESG Ratings to the highest rating of “A” from “BBB”. The company said it is also among the top 15.0% percentile of its Industry Classification Benchmark (ICB) Supersector assessed by FTSE Russell. (The Star)

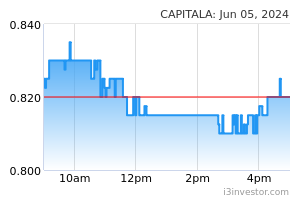

Tan Sri Tony Fernandes, chief executive officer of Capital A Bhd has clarified that the group decided not to proceed with a club facility of up to RM500.0m under the Danajamin Prihatin Guarantee Scheme as it deemed some of the conditions imposed unreasonable. Capital A will continue to explore other financing alternatives more suited to its operations and requirements, while noting that the group’s fundraising strategy remains firmly on track to sustain operations through 2022 and support the airline’s recovery. (The Edge)

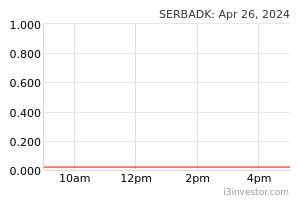

The High Court (commercial division) had dismissed four Serba Dinamik Holdings Bhd subsidiaries' applications for all of them to be placed under interim judicial management until the determination of a permanent judicial manager (JM) is made. The four companies do not pass the threshold of prima facie for the appointment of an interim judicial manager, as the hearing to appoint a permanent JM is already fixed on 24th March 2022, which is less than two weeks away. (The Edge)

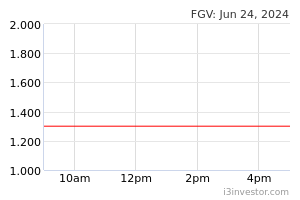

FGV Holdings Bhd has the plantation group does not appoint employment agencies or companies in India or other countries to hire plantation workers as alleged in advertisements and letters. It has also never used the services of Searising Overseas Training & Manpower Solution Pvt Ltd or authorised the company to hire workers for FGV. (The Edge)

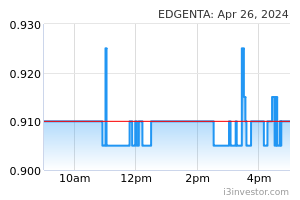

Sarawak Economic Development Corp (SEDC) has entered into a joint venture with UEM Edgenta Bhd’s subsidiary to provide project management services and engineering design consultancy services relating to engineering and construction projects. SEDC wholly-owned subsidiary PPES Consults Sdn Bhd (PCSB) will hold 51.0% of Opus Consultants (Sarawak) Sdn Bhd (OCS), while UEM Edgenta’s wholly owned subsidiary Opus International (M) Bhd (OIMB) will hold the remaining 49.0% stake. (The Edge)

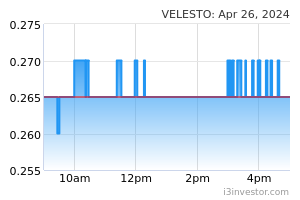

Velesto Energy Bhd (VEB) unit has received a 2 year contract to provide jack-up drilling rigs to Petronas Carigali Sdn Bhd (PCSB). PCSB's contract was awarded to Velesto Drilling Sdn Bhd (VED), which is mainly engaged in offshore drilling and operations and other engineering services for oil and gas exploration, development and production in Malaysia and overseas. (The Edge)

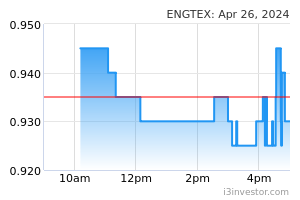

Engtex Group Bhd and its director Tan Sri Tee Tiam Lee are disposing of a 100.0% equity interest in property development firm Corporate Benchmark Sdn Bhd (CBSB) for RM13.5m. Following the disposal, CBSB will cease to be a subsidiary of Engtex. The disposal provides an opportunity for Engtex to unlock the value of the land since its acquisition in 2014 and generate immediate cash flow for its working capital purposes. (The Edge)

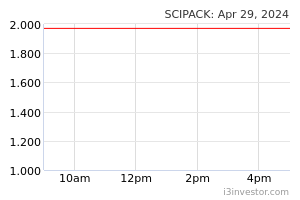

Scientex Packaging (Ayer Keroh) Bhd’s 2QFY22 net profit fell 22.6% YoY to RM11.7m, due to a rise in raw material and freight costs. Revenue for the quarter, however, rose 20.5% YoY to RM194.5m. (The Edge)

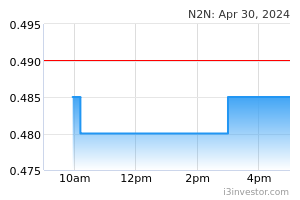

N2N Connect Bhd has announced the resignation of Datuk Tan Boon Leng as the company’s independent and non-executive director effective 11th March 2022. Tan, who had served on the board since 2009, has decided to step down as a director of the company after more than 12 years of service. (The Edge)

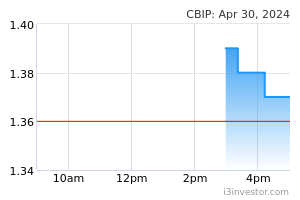

CB Industrial Product Holdings Bhd (CBIP) has acquired the remaining 30.0% stake or 30.0m shares in biofuels producer Gulf Lubes Malaysia Sdn Bhd (GLM) for RM24.0m in cash. Upon completion of the proposed acquisition, GLM will become a wholly-owned subsidiary of CBIP and enable the company to plan and set direction of GLM so as to achieve any potential synergy among the group of companies as well as to resolve the management deadlock in GLM as announced on 30th June 2020. (The Edge)

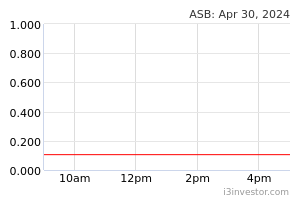

Advance Synergy Bhd (ASB) is proposing to undertake a renounceable rights issue of up to 1.86bn new ordinary shares in the company on the basis of 2 right shares for every 1 existing ordinary share held on an entitlement date to be determined later. In addition, the company is seeking a proposed exemption for its chairman Datuk Ahmad Sebi Bakar and the persons acting in concert with him from the obligation to undertake a mandatory take-over offer for the remaining ASB shares not already owned by them, upon completion of the proposed rights issue. (The Edge)

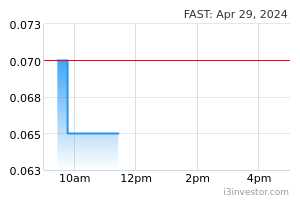

Fast Energy Holdings Bhd plans to raise up to RM4.7m through a private placement of up to 78.5m new shares or 10.0% of its total issued shares, at issue price to be determined later. Proceeds from the proposed private placement will be used mainly to fund the working capital of the petroleum trading business, as the company has already entered into contracts for its petroleum products. (The Edge)

Source: Mplus Research - 14 Mar 2022