Investment Highlights

- We maintain base-case end-2023 FBMKLCI target at 1,630, pegged to 0.5 standard deviation below its 5-year median (SDB5YM), which is supported by Malaysia’s relatively stronger economic outlook and our economist’s strengthening MYR expectation to RM3.95-RM4.00/US$ next year. Although Malaysia’s 2023 GDP growth is expected to taper down to 4.5% from 8.5%-9% in 2022, this remains better than recessionary prospects in US and Europe with expectations for a reset in US interest rate trajectory in 2H2023.

Best-case scenario from an abrupt US Federal Reserve policy reversal, complete removal of Covid restrictions in China and better-than-expected global economic growth would be a 2023 FBMKLCI target of 1,740 at parity to its 5-year median PE of 16.2x.

The worst-case scenario from a full-blown global recession, new pandemics and worsening geopolitical conflicts translates to 1,380, pegged at 2 SDB5YM. We do not discount equity volatility from more US rate hike surprises with supply chain disruptions from China’s intermittent Covid lockdowns, US-China trade tensions and Russia being shunned by the global economy.

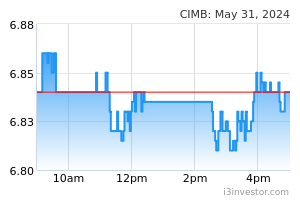

- Surge in net foreign equity selling recently. Foreign selling pressure rose to RM1bil from 1-12 Dec, surging from a slight November net sales of RM282mil (Exhibit 8). Over the 8 days, this was offset by local institutional buying of RM1.2bil, which stabilised the FBMKLCI at 1,470, still up from a 2-year low of 1,373 on 13 October 2022, a level not seen since May 2020 during the initial outbreak of the Covid-19 pandemic. The recent selling activities mostly focused on financial services (68%) followed by industrial products & services (17%) and plantation (11%). This could offset the increase in foreign equity shareholdings from 20.5% in October to November to 20.7%, which remains substantively below the 22.4% in January 2020 before the Covid 19 global outbreak (Exhibit 9).

- Partially cushioned by local buying. While the recent local institutional net buying activities were a mild relief amid countercyclical transactions with foreign investors, local institutions were still YTD net sellers of RM7bil (Exhibit 6-8). Since the beginning of the year, the weakness on Malaysian equities was partly cushioned by foreign buying support which reached RM4.7bil. This accounted for only 67% of cumulative local net sales in 2022 so far, against the backdrop of an aggressive US Federal Reserve stance and Malaysia’s GE15.

- Still among ASEAN countries with YTD net foreign inflows. The net selling over the past 3 months cut YTD 2022 foreign net buying position by 43% from RM8.2bil as at 31 August 2022 to RM4.7bil (Exhibit 10), of which 79% was into the financial sector with the balance mostly into plantation and industrial products/services. Within ASEAN, Indonesia, Thailand, Malaysia and Vietnam enjoyed YTD net foreign equity inflows with Malaysia accounting for a 9% share of ASEAN’s net purchases (Exhibits 10-11).

- Malaysian equities at bargain Southeast Asian valuations. India and Indonesia has bucked the regional YTD downtrend with the Nifty 50 delivering index gains of 7% and Indonesia 5% while Singapore was flattish. The worst performers were Vietnam (-31%), Korea (-20%), Taiwan (-20%), Hong Kong (-17%) and China (-13%) vs Malaysia’s -6% (Exhibit 4). Hence, the FBMKLCI still trades at a Southeast Asian bargain at 1.0 SDB5YM of 16.2x vs 0.4 for Thailand, 1.1 for Indonesia and 2.1 for Vietnam (Exhibit 15).

- Tapering interest rate hike expectations next year. Our economist expects Bank Negara to raise the overnight policy rate (OPR) by 25 basis points (bps) in January 2023 that will bring the OPR to 3.00% for the whole of next year. Given the aggressive stance of the US Federal Reserve, consensus’ expectations of additional rate hikes this year could elevate the Federal funds rate from 4.25%-4.50% currently. However, our economist expects a weakening US economy to trigger a policy reversal by 2H2023, which will lead to the Federal funds rate tapering to 3.50%-3.75% (vs consensus’ 4.70%) next year.

- Expect changes with a new unity government. With a new unity government, we expect changes in administrative processes and approvals that may defer government-driven construction projects which have to be secured via open tenders. As the new government aims to address inflationary pressures and higher costs of living, we do not discount potential approval delays and revisions to Tenaga’s electricity surcharge for 1H2023 and gas transportation tariffs under the second regulatory period.

For consumer sector, new measures could be introduced under the current subsidies provided to essential items such as poultry and livestock. For the telecommunication sector, the 5G deployment structure may be reviewed to prevent leakages (Exhibit 1).

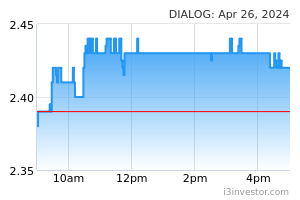

- Easing China’s zero-Covid policy. China has recently deactivated its Covid tracking app, which affirmed the relaxation of a much-criticized pandemic policy. As Covid cases begin to surge, we are wary of the possibility of the policy reintroduction. Even so, the easing of movement restrictions engender improving prospects for regional economic and consumption growth and the restoration of supply chains that have disrupted global trade over the past year. This will positively impact most sectors involved in technology, EMS, transportation, plantation, oil & gas, construction, ports, REITS, consumer, local pharmaceuticals and selected property companies with China exposure (Exhibit 2).

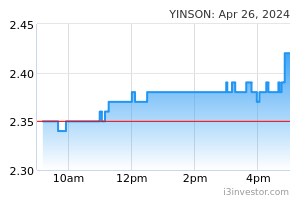

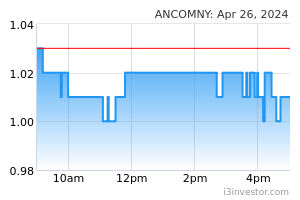

- Winners and losers from stronger MYR outlook. The MYR has strengthened by 8% to RM4.40/US$ currently from RM4.75/US$ on 4 Nov following the resolution of GE15, with our economist now projecting our currency to improve further to RM3.95-RM4.00/US$ by end-2023. We expect the beneficiaries to be automakers, consumer stocks such as Leong Hup International and Spritzer as well as transport companies such as Capital A, which will pay lower fuel and interest costs. However, the revenue impact will be negative for glove makers (Top Glove, Hartalega and Kossan) and exporters such as Ancom Nylex, as well as for shipping and oil & gas companies including MISC, Hibiscus Petroleum, Yinson and Bumi Armada (Exhibit 3).

- Expect net foreign equity outflow to reverse. Underpinned by our stronger currency outlook, we expect a return of foreign equity buyers amid attractive Malaysian equity valuations and our inhouse 2023 GDP growth projection of a robust 4.5% vs the global average of 2.1% and US’ meager 0.4%.

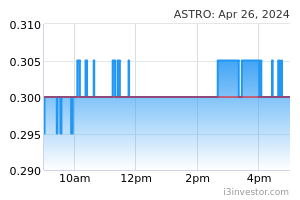

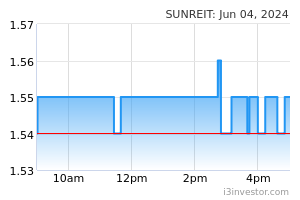

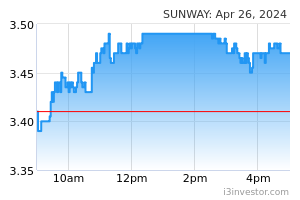

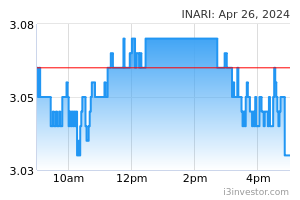

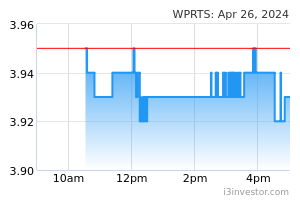

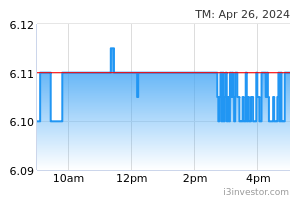

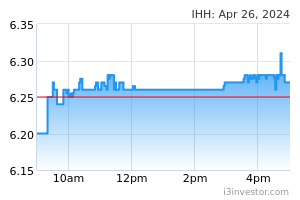

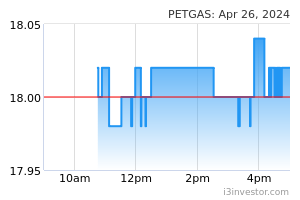

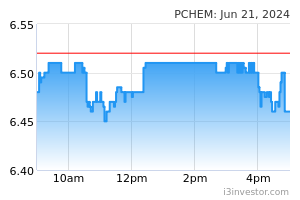

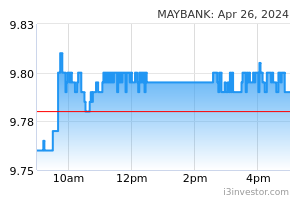

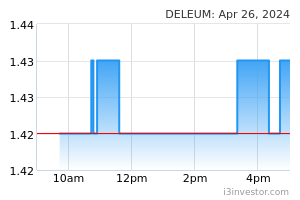

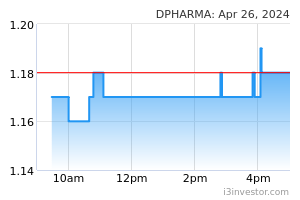

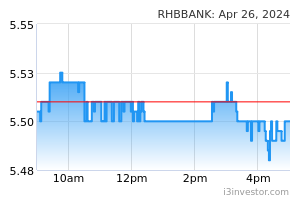

- OVERWEIGHT on banks, oil & gas, autos, ports, property, REIT, healthcare and media with top picks being Maybank, RHB Bank, CIMB, Yinson, Telekom Malaysia, Dialog Group, Inari Amertron, Sunway REIT and DuoPharma BioTech (Exhibit 22). We also like small cap stocks with strong brand names which can safely navigate inflationary pressures such as Spritzer and niche agrichemical producer Ancom Nylex, as well as grossly undervalued companies such as Deleum (Exhibit 23). Our ESG champions are MayBank, Petronas Chemicals Group, Petronas Gas, IHH Healthcare, Telekom Malaysia, Westports Holdings, Inari Amertron, Sunway Holdings, Yinson Holdings, Sunway REIT and Astro (Exhibit 21).

Source: AmInvest Research - 14 Dec 2022