Downward pressure unease

Market Review

Malaysia:. The FBM KLCI (-0.2%) recorded its fourth day losing streak, on the back of weakness in banking and gloves heavyweights yesterday. The lower liners, however, rebounded on bargain hunting activities, while broader market turned mostly upbeat, led by the recovery in technology sector (+1.9%).

Global markets:. Wall Street erased their intraday gains to sink in the red as the Dow (-0.9%) declined on concerns over the anticipated rising interest rates environment, while jobless claims data rose to 3 months high. The European stockmarkets ended mostly higher, while Asia stockmarkets ended mixed.

The Day Ahead

The FBM KLCI declined for another session amidst mixed regional markets as banking heavyweights fell after BNM kept its OPR unchanged. Tracking the weakness from Wall Street overnight, we believe investors may still be jittery in the anticipation of an interest rate hike environment as well as the still-spiking Covid- 19 cases. Hence, the negative sentiment may spillover to stocks on the local front and profit taking activities on the technology counters may emerge. On the commodity markets, the CPO price continued to trend above its all-time-high, while the crude oil price hovered above the USD88/bbl mark.

Sector focus:. We remained positive in the energy and plantation stocks as commodities price sustained. Meanwhile, we believe technology may turn lower on the back of profit taking activities, while we expect building material segment to gain traction as metals rally heats up.

FBMKLCI Technical Outlook

The FBM KLCI ended lower for the fourth consecutive session as the key index crossed below the immediate support at 1,530. Technical indicators remained negative as the MACD Histogram has shown a negative bar, while the RSI remained below the 50 level. Next support is set at 1,505, while the resistance is located at 1,570.

Company Brief

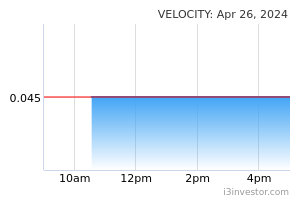

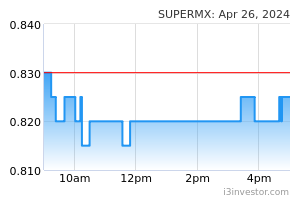

Supermax Corp Bhd confirmed that two of its existing contracts for the supply of nitrile gloves in Canada have been terminated. The remaining balance of these two contracts at free on board value is US$12.7m or under 0.8% of the group’s revenue. Meanwhile, the group’s Canadian unit’s contracts for other personal protective equipment (PPE) products remain in place and are not affected. (The Star)

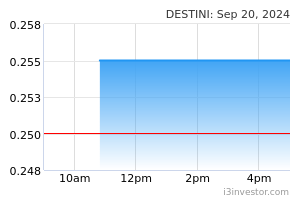

Destini Bhd’s wholly-owned subsidiary, Destini Prima Sdn Bhd has secured two contracts from the Ministry of Defence (Mindef) worth a total of RM89.0m to provide maintenance services and supply equipment to the military. Both the contract is to provide maintenance, repair and overhaul (MRO) services and supply safety and survival related equipment. (The Star)

NWP Holdings Bhd has announced that an extraordinary general meeting (EGM) requisitioned by several shareholders of the timber company will not be held as its board of directors deems it invalid. The requisitions of the EGM from Maybank Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Datuk Tan Lik Houe and Affin Hwang Nominees (Tempatan) Sdn Bhd Pledged Securities Account for Chang Huan Soon are not members of the company for at least 10.0% of the issued share capital of the company in aggregate as on 6th January 2022. (The Edge)

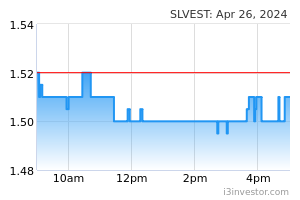

Solarvest Holdings Bhd, insurers QBE Insurance (Malaysia) Bhd and Anora Agency Sdn Bhd have collaborated to provide solar photovoltaic (PV) investors a solar investment insurance product, namely the SolarPro Line-Stoppage insurance policy. The trio have signed a tripartite Memorandum of Understanding (MoU) to enable Solarvest to be able to take up, as well as provide its solar PV investors with an all-new solar investment insurance product. (The Edge)

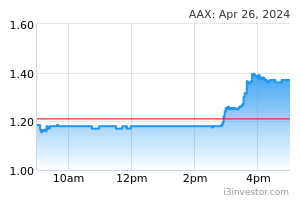

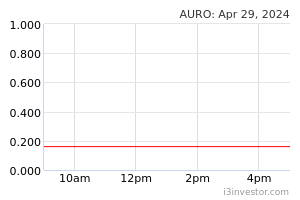

AirAsia X Bhd (AAX) along with AAX Leasing Two Ltd has withdrawn their application to challenge the registration of a UK court judgement by its lessor BOC Aviation Ltd for the airlines to pay US$23.4m (RM96.8m). Initially a hearing date was fixed for October 2021, but that did not proceed. (The Edge)

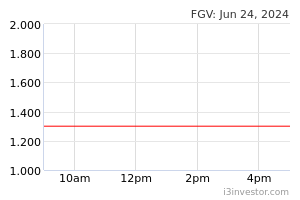

FGV Holdings Bhd has signed 12 collective agreements (CAs) with its workers' unions for the years 2022 to 2024. The successful negotiations for the 12 CAs, amidst lingering pandemic challenges, demonstrated strong commitments and commendable industrial relations among all parties. (The Edge)

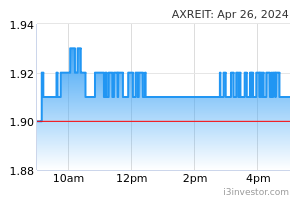

Axis Real Estate Investment Trust's (Axis REIT) 4QFY21 net property income rose 10.4% YoY to RM53.8m, mainly due to contributions from newly acquired properties and positive rental reversion. Revenue for the quarter grew 9.4% YoY to RM62.9m. A distribution per unit (DPU) of 0.38 sen, payable on 28th February 2022 was declared. (The Edge)

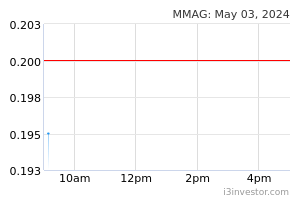

MMAG Holdings Bhd has raised its stake in ceramics and pottery products manufacturer CSH Alliance Bhd to 16.6% by subscribing for new shares in a rights issue. MMAG emerged as a substantial shareholder in CSH in May 2021 after acquiring 35.0m shares or a 5.1% stake in the company on the open market. The group also received 194.5m free detachable warrants on the basis of one warrant for every one rights share subscribed. (The Edge)

Source: Mplus Research - 21 Jan 2022