Investment Highlights

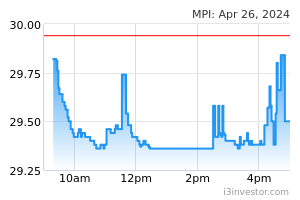

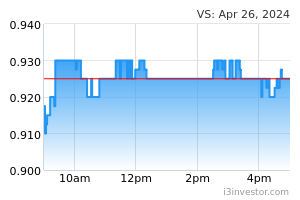

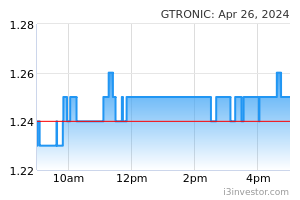

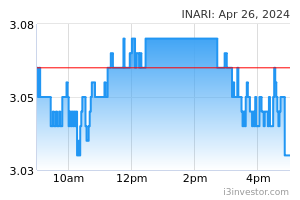

- 4QCY22 results were largely within expectations. Out of 6 companies under our active coverage, 3 reported withinexpected results, 2 below and 1 above. ViTrox Corp’s (ViTrox) (HOLD, FV: RM7.60) earnings exceeded expectations, primarily attributed to stronger demand for automated board inspection (ABI) machines. Meanwhile, Malaysian Pacific Industries’ (MPI) (HOLD, FV: RM28.10) results disappointed due to weaker-than-expected demand for consumer electronic products despite the reopening of China. VS Industry’s (BUY, FV: RM1.05) 1QFY23 earnings were below expectation due to the slower-than-expected ramp-up in production. For the 3 other companies - Globetronics (HOLD, FV: RM1.12), Inari Amertron (Inari) (BUY, FV: RM3.72), and Pentamaster Corporation (Pentamaster) (HOLD, FV: RM4.64) - their results met our and consensus expectations.

- The sector’s 4QCY22 earnings shrank 13% from the previous quarter, dragged down by MPI’s underperformance as its Suzhou plant continues to operate at a suboptimal level. Compared to the same period last year, the sector’s core PATAMI declined 12% due to weaker sales and margin compression in outsourced semiconductor assembly and test (OSAT) players following sluggish demand for end-market products and inventory correction. This is supported by Canalys’ data where global shipment of personal computers/laptops plunged 29% YoY and 6% QoQ in 4QCY22 while global smartphone shipment dropped 18% YoY albeit flat QoQ.

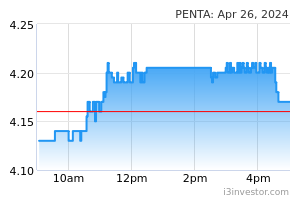

- Slight sectoral earnings adjustment. Post-4QCY22 results, the aggregate CY23F (calendarised) earnings for stocks under our universe were adjusted lower by 1% as we lowered MPI’s earnings to reflect a more gradual recovery of its China operation, partially offset by the upward revision of ViTrox’s PATAMI which now has a more bullish sales assumption following stronger-than-expected revenue during the quarter. Also, we downgraded our recommendation on Pentamaster to HOLD given the limited upside to our unchanged FV of RM4.64/share following its positive share price performance.

- The sector’s revenue may remain sluggish at least until the end of 1HCY23 in our view as the inflationary environment and global macroeconomic uncertainties will continue to affect demand for consumer electronic products. Also, some enterprises will hold back from making big investments in the near term. Nevertheless, demand from certain sectors is relatively less impacted by the broad-based weakness, such as automotive and telecommunication. In view of this, we are forecasting the sector’s 2023F revenue (excluding VS) to improve by 8% and core PATAMI to grow by 12% (Exhibit 4-5).

- China is recovering but at a slower pace than previously anticipated. Anecdotally, companies under our coverage are seeing some demand recovery following the phasing out of the strict Covid-19 movement control order in China, although at a modest pace at this juncture. The headwinds of tepid business and consumer confidence as well as weak export demand for China-made products following the US-China technology war could weigh down the economic reopening recovery. In line with this, the China government set a modest gross domestic product growth target of 5% for 2023, the lowest over the past 25 years, excluding the year 2020 when no target was provided. While the pickup in broader economic activities in China will have a net positive impact, the slower-than-expected recovery may not bode well for the sector’s sentiments given that most of the larger cap technology companies have direct revenue exposure to China.

- We maintain our NEUTRAL recommendation on the sector as near-term earnings growth potential could be further capped by the slowdown of global economic activities and sustained global inflation which is affecting demand for end-products, especially within the consumer-driven markets. Besides that, the impact of stronger MYR against US$ also will be fully reflected in the upcoming 1QCY23 results, which pose further downside earnings risks. Our only Buy recommendation is Inari given its RF earnings and margin resiliency coupled with a strong balance sheet.

- Key risks. Escalation of the US-China technology war and geopolitical conflicts pose downside risks to our earnings estimates and recommendations. However, signs of faster-than-expected demand recovery of end-market products may positively rerate the sector.

Source: AmInvest Research - 7 Mar 2023