Hovering near support

Market Review

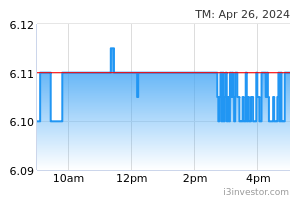

Malaysia:. The FBM KLCI (-0.1%) recorded its third straight decline after erasing all its intraday gains, dragged down by weakness in selected banking heavyweights. The lower liners trended mostly lower, while the technology sector (+1.5%) anchored the mostly positive broader market.

Global markets:. The US stockmarkets retreated as the Dow slipped 0.9%, dragged down by the selloff in technology stocks, coupled with the threat of rising inflation. Both the European stockmarkets extended their losses, while Asia stockmarkets ended mixed.

The Day Ahead

The FBM KLCI ended marginally lower, as foreign funds inflow declined for the session amid mixed regional market performances on the back of concerns over US debt ceiling crisis as well as China Evergrande’s issues. However, trading interest was noticed in recovery theme sector as recovery in sight with the adult vaccination rate hitting 88.0%, and the number of Covid-19 daily confirmed cases trending lower. Meanwhile, the crude oil price settled above USD81 per barrel mark as OPEC+ stick to its schedule of gradual monthly output increases. The CPO price stood firmer above the RM4,500 mark.

Sector focus:. We believe the rally in Brent oil price should bode well for the trading of oil & gas stocks. Besides, trading interest in recovery theme stocks such as aviation, consumer, building material and property should continue.

FBMKLCI Technical Outlook

The FBM KLCI marked third session of decline as the key index continued to hover below the daily EMA9 level. Technical indicators remained negative as the MACD Histogram has extended another red bar, while the RSI is still below the 50 level. Resistance is located at 1,550-1,560, while the support is pegged along 1,500- 1,515.

Company Brief

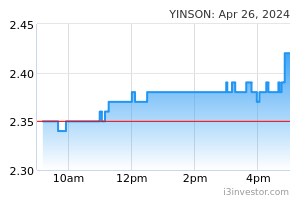

Yinson Holdings Bhd has appointed Gregory Lee as an independent non-executive director, effective from 1st October 2021. He is a long-term venture investor in technology companies, with roles including global CEO of Bower & Wilkins, founder and director of 1DERLIFE Investment Management, director of 1derfood Technology Pte Ltd, CEO and strategic adviser of FoodZaps Technology Pte Ltd. (The Star)

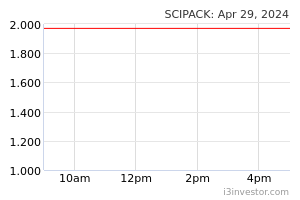

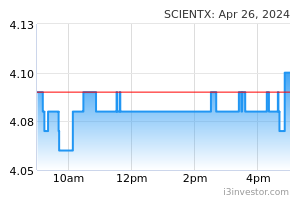

Daibochi Bhd has until 25th October 2021 to consider whether to accept Scientex Bhd's takeover offer after receiving the offer documents relating to the unconditional voluntary takeover offer by Scientex. The offer is open for acceptances until 5.00pm Malaysian time on 25th October 2021, unless an extension is announced no later than two days before the closing date. (The Star)

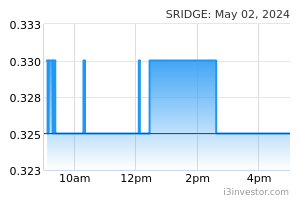

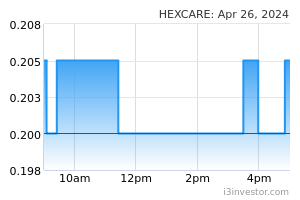

Silver Ridge Holdings Bhd’s (SRHB) wholly-owned subsidiary Silver Ridge Sdn Bhd has secured a job award from Telekom Malaysia Bhd (TM) worth RM20.6m. The contract is for the supply, delivery, testing, commissioning, maintenance, and support services of Metro Ethernet Forum Carrier Ethernet 2.0 Complaint network interface device with its associated accessories and element management system. The tenure of the contract is for a period of 36 months commencing from 4th May 2021 to 3rd May 2024. (The Star)

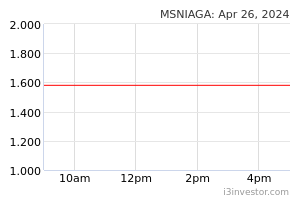

Mesiniaga Bhd has accepted two contracts with Measat Broadcast Network Systems Sdn Bhd. The contract for the supply of the internet service provider core infrastructure carries a value of RM49.3m, is for the period from 30th September 2021 to 28th February 2027. Meanwhile, the contract for the supply of RGW and MESH WiFi routers has a value range of RM4.1-RM114.8m, subject to the purchase orders issued by the customer based on its requirement is for the period of 30th September to 29th September 2026. (The Star)

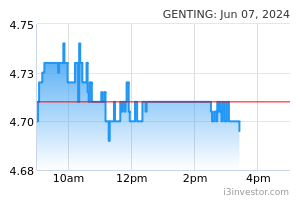

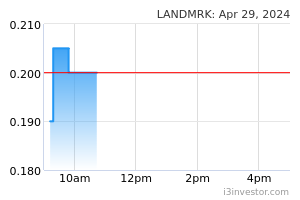

Genting Bhd via 25.0%-owned associate Landmarks Bhd is expected to gain its maiden exposure to Singapore-listed Blumont Group Ltd after Landmarks proposed to sell its Indonesian hospitality asset to Blumont in an estimated S$63.4m (RM195.1m) all-share deal which will see Landmarks emerge as a substantial shareholder with a 29.3% stake in Blumont. (The Edge)

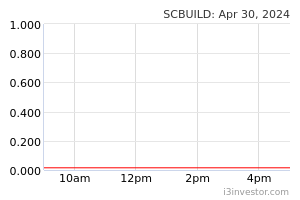

Trading in the shares of construction company SC Estate Builder Bhd will be suspended on today morning at the company's request, pending the release of a material announcement. (The Edge)

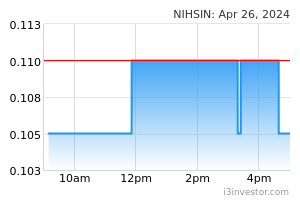

A unit of stainless steel cookware maker Ni Hsin Group Bhd has entered into a brand partnership deal with the Malaysian Institute of Estate Agents (MIEA) to market its products and services to registered members of MIEA. Ni Hsin’s indirect subsidiary BlackBixon Sdn Bhd signed the agreement as part of its efforts to diversify into the food and beverages business. (The Edge)

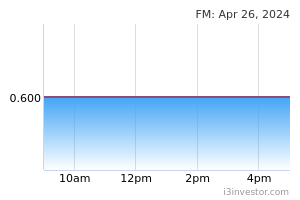

Freight Management Holdings Bhd is buying three US-based freight forwarding services companies for a combined US$2.2m (approximately RM9.2m) as part of the group's expansion initiatives into selective international markets. Freight Management indirect wholly-owned subsidiary FM Global Logistics Ventures Sdn Bhd has entered into a stock purchase agreement with several independent third parties to acquire the entire issued shares of Inter-Orient Services, Inter-Orient Corp and Noble Shipping Corp. (The Edge)

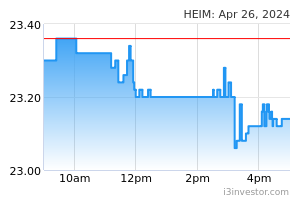

Heineken Malaysia Bhd has joined the 30.0% Club Malaysia, a local chapter of the global business-led campaign focused on building an ecosystem of businesses to promote diversity, equity and inclusion with a focus on gender balance on boards and C-suites. This highlights part of its 2030 Brew a Better World sustainability commitment. (The Edge)

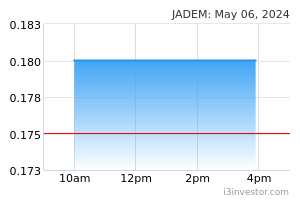

Jade Marvel Group Bhd has acquired a 51.0% stake in licensed community credit services provider MYK Capital Management Sdn Bhd for a purchase consideration of RM1.2m. Jade Marvel wholly-owned subsidiary Total IPCO Sdn Bhd has entered into a share sale agreement with Datuk Tan Cheng Yam, Tan Eng Hwa and Pinjam Gadai 916 Sdn Bhd for the purchase. (The Edge)

Making its first foray and diversification into property investment, glove maker Rubberex Corp (M) Bhd is undertaking a joint collaboration with Alliance Premier Sdn Bhd, EXSIM Holdings Sdn Bhd and JT Momentum Sdn Bhd (EXDJ shareholders) for the development and operation of Empire City Mall in Petaling Jaya, Selangor. Rubberex has entered into a subscription agreement with Alliance Empire to subscribe 200,000 new shares or a 20.0% equity interest in the latter for RM180.0m cash, while Alliance Premier will hold 60.0% and EXDJ shareholders the remaining 20.0%. (The Edge)

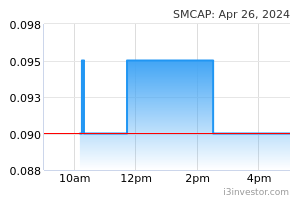

Sinmah Capital Bhd has proposed a capital reduction exercise, that entails the reduction of RM88.0m of its issued share capital, which totalled RM188.5m, as of 1st October 2021 to eliminate its accumulated losses. The corresponding credit of RM88.0m will be utilised to eliminate the group's accumulated losses of RM80.2m as of 30th June 2021. (The Edge)

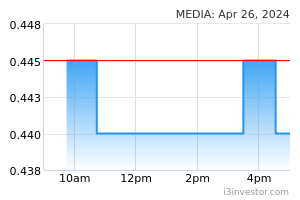

Media Prima Bhd has appointed Samuel Wee as chief executive officer of its digital arm, REV Media Group, effective 1st October 2021. Wee will be taking over from Rafiq Razali, who has been appointed group managing director of Media Prima. (The Edge)

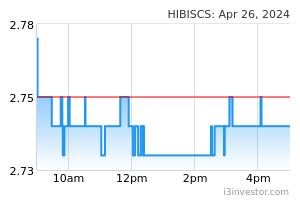

Hibiscus Petroleum Bhd indirect wholly-owned subsidiary Anasuria Hibiscus UK Ltd remains committed to working with the UK Oil and Gas Authority to move the Quad 15 area development in the UK North Sea forward. Hibiscus also proposed a final dividend of 1.0 sen per share for FY21, subject to shareholders' approval at the forthcoming annual general meeting. (The Edge)

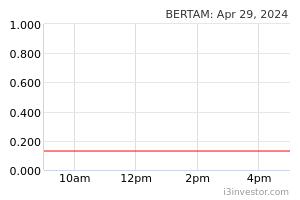

Bertam Alliance Bhd has announced that the RM8.3m contract it clinched via its wholly-owned subsidiary Bertam Development Sdn Bhd from Integral Acres Sdn Bhd to complete the external works and services and balance of works for a six storey car park and community facilities block at PR1MA @ Sandakan City Centre has been terminated. The termination follows a notification by Integral Acres that the latter received a notice of termination from its client, PR1MA Corp Malaysia, on 27th August 2021 on the PR1MA @ Sandakan City Centre project. (The Edge)

Source: Mplus Research - 5 Oct 2021