Investment Highlights

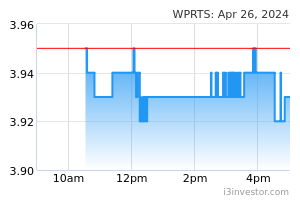

- We downgrade Westports from BUY to HOLD as the share price has surged by 16% since our update on 7 Nov 2022. Nevertheless, we raise our fair value to RM3.90/share from RM3.82/share previously based on a FY23F PE of 20x, in line with its 3-year average. Our FV also incorporates a 3% premium to reflect its unchanged 4-star ESG rating.

- Westports’ FY22 core net profit (CNP) of RM679mil was above expectations, coming in 8% higher than our forecast and 9% above consensus. The deviation was mainly due to a lower-than-expected effective tax rate in FY22 arising from investment tax allowances (ITA), which amounted to RM51mil as at 31 Dec 2022.

- Westports also declared a DPS of 7.5 sen in 4QFY22, bringing FY22 total DPS to an above-expected 14.4 sen,

- We raise FY23F earnings by 2% to account for a lower effective tax rate as the ITA is effective from FY22 to FY31F.

- Although operational revenue grew by 4% YoY, CNP fell 8% YoY to RM679mil in FY22 mainly due to higher fuel cost (+69%) and manpower cost (+6%).

- Container throughput fell 3% YoY in FY22 mainly due to a 10% YoY drop in transhipment, partly cushioned by a 9% YoY growth in gateway volumes, which resulted in a 2% YoY improvement in container revenue.

- Meanwhile, conventional throughput grew 8% YoY in FY22 supported by higher liquid bulk, i.e. gasoline and diesel, following the commencement of the Liquid Bulk Terminal 5 (LBT5) in 3QFY22. This led to an 8% YoY improvement in conventional revenue.

- Operational revenue fell marginally (-1%) QoQ to RM494mil in 4QFY22 dragged by lower conventional throughput (-5%). In spite of this, CNP grew 37% QoQ to RM209mil in 4QFY22 due to ITA and lower fuel cost (-11%).

- To capture the future growth of non-bunker fuel and liquid storage requirements, construction of Liquid Bulk Terminal 4A (LBT4A) commenced in 4Q2022 and is slated for completion in 4Q2023.

- For FY23F, we raise our cost assumptions for manpower by 5% and electricity by 30%. Westports raised the minimum wage for their workers to RM1.7K from RM1.5K pax/month.

- As for Port Klang Cruise Terminal (50:50 JV with Northport), Westports recognised an FY22 core profit of RM6mil (excluding one-offs which were mainly impairment reversal of RM42mil) vs. a loss of RM0.4mil in FY21. We anticipate an FY23F core profit of RM20mil for the cruise terminal from an expected recovery of the tourism industry. Hence, Westports plans to upgrade facilities in the terminal to cater to improving demand.

- We are cautious on Westports’ short-term outlook due to global macroeconomic headwinds. However, the longer term positive prospects for the port sector in Malaysia are underpinned by global trade and investments in the manufacturing sector, which will support inbound and outbound throughput growth. MNCs have been relocating from China to South East Asia due to rising labour and land costs amid continuing trade tensions with US. To capitalise on this, Westports has charted a mega port expansion project, Westports 2.0, which will double the port’s container handling capacity to 28mil TEUs. We anticipate expansion to make headway in 2H2023.

The Stock Is Currently Trading at a Fair 20x FY23F PE, at Parity to Its 3-year Average.

Source: AmInvest Research - 25 Jan 2023