Investment Highlights

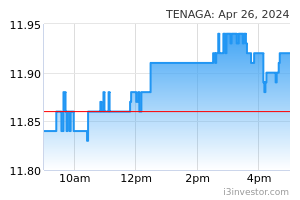

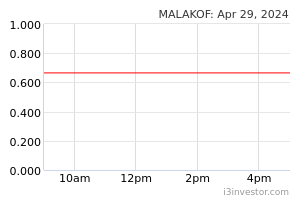

- Overweight. We like Tenaga Nasional (TNB) for its protected rate of return of 7.3%. We expect TNB’s normalised net profit to recover by 16% in FY23F in the absence of the prosperity tax. At RM9.37, TNB’s FY23F PE is undemanding at 11x. We have a DCF-based fair value of RM11.80/share for TNB. We also have a BUY on Malakoff with a fair value of RM0.79/share. We like Malakoff for its decent dividend yield of 8% based on a share price of RM0.66.

- Dividend yields of 5% to 8% for power sector in FY23F. TNB’s FY23F dividend yield is forecast at 5%. We estimate Malakoff’s FY23F dividend yield at 8% while YTL Power (YTLP) is expected to return a dividend yield of 6%. Dividend payments are envisaged to be underpinned by the companies’ stable operating cash flows.

- 3-star ESG rating. In spite of initiatives to reduce carbon emissions, we believe that the implementation would take time. For example, TNB’s new gas power plant with hydrogen combustion would only be completed in FY31F. TNB would only be halving its coal exposure by FY35F. In the meantime, coal would still play a significant role in electricity generation in Malaysia.

- Expansion and acquisition of renewable assets are still slow. TNB plans to achieve 8,300MW of renewable energy by FY25F vs. 3,889MW as of October 2022. Presently, earnings from renewable projects are still small and will take time to acquire renewable assets. Hydro and solar accounted for only 1.4% of the country’s generation mix in 3Q2022. Malakoff’s exposure to solar is only 40MW compared with its total effective generating capacity of 5,836MW. Meanwhile, YTLP is venturing into data centres and solar farms.

Outlook and Developments in 1H2023 and Beyond

- Sales of electricity volume in Peninsular Malaysia to improve by 5% in 2023F (2022E: 6%) (ex-RP3 cap). This is in line with the country’s lower GDP growth. Bloomberg consensus estimates Malaysia’s GDP to grow by 4.2% in 2023F compared with 7% in 2022E. We believe that the slower growth would come from export-oriented industrial sectors (mainly petrochemical, cement, electrical and engineering and steel activities). On the other hand, we reckon that electricity demand from the commercial sector would remain positive on the back of higher tourism and educational activities.

- Although energy costs may decline in 2H2023, they would still exceed the reference rates in RP3. Fitch Solutions forecasts average Newcastle coal price to be US$280/tonne in 2023F vs. US$320/tonne in 2022E. The Energy Information Administration predicts that the average price of Henry Hub natural gas would fall to US$6/mmbtu in 2023F from US$9/mmbtu in 4Q2022. In spite of the downward price forecasts, they would still exceed the reference prices of US$79/tonne for coal and RM26/mmbtu for gas stipulated in RP3 (Regulatory Period). Also, the exchange rate assumption in RP3 is only US$1.00:RM4.123 compared with US$1.00: RM4.40 currently.

- Coal will still be dominant in 2023F. As de-carbonisation efforts take time, we believe that coal would still be the main feedstock in electricity generation in Malaysia. Coal is expected to account for 58% to 60% of generation mix in the country while gas contribute another 37% to 40%. Hydro, solar and oil/distillate are anticipated to make up the balance 5% of the generation mix.

- No new capacity coming on-stream until 2024F. Worldwide Holdings’ RM3.3bil 1,200MW combined-cycle gas power plant in Pulau Indah is expected to be commissioned in 2024F. Except for the LSS power plants, we do not expect any new power plant to come on-stream in 2023F.

- Energy reserve margin to be close to 45% in 2024F. The energy reserve margin is high due to commissioning of Worldwide’s 1,200MW gas power plant. By the end of 2023F, we estimate the country’s energy reserve margin to be almost 40%. The PPA of Malakoff’s 640MW GB3 gas power plant expired in December 2022. GB3 accounted for 12% of Malakoff’s capacity payments and 2% of energy payments in 1HFY22.

- Decarbonisation efforts are taking place. Malakoff and TNB are implementing efforts to de-carbonise their power plants. Both companies plan to use ammonia/hydrogen technology in their power plants. Malakoff is carrying out a study with Itochu Corporation on co-firing options using ammonia/hydrogen. TNB is re-powering the 1,400MW Paka power plant with hydrogen technology and building a RM9.5bil 1,400MW gas power plant with hydrogen combustion capability in Kapar.

- Hydro is getting more buzz than solar. KPower was awarded the 40.4MW hydro plant project in Gua Musang, Kelantan in May 2022. TNB was awarded the RM5bil 300MW Nenggiri hydro dam project in Kelantan in September 2021. Hydro accounted for 3.5% of TNB’s generation mix in Peninsular Malaysia in 2QFY22. We estimate the cost to develop a hydro power plant to be RM17mil/MW.

- No LSS 5 (large scale solar) tender? Due to the high energy reserve margin, we believe that LSS5 would be delayed. There were no LSS tenders in 2021 and 2022. Also, competitive bidding for large scale solar projects is not as attractive as before given that the cost of solar panels has gone up by more than 30%. According to news reports, companies that won LSS4 are facing difficulties as the tariff rate, which was submitted during the tender, is not enough to cover the cost of materials. The tariffs, which were submitted in LSS4 ranged from 17.7 sen/kWh to 24.8 sen/kWh. The tariff reference rates were 24 sen/kWh for LSS4, 32.4 sen/kWh for LSS3 and LSS2 and 41 sen/kWh for LSS1. Some of the winners of LSS4 were Solarvest Holdings and MK Land.

- Winner of waste-to-energy (WTE) plant may be announced in 2023F. We think that the winner of the WTE tender for Sg Udang, Melaka would be announced in 2023F. Malakoff is expected to be the front-runner to win the project. We estimate the cost of building a WTE plant to be RM13mil to RM20mil per MW. Apart from this, we think that the bidding process for WTE plants in Pahang, Kedah and Terengganu would take place in 2023F. The country’s target is to have 6 WTE plants by 2025F. So far, there has only been a single WTE plant in Malaysia i.e. the RM300mil WTE plant in Tanah Merah, Negeri Sembilan, which was built by Cypark Resources. This has not commenced operations yet.

- More overseas expansion in 2023F? We think that the pace of acquisitions may pick up in 2023F after a lull in 2022. The challenge is the strong USD, which will result in in a higher cost of acquisition. In terms of location, we reckon that TNB would be focusing on renewable assets in the UK and Europe instead of emerging markets like Turkey. Recall that TNB made provisions for its investment in Gama Enerji in FY19 and FY20. As at end-September, TNB’s gross cash and cash equivalents stood at RM4.2bil while borrowings were RM62.9bil.

Source: AmInvest Research - 5 Jan 2023