Investment Highlights

- We maintain BUY on PPB Group with a higher fair value of RM19.40/share vs. RM19.30/share previously from PPB’s FY23F net profit increase of 2% to account for higher earnings from the film exhibition and distribution unit. Our fair value for PPB is based on a FY23F PE of 15x, which was the average in the past 2 years. We ascribe a 3-star ESG rating to PPB.

We Visited PPB’s Cinema Operations at MidValley Mall Recently. Here Are the Key Takeaways:-

- The higher number of blockbuster movies in FY23F is expected to underpin the recovery in cinema patronage. We believe that Golden Screen Cinemas (GSC) is wellpositioned to benefit from this due to its large network and offering of cinema halls catering to different consumer segments. Blockbuster movies that are slated to be released in FY23F include Mission Impossible7, Dungeons and Dragons: Honor among Thieves and Guardians of the Galaxy Vol 3. GSC has a market share of 52% in box office collections in Malaysia.

- Over the long-term, GSC’s earnings are expected to be sustained by the opening of new cinemas. In 1QFY23, GSC will commence operations at IOI Mall Kulai and IOI City Mall Phase 2. In 2QFY23, GSC will open at Bukit Bintang City Centre and Sunway Carnival Extension. In 3QFY23, GSC will start operations at 163 Retail Park, Mont Kiara. We understand that the payback period for a cinema is 5 to 6 years.

- We believe that the film and distribution division will be able to maintain its pre-tax profit margin on the back of sales of high-value food products and ancillary income such as renting of hall and space to corporate clients. We gatherthat since the pandemic, operating costs have gone up by 30%. Rent and wages account for the bulk of GSC’s operating costs. As a % of box office revenue, electricity expense contributes another 7%.

- To keep a lid on electricity costs, GSC will be automating some of its processes. These include automatic switch-off of lights at empty cinema halls and turning off airconditioning half an hour before the last movie ends. GSC also plans to use laser projectors, which will reduce electricity consumption by 70%.

- Overall, we forecast the revenue of PPB’s film and exhibition division to grow by 20% to RM419mil in FY23F. We have assumed that the unit’s pre-tax profit margin would improve to 12% in FY23F from 10% in FY22E.

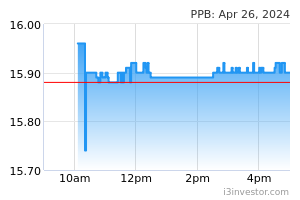

- PPB is currently trading at an undemanding FY23F PE of 14x, which is below its 5-year average of 20x.

Source: AmInvest Research - 25 Jan 2023