Investment Highlights

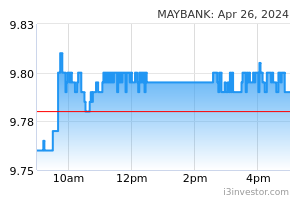

- We maintain our BUY call on Malayan Banking (Maybank) with an unchanged fair value (FV) of RM9.80/share, pegging the stock to a P/BV of 1.3x supported by FY23F ROE of 10.9%. Our 4-star ESG rating has been maintained, resulting in a 3% premium to our FV on the stock.

- We make no changes to our earnings estimates.

- The group provided a briefing last Friday to update on its progress as well as 2023 focus and beyond of its key business sector, the Group Community Financial Services (GCFS).

- 94.6% of GCFS customers are retail customers. This is followed by 5.1% retail SME and 0.3% business banking, which includes SME plus customers with sales turnover of more than RM25mil.

- Recall in FY22, GCFS contributed 59.3% to the group’s revenue and 53% of Maybank’s pre-provisioning operating profit (PPOP).

- We gather the revenue of GCFS’ mortgage segment in FY22 slid by 1.6% YoY to RM1.5bil, contributed by the redemption of residential property loans in Singapore. Additionally, the decline was attributed to property cooling measures imposed by the authorities and higher interest rates in Singapore.

- Meanwhile, by countries, Indonesia’s revenue for GCFS fell slightly by 0.6% YoY to RM2bil in FY22. This was driven by the cautious stance in growing loans and rebalancing of non-retail financing portfolio in Indonesia. GCFS will continue to refine its SME loan portfolio to accelerate its growth in Indonesia moving forward.

- As at end of FY22, GCFS’ loans stood at RM386bil. This comprised largely of retail financing which are mainly mortgages (44.7%) and auto financing (20.2%). Business banking financing accounted for 12.2% while SME loans make up 9.7% of total GCFS loans.

- GCFS’ deposits were RM383bil (51.6% CASA and 48.4% FDs and other deposits) as at end of FY22.

- GCFS has strong market shares in key portfolios (auto: 30.4%, mortgage: 14.8%, credit cards: 21.1%, SME: 17.9% and retail CASA: 25%)

- GCFS has a large customer base (both borrowing and non-borrowing) comprising of 12.1mil retail customers. Additionally, it has 764,000 SME customers vs. the industry’s 1.2mil.

- This business sector has high market shares for transactions done digitally through mobile (53.1%) and internet banking (50.2%).

- Since Sept 2020, RM2.93bil of SME financing has been approved digitally. We gather that 164,554 SME digital accounts have been activated since Feb 2020.

- Moving forward, GCFS intends to accelerate growth across key markets with customer-focused propositions. For wealth segment, it aims to provide comprehensive wealth services and solutions to match the needs of clients. Besides, it plans to leverage on regional cross border referrals and onboarding, offer digital wealth solutions and grow its Islamic wealth management business.

- Management sees the opportunity to strengthen its relationship with retail customers and drive the expansion of its consumer portfolio by balancing the growth in primary and secondary markets for mortgages. The group alluded to the opportunities to drawdown loans for purchase of residential properties in the secondary market at a faster pace compared to those acquired by borrowers in the primary market. Management is looking at the entire ecosystem, which involve end-to-end requirements of retail customers for the acquisition of residential properties and motor vehicles.

- On non-retail business, GCFS will be redefining SME segment limits to expand its reach to more customers. For digital SME loans, the minimum loan amount will be lowered from RM10,000 to RM3,000 while the maximum limit will be raised from RM250,000 to RM500,000. Elsewhere, we understand that the limit on RSME loans of RM5mil will now be based on entity instead of consolidated level. Revision to limits placed on SME plus borrowers is also being considered.

- SME digital financing has already been rolled out in Singapore. It will subsequently be implemented in Indonesia.

- In 2023 and ahead, GCFS will strengthen its sales force and channels as well as capture synergies across sectors and borders.

- It will also improve its operational efficiencies through the review of onboarding, account opening, eKYC and digitalisation of documentation.

- To enhance customer experience, core digital services and platforms will be regionalised.

- Asset quality of GCFS has improved as evidenced by the lower GIL ratio of 1.1% in FY22 vs. 1.3% in FY21. Credit cost for GCFS decreased to 18bps in FY22 vs. 24bps in FY21. The segment will focus on: i) discipline credit origination, ii) proactive management and engagement with customers, and iii) active collection and recovery efforts.

- In terms of ESG initiatives, GCFS has mobilised RM5bil in sustainable financing in FY22. GCFS is focused on financing green homes, solar, hybrid or EVs and supporting 1st time home buyers with affordable financing.

- The group’s foreign shareholdings stood at 17.4% as at end Feb 2023 compared to 18% in Dec 2022.

- The stock is trading at FY23F P/BV of 1.1x, below its 5-year historical average P/BV of 1.2x and offers an attractive dividend yield of 7.4%.

Source: AmInvest Research - 27 Mar 2023