Heading back onto 1,600

Market Review

Malaysia:. The FBM KLCI (+0.4%) recovered most of its previous session losses, taking cue from gains on Wall Street overnight as the key index recorded 2.2% WoW gains. The lower liners were upbeat, while healthcare sector (-0.2%) was the sole decliner on the broader market.

Global markets:. The US stockmarkets extended their gains as the Dow jumped 1.1%, boosted by a string of stronger-than-anticipated corporate earnings from Goldman Sachs Group, Charles Schwab, J.B. Hunt Transport Services and Alcoa. Both the European and Asia stockmarkets were also traded on an upbeat manner.

The Day Ahead

The FBM KLCI advanced on Friday in tandem with the regional peers following the positive cues from Wall Street lifted by optimism in the corporate earning seasons as well as the improved labour data. We expect buying momentum to persist on the local front following a streak of buying interest from foreign funds. Meanwhile, the relaxation in SOPs and the movement of Klang Valley, Melaka and five other states into the next phase of NRP would continue to drive the recovery theme stocks. Meanwhile, both the CPO and crude oil prices rose; the latter is trading above the USD85 per barrel mark at the time of writing.

Sector focus:. Whilst the local bourse may mirror the overnight gains in Wall Street, investors may continue piling into counters that would benefit from economic reopening, such as aviation, consumer, property and construction. Besides, the oil and gas counters may maintain its momentum amid high crude oil price.

FBMKLCI Technical Outlook

The FBM KLCI rebounded from the previous session loss as the key index traded near the 1,600 psychological level. Technical indicators remained positive as the MACD Histogram has extended a green bar, while the RSI continued hovering mildly below 70. Resistance is envisaged along 1,605-1,620, while the support is located at 1,580.

Company Brief

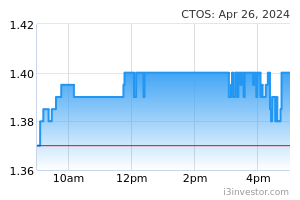

CTOS Digital Bhd’s 3QFY21 net profit grew 9.3% YoY to RM11.7m, supported by higher topline contribution. Revenue for the quarter gained 13.4% YoY to RM38.6m. An interim dividend of 0.53 sen per share, payable on 10th December 2021 was declared. (The Star)

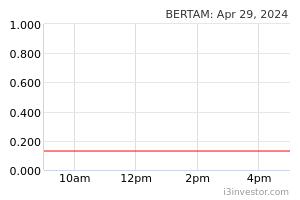

Bertam Alliance Bhd has accepted a RM25.0m subcontract from BBSB Holdings Sdn Bhd to build an office complex for the Malaysia Anti-Corruption Agency (MACC), Sabah. The letter of award was dated 5th July 2021, but Bertam had delayed accepting the award due to the lockdown in Sabah. (The Star)

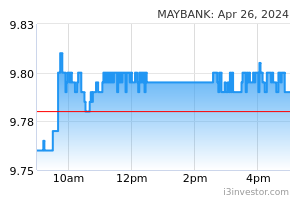

Malayan Banking Bhd (Maybank) has issued 250.0m yuan (about RM161.0m) worth of fixed-rate bonds due 2024 on the Singapore Exchange (SGX). The fixed rate notes, which pay an annual interest rate of 3.15%, will be listed and quoted on SGX's Bonds Market at 9.00am on 18th October. Maybank, however, did not announce how the bond sale proceeds will be used. (The Edge)

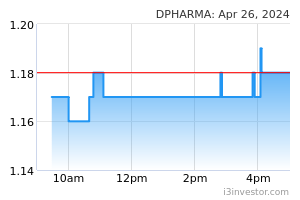

Sinopharm's Covid-19 vaccine is now available in Malaysia, according to Duopharma Biotech Bhd. The first shipment of the vaccine arrived in batches in September 2021 and it is now widely available at clinics and private hospitals nationwide. (The Edge)

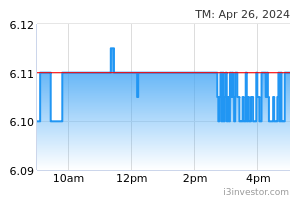

Telekom Malaysia Bhd (TM) has started migrating its unifi customers to private Internet Protocol (IP) to enable more seamless connectivity and better security. This is due to the rapid growth of Internet usage which has caused Internet Service Providers (ISPs) worldwide to face the exhaustion of IPv4 addresses. (The Edge)

Axteria Group Bhd has signed a non-binding letter of intent with Far East Hospitality Management (S) Pte Ltd (FEH), expressing its intent in managing the hotel and serviced suites located in Kota Laksamana, Melaka. The project consists of a 16-storey development building with 241 hotel rooms and a 44-storey development building with 306 serviced suites, both of which are being proposed to be managed under the FEH brands. (The Edge)

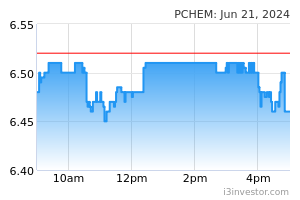

Petronas Chemicals Group Bhd's (PChem) joint-venture BASF Petronas Chemicals Sdn Bhd (BPC) is planning to expand production capacity in its Verbund site in the Gebeng Industrial Area, Kuantan, Pahang. The Gebeng site currently produces 2- Ethylhexanoic Acid (2-EHA). BPC is planning to double its annual production to 60,000MT by 2024, from 30,000MT currently. (The Edge)

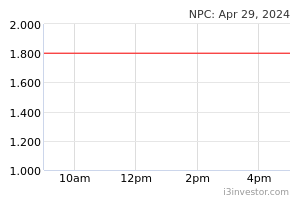

NPC Resources Bhd is disposing of four parcels of agricultural land in Kinabatangan, Sabah, to Syarikat Kretam Plantations Sdn Bhd (SKPSB) for a total of RM52.7m. The four parcels of land with a total net book value of about RM45.7m as of 31st December 2020 are fully cultivated and come with infrastructure, buildings, fixtures, fittings, and assets. (The Edge)

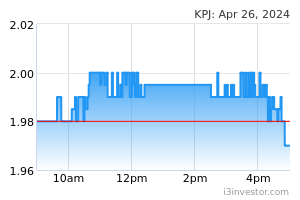

KPJ Healthcare Bhd and Al Aqar Australia Pty Ltd are varying an existing lease agreement to revise the rental rate of the former's Jeta Gardens elderly care properties in Brisbane, Australia. The new agreement values the properties at AU$28.5m from AU$45.5m since 2011, while its base rental rate was reduced to 6.5% to the market value of the properties, from 8.5% previously. The revised rental rate is effective 2nd October 2021 until 1st November 2023, with another revision planned for 2023-2026. (The Edge)

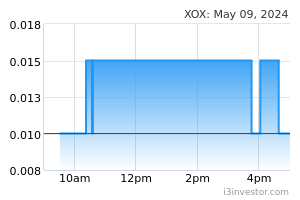

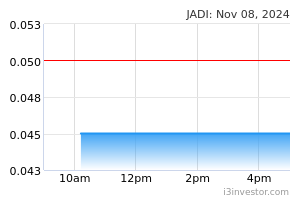

XOX Bhd, via its wholly-owned subsidiary XOX (Hong Kong) Ltd (XOX HK), has entered into an agreement to acquire 200.0m shares or a 19.0% stake in Jadi Imaging Holdings Bhd for RM46.0m. XOX HK entered into a sale and purchase of shares agreement with Liew Kim Siong and Ng Poh Imm for the proposed acquisition. (The Edge)

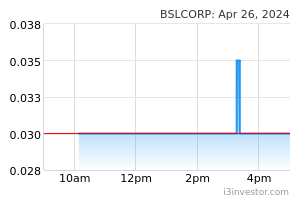

BSL Corp Bhd has announced the resignation of Ngiam Tee Wee as its chief executive officer. Ngiam, 53, has resigned due to other work commitments as the managing director at the subsidiary level, but did not elaborate. (The Edge)

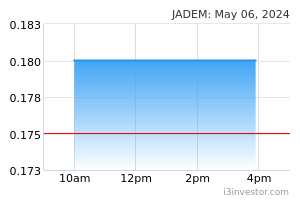

Jade Marvel Group Bhd is planning to collaborate with a newly incorporated local private company to jointly undertake the management of wellness industry-related businesses via a one-stop information technology control system. Jade Marvel has inked a memorandum of understanding with BHealthy Wellness Sdn Bhd, whose owners and directors Chua Kian Leong and Goh Chee Siang both have vast experience in the wellness industry, including spa, reflexology and beauty specialist businesses. (The Edge)

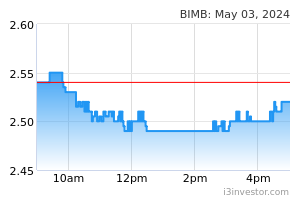

Bank Islam Malaysia Bhd plans to establish a dividend reinvestment plan (DRP) to provide shareholders with the option of reinvesting their dividend in new Bank Islam shares, in lieu of receiving cash. Under the DRP, Bank Islam's board may decide whether to pay dividends in cash or to offer shareholders the option to reinvest all or part of it in DRP shares. (The Edge)

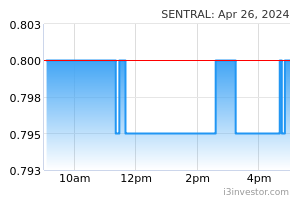

Sentral REIT has lodged debt programmes with the Securities Commission, through which it plans to raise up to RM3.00bn in combined aggregate value to finance its investment activities and general working capital, as well as to refinance its borrowings. (The Edge)

Source: Mplus Research - 18 Oct 2021