Recovery still premature

Market Review

Malaysia:. The FBM KLCI (+0.6%) snapped a 3-day losing streak, on the back of bargain hunting activities amongst plantation, oil & gas and banking heavyweights yesterday. The lower liners also rebounded, while the broader market closed mostly higher, led by the sharp recovery of technology sector (+4.2%).

Global markets:. Wall Street extended its losses as the Dow (-1.4%) trended lower for the fifth straight session after US President Joe Biden has expanded sanctions against Russia. The European stockmarkets ended mostly downbeat, but Asia stockmarkets finished mostly higher.

The Day Ahead

The FBM KLCI notched higher amidst the mixed regional markets, mainly propelled by the banking and plantation heavyweights. We believe the commodity related sectors will remain buoyant with the firm crude palm oil and crude oil, which are trading around RM6,054 and USD96.84, respectively. On the technology sector, the rebound could be short lived tracking another selldown in Nasdaq overnight. Besides, gold price continues to charge higher, trading above USD1,900 per ounce on the back of the unsettled geopolitical tensions between Russia and Ukraine.

Sector focus:. Investors may keep an eye on the metal-related companies amid higher iron ore and aluminium prices. Also, we expect traders to focus on plantation, oil and gas and gold related sectors given the underlying commodity trends remain intact. Meanwhile, the technology sector may see some pullback following the slump in Nasdaq overnight.

FBMKLCI Technical Outlook

The FBM KLCI snapped the three-session losing streak and finished above the previous support level at 1,580. Technical indicators are mixed as the MACD fell below the zero level, while the RSI hovered above the 50 level. Resistance is set at 1,600-1,620, while the support is envisaged at 1,570-1,580.

Company Brief

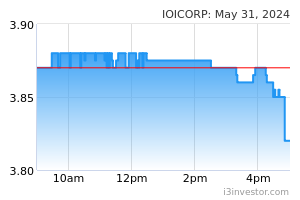

IOI Corporation Bhd’s 2QFY22 net profit rose 39.1% YoY to RM494.7m, bolstered by higher crude palm oil (CPO) price. Revenue for the quarter added 67.8% YoY to RM4.11bn. (The Star)

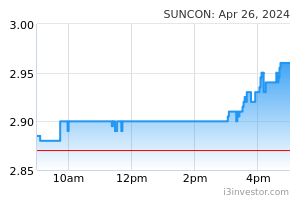

Sunway Construction Group Bhd’s (SunCon) 4QFY21 net profit jumped 114.3% YoY to RM64.7m, driven by better performance of its construction segment. Revenue for the quarter, however, fell marginally by 0.1% YoY to RM626.6m. A second interim dividend of 4.0 sen per share, payable on 7th April 2022. (The Star)

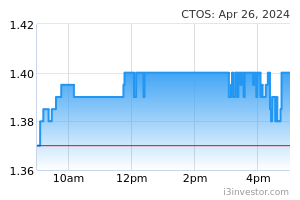

CTOS Digital Bhd has finalised the issue price of its proposed primary placement exercise at RM1.58 per share to raise a total of RM173.8m. CTOS is placing out 110.0m shares representing 5.0% of its share base to optimise the amount of equity and debt to fund the company’s acquisitions, and to defray the estimated costs associated with the proposed placement. (The Edge)

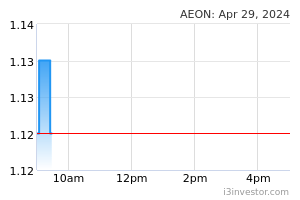

AEON Co (M) Bhd’s 4QFY21 net profit jumped 161.3% YoY to RM71.0m, on the back of higher revenue following the relaxation of Movement Control Order restrictions in September 2021 and lower costs. Revenue for the quarter rose 8.3% YoY to RM992.1m. (The Edge)

Apex Healthcare Bhd’s 4QFY21 net profit climbed 43.8% YoY to RM20.7m, on higher margin products in the sales mix of the group’s operating subsidiaries and improved quarterly contribution from its associates. Revenue for the quarter rose 22.3% YoY to RM197.7m. A final dividend of 3.0 sen per share, as well as a special dividend of 6.0 sen per share, to be approved by its shareholders at the upcoming annual general meeting was proposed. (The Edge)

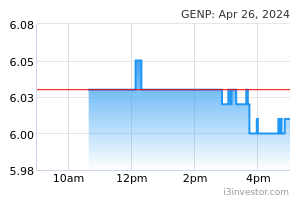

Genting Plantations Bhd’s 4QFY21 net profit jumped 104.5% YoY to RM161.6m, backed by improved contributions from both its plantation and downstream manufacturing segments. Revenue for the quarter rose 44.8% YoY to RM1.07bn. A dividend payout of 19.0 sen per share, comprising 15.0 sen special dividend per share and a proposed final dividend of 4.0 sen per share was proposed. (The Edge)

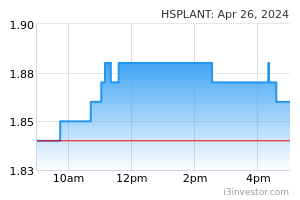

Hap Seng Plantations Holdings Bhd’s 4QFY21 net profit jumped 155.2% YoY to RM94.3m, underpinned by higher palm oil prices. Revenue for the quarter rose 27.1% YoY to RM194.8m. A second interim dividend of 15.5 sen per share, payable on 23rd March 2022 was declared. (The Edge)

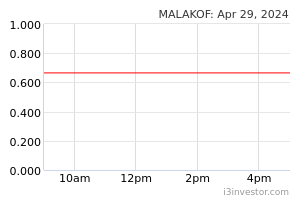

Malakoff Corp Bhd’s 4QFY21 net profit sank 77.9% YoY to RM9.2m, due to write offs and impairments. Revenue for the quarter, however, improved 28.5% YoY to RM1.94bn. (The Edge)

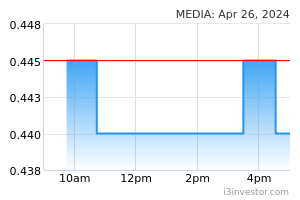

Media Prima Bhd’s 4QFY21 net profit surged 279.3% YoY to RM28.9m, on higher revenue and lower operating costs. Revenue for the quarter grew 22.8% YoY to RM315.9m. A first and final dividend of 1.5 sen per share, payable on 20th May 2022 was declared. (The Edge)

Sarawak Plantation Bhd’s 4QFY21 net profit jumped 94.9% YoY to RM32.5m, in line with an increase in operating profit that offset the loss arising from changes in fair value of biological assets of RM11.8m. Revenue for the quarter grew 84.3% YoY to RM243.6m. A single tier interim dividend of 5.0 sen per share, payable on 29th March 2022 was declared. (The Edge)

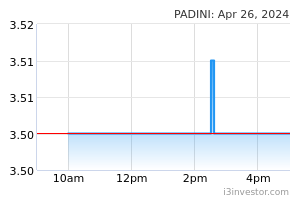

Padini Holdings Bhd’s 2QFY22 net profit soared 471.7% YoY to RM60.9m, boosted by the full reopening of the economy after the national Covid-19 vaccine roll-out last year. Revenue for the quarter rose 73.7% YoY to RM427.2m. (The Edge)

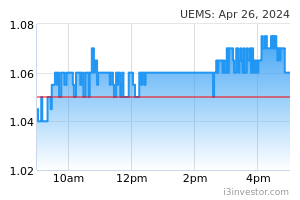

UEM Sunrise Bhd’s 4QFY21 net loss widened to RM152.3m, from a net loss of RM134.7m recorded in the previous corresponding quarter, dragged down by larger foreign exchange losses. Revenue for the quarter fell 18.9% YoY to RM496.3m. (The Edge)

Source: Mplus Research - 24 Feb 2022