Investment Highlights

- We maintain our BUY call on Lee Swee Kiat Group (LSK) with an unchanged fair value (FV) of RM0.90/share, based on an FY23F target PE of 11.7x, at parity to its 5-year median. No ESG-related FV adjustments based on an unchanged 3-star rating.

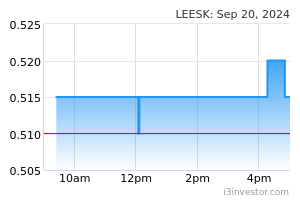

- Our earnings forecasts are maintained for FY22F-24F as the recent 14% spike in daily natural latex prices from RM4.71/kg in early-Jan 2023 to RM 5.36/kg in mid-Feb 2023 (Exhibit 1) is still within our assumption of RM5.50/kg in FY23F.

- YTD the average latex price is 9% higher than in 4QFY22 mainly due to the following factors:

1. Improving business sentiments and economic outlook in China following Beijing’s relaxation of zero-Covid policy. China is the world's largest natural rubber importer with a market share of 43%;

2. The circular leaf spot disease (Exhibit 2) has severely impacted the output for rubber in northern Indonesia and southern Malaysia. Based on the European Rubber Journal, this disease could reduce latex production by 30%;

3. Advent of the wintering season could further decrease production yield for the coming months ahead. Wintering period for the rubber industry involves an annual cycle that typically falls in Feb-May and last 4-6 weeks. Throughout this period, the leaves of the rubber trees die and fall off, forming new leaves. During the current cycle, latex production is likely to shrink by 45%-60% from the peak in Sep-Jan.

- Notably, LSK has been able to pass on any material cost increase to its customers given that the group is the largest manufacturer of natural latex bedding in Malaysia, along with its wellestablished brand names such as Napure and Englander.

- Historically, a change in natural latex price will translate to a reverse direction in net profit margin in the quarter, with an inverse correlation of -0.74 during pre-pandemic FY17-19. This is mainly due to the lagging pricing adjustments of 1-2 months by LSK.

- Based on our regression model, we estimate that the recent 9% increase in average natural latex price will cause a 0.5%-1.5%- point reduction in LSK’s net profit margin in 1QFY23F, assuming no hedging arrangement.

- This is in contrast to a 3.8%-4.8%-point net profit margin expansion in 4QFY22F from 2QFY22 with a lower average latex price by 28%, given that LSK has not incurred additional hedging costs in the quarter, unlike 3QFY22.

- We continue to favour LSK for (a) being the largest natural latex mattress manufacturer in Malaysia, (b) expanding market share of natural latex mattress vs. its domestic peers (Exhibit 3), and (c) collaboration in marketing the Aseries mattress through rental-based business model under Cuckoo’s platform.

- The stock currently trades at a compelling FY23F PE of 10.5x – 10% discount to its 5-year median of 11.7x while offering a decent dividend yield of 3.8%. Also, LSK has a healthy net cash position of RM9mil (7% of market cap).

Source: AmInvest Research - 16 Feb 2023