Investment Highlights

- Mixed CY22 results. Out of the 8 companies under our coverage, 3 exceeded our expectations, 4 were in line and 1 underperformed (Exhibit 2). Most of the developers posted stronger CY22 results YoY while only Lagenda Properties (Lagenda) registered a weaker bottom line (Exhibit 3). The following are the salient highlights of the companies’ CY22 performance:

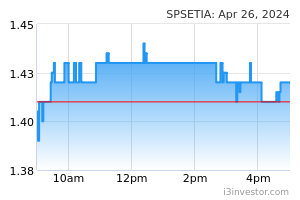

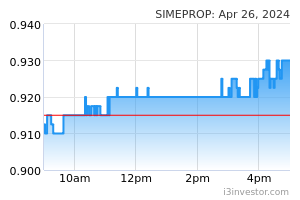

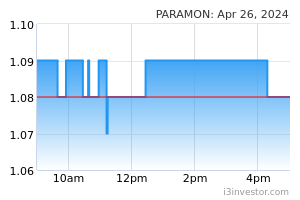

- The outperformers Sime Darby Property’s (SimeProp), S P Setia (Setia) and Paramount reported better-thanexpected CY22 earnings. SimeProp’s earnings beat expectations due to its stronger-than-expected property sales in 4QCY22, contributed by stronger sales in its residential landed (+18% YoY) and industrial properties (+70% YoY). Setia recorded a higher profit YoY, supported by increased revenue recognition for its overseas projects in 4QCY22, particularly the Sapphire by the Gardens and UNO Melbourne. Meanwhile, Paramount’s earnings exceeded expectations due to a reduction in distribution to private debt securities holders subsequent to a redemption in September 22, coupled with a higher mix of high-margin projects.

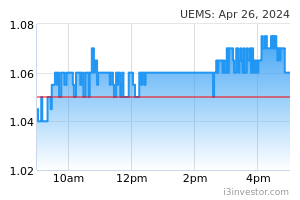

- UEM Sunrise (UEMS) earnings missed our estimate due to lower-than-expected property sales in 4QCY22. The lower property sales were attributed to slower FY22 launches of RM517mil (vs. RM550mil in FY21) as a result of the delays in obtaining authority approvals.

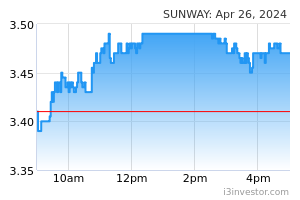

- The core net profits of Sunway, Lagenda, Mah Sing and IOI Properties (IOIProp) came in within expectations.

- QoQ, all of the developers posted stronger results, except UEMS. This was mainly attributed to their stronger sales (Exhibit 6) and higher progress billings from ongoing development projects as a result of the easing of labour shortages.

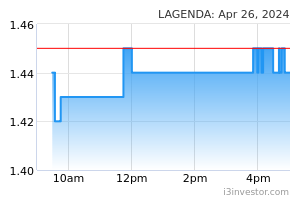

- Record-high sales for 3 developers. On a full-year basis, most developers’ sales (except Sunway, Lagenda and UEMS) have surpassed their CY22 sales target. Moreover, Mah Sing, SimeProp and Paramount reported record-high property sales in CY22. Sunway’s sales were slightly below its earlier 2022 target of RM2.2bil due to the postponement of launches in Singapore and China to CY23. Also, UEMS encountered delays in obtaining authority approvals for the launches of its key projects, namely The Minh and The Connaught One with a combined gross development value (GDV) of RM1.7bil. In addition, Lagenda pushed its 2HCY22 launches to 4QCY22 due to the delay in regulatory processes for licenses.

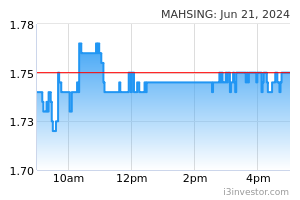

- Mixed sales target in CY23F. Generally, the developers are optimistic on the prospect of property sector in CY23F. Driven by their impressive CY22 sales, Paramount and Mah Sing are being more aggressive in CY23F with a double-digit growth in sales target as compared to CY22. Meanwhile, Sunway and Setia have both set marginally higher sales targets in CY23F, supported by new launches. Those who have missed their CY22 sales target, including UEMS and Lagenda, are being prudent in CY23F and have maintained their sales target. Despite having commendable sales in CY22, SimeProp set a more conservative CY23F sales target of RM2.3bil vs. RM2.6bil in CY22 to reflect moderating operating environment (Exhibit 5).

- Ramp up of launches in CY23F. According to a survey conducted by the Real Estate and Housing Developers’ Association (Rehda) on October 2022, 48% of developers surveyed did not plan for any launches in 2HCY22. The top reasons cited are the unfavourable market conditions and the delays in approval from authorities. However, we have seen a 71% rise in new property launches (for those under our coverage) in 2HCY22 with a total GDV of RM6.8bil vs. RM3.9bil in 1HCY22 (Exhibit 9). Moving forward, all developers intend to accelerate its launches in CY23F in light of the stabilisation of building material prices and easing of labour shortages (Exhibit 8). The developers with lower-than-anticipated launches in CY22, such as Sunway, UEMS and Setia, set a more aggressive targeted launches with a YoY growth of >100% in CY23F in view of the strengthening market outlook. The higher launches were also partly attributed to the postponement of CY22 planned launches to CY23F.

- Building material costs reached its peak in 2QCY22. We believe that most building material costs have reached their peaks in 2QCY22 following the easing of supply chain disruptions. Steel price in Central Peninsula slid 29% to RM3,099/MT in Jan 2023 from a peak of RM4,344/MT in Apr/May 2022 (Exhibit 13), whereas bag cement prices rose to RM19.23/50kg bag – 8% higher than Jan 2021 levels (Exhibit 14). While steel prices may remain higher than before the pandemic, we believe that the increased building material cost for new projects will be mitigated through the adoption of industrialised building system (IBS), bulk purchasing and value re-engineering initiatives by developers.

- Gradual easing of labour shortages. Based on our recent meetings with developers, we understand that foreign workers are arriving in phases and worker constraints are expected to gradually ease in 2023. We anticipate that the return of foreign labour would accelerate the construction progress of ongoing projects, which will subsequently improve developers’ recognition of progress billing in CY23. The stronger development of site progress works were seen in 4QCY22 with a 2% QoQ decline in average unbilled sales. Moving forwards, we believe developers with higher unbilled sales, particularly Sunway and Setia, are set to benefit the most from the gradual easing of labour shortages (Exhibit 7).

- Land acquisition by affordable housing players. In January-February CY23, Mah Sing and Lagenda kicked off their first land deal of the year to tackle pent-up demand for affordable housing. Mah Sing plans to widen its affordable-range development, the M Series through the acquisition of 2 parcels of leasehold land with a size of 8 acres in Daerah Petaling. Meanwhile, Lagenda acquired 2 parcels of freehold vacant land totaling 1,075 acres in Kulai, Johor to expand its footprint in Johor.

- Overnight policy rate (OPR) to be normalised in 2023. Our in-house economist is anticipating Bank Negara Malaysia (BNM) to raise OPR by another 25bps in 2023, pushing to 3.00%. This will bring interest rates to pre-pandemic level. Based on our sensitivity analysis, monthly installments for a property purchased at RM500,000 with 90% loan financing will increase by RM66–69 or 3.3%–3.5% for every 25bps hike. While the interest rate hike will dampen consumer sentiments, we believe Malaysia is coming to the tail end of the rate hike cycle. In addition, weaker consumer sentiment could be mitigated by still relatively firm economic growth and employment outlook following the reopening of international borders.

- Remain OVERWEIGHT on property sector. Since the beginning of CY23, Kuala Lumpur Property Index (KLPRP) has outperformed Kuala Lumpur Composite Index (KLCI) with a gain of 8% vs. KLCI’s loss of 2%. Valuation-wise, we still believe the current developers’ (under our coverage) and KLPRP’s price-to-book value (PBV) of 0.4x is appealing vs. the 10-year average and median of 0.7x and pre-pandemic (2018–2019) average PBV of 0.5x (Exhibits 15-16).

Moving forward, we expect a gradual recovery in property transaction volumes with the improved market sentiments and stronger demand, aided by our economist’s estimated CY23F GDP growth of 4.5% and the recovery in job market. This will be further supported by developers’ more aggressive planned launches and targeted sales in CY23F. We believe selective developers with strategic land banks in prime locations such as in city centres and matured towns together with strong reputations will continue to maintain their positive sales momentum in CY23F.

- Selective criteria. We like developers with healthy balance sheets (net gearing ratios of less than 0.5x) and sufficient cash flows to support prospective land acquisitions while also sustaining operations during industry downturns. We also favour developers with a high exposure in the sought-after affordable housing segment, particularly those launching in strategic locations.

- Our top BUY is Sunway (fair value RM2.39) given the strong brand recognition established by its highly successful landmark developments and expanding healthcare business, supported by substantive unbilled sales and outstanding order book. We favour Lagenda (FV RM1.81) for its focus on the underserved and affordable landed housing development in second-tier states which have a large population of the B40 and M40 income groups. We also like Mah Sing (FV RM0.87) for its strength in affordable housing developments at strategic locations as well as savvy execution and quick-turnaround business model.

- Key risks for the sector: i) Stagflation which could lead to higher unemployment alongside accelerated inflation, posing downside risk to property demand; ii) a new pandemic wave, which could disrupt business operations and construction progress; and iii) any prolonged or worsening of supply chain disruptions, which will impact the pace of economic recovery and heighten the cost of building materials.

Source: AmInvest Research - 9 Mar 2023