Positive sentiment may persist

Market Review

Malaysia:. The FBM KLCI (+0.4%) extended its winning streak in line with the positive performances across regional peers as investors looked past Omicron risks. The lower liners extended gains, while all the 13 sub-indices on the broader market climbed for the second session.

Global markets:. The US stockmarkets ended mixed as the Dow (+0.3%) extended its year-end rally, but the S&P 500 (-0.1%) and Nasdaq (-0.6%) dipped following recent gains as Omicron fears returned. However, both the European and Asia stock markets trended higher.

The Day Ahead

The FBM KLCI was supported on the back of positive regional performance and ongoing window dressing activities. Although Omicron variant might be having mild symptoms, lower hospitalisation and death rates, it has caused cancellation of flights in various countries as cases spiked. However, countries with higher vaccination rate should be able to mitigate the risk of another full lockdown. Given the mixed feeling on the Omicron worries, we expect mild profit taking activities to emerge on the local front. Nevertheless, market trading activities might recover with the new developments on the share trading stamp duty and that should limit the downside risk on the broader market. On the commodity markets, the Brent oil and the crude palm oil have been trading firmly higher over the past few days.

Sector focus:. Given the mixed feeling on the Omicron variant, we expect trading interest to return on healthcare stocks, while traders may focus on the window dressing activities on the heavyweights. Meanwhile, the overall broader market sentiment may turn positive as stamp duty capping on share trading may return.

FBMKLCI Technical Outlook

The FBM KLCI continued its upward move for the fifth straight session to close above the daily EMA120 level. Technical indicators remained positive as the MACD Histogram has extended a positive bar, while the RSI is hovering above 50. The resistance is pegged at 1,560, while the support is set along 1,520-1,530.

Company Brief

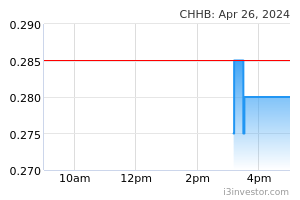

Country Heights Holdings Bhd (CHHB) has inked a licensing agreement and a collaboration agreement with Beijing Wodong Tianjun Information Technology Co Ltd (JD.com) as part of its digital transformation plan. The agreement will lead to the development of JD.com's omnichannel business model using JD.com technologies and CHHB's resources for the Malaysian market. JDMines will also build a physical store of about 100,000 sq ft on the ground floor of Mines International Exhibition and Convention Centre. (The Star)

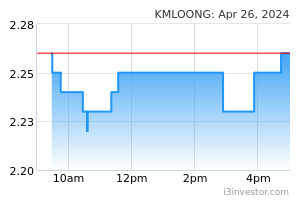

Kim Loong Resources Bhd's 3Q21 net profit rose 42.5% YoY to RM41.1m, mainly contributed by higher average CPO selling price. Revenue surged 76.9% YoY to RM492.8m. A special dividend of 4.0 sen per share, payable on 17th February 2022 was declared. (The Star)

NWP Holdings Bhd’s wholly-owned subsidiary NWP Construction Sdn Bhd had accepted letters of award from Pembinaan Bintang Baru Sdn Bhd to supply and install aluminium formwork system and undertake skim coating works for RM30.4m. The works will be done for two development sites in Klang Valley. (The Star)

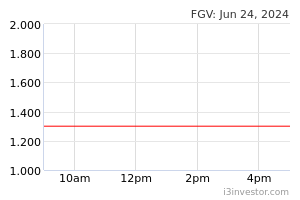

FGV Holdings Bhd will issue a combined RM500.0m worth of Islamic bonds or sukuk in the form of Islamic medium term notes across eight tranches on 31st December 2021. The eight sukuk tranches, which have tenures of between one and eight years, will pay profit rates of between 4.5% and 5.6% a year. (The Edge)

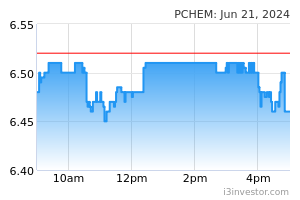

Permodalan Nasional Bhd's unit trust fund Amanah Saham Bumiputera (ASB) has ceased to be a substantial shareholder in Petronas Chemicals Group Bhd (PetChem) after it disposed of 2.8m shares in the group. A calculation done on the back of an envelope showed that the latest transaction left ASB with 398.6m PetChem shares, or just under 5.0%, in the group. According to Bloomberg data, ASB is the third largest shareholder of the group, behind its parent company Petroliam Nasional Bhd with a 64.4% stake and Employees Provident Fund with a 6.5% stake. (The Edge)

Ancom Bhd is diversifying into the manufacturing of chemical and animal health products. The group has proposed to acquire an 80.0% equity interest each in Shennong Animal Health (Malaysia) Sdn Bhd and Vemedim Sdn Bhd (collectively known as Shennong Group) for a total of RM23.9m. The proposed acquisition comes with an earnings guarantee of RM4.6m in profit after tax per year for 2022 and 2023. (The Edge)

SCGM Bhd's 2Q21 net profit fell 18.6% YoY to RM7.8m due to higher resin prices. Revenue for the quarter, however, was up 18.9% YoY to RM72.5m on the back of higher demand for its thermo-form food and beverage packaging, as well as a 24.1% increase in domestic sales to RM49.2m, and a 9.3% rise in export sales to RM23.3m. A second interim dividend of 1.7 sen per share, payable on 26th January 2022 was declared. (The Edge)

SMTrack Bhd has entered into an autonomous aerial vehicle agreement with Strong Rich Holdings Ltd to purchase an EHang 216 (EH216) AAV worth US$2.5m (RM10.5m). The rationale of the acquisition is to establish business integration with Strong Rich to enhance SMTrack's revenue. The acquisition will be funded via the proceeds arising from the issuance of redeemable convertible notes and private placement. (The Edge)

The Securities Commission Malaysia on Tuesday secured a warrant of arrest for Serba Dinamik Holdings Bhd group managing director and chief executive officer Datuk Dr Mohd Abdul Karim Abdullah, who is currently at large. Earlier in the day, the regulator charged the group's executive director Datuk Syed Nazim Syed Faisal, group chief financial officer Azhan Azmi, and vice president of accounts and finance Muhammad Hafiz Othman for allegedly submitting a false statement to Bursa Malaysia Securities Bhd in relation to a revenue figure of RM6.01bn contained in Serba Dinamik's financial report for the quarter and year ended 31st December 2020. (The Edge)

Source: Mplus Research - 29 Dec 2021