Investment Highlights

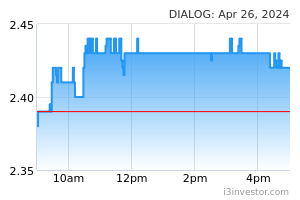

- Palatable 3QCY22 report card. Companies within our coverage delivered a set of palatable 3QCY22 earnings with 4 companies beating expectations (Bumi Armada, MISC, Petronas Gas and Yinson) while 3 were in line (Hibiscus Petroleum, Petronas Chemicals Group, and Deleum). The sole underperformance came from Dialog Group with persistently compressed margin in downstream operations, despite fresh earnings contributions from Pan Orient Energy (Siam) [POES], the concessionaire and operator of Concession L53/48 onshore Thailand.

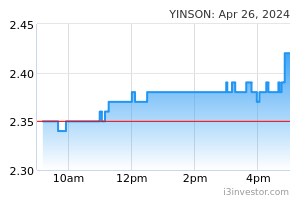

Notably, Bumi Armada outperformed our expectations with a higher revenue as a result of the addition of the subsea construction and the preliminary front-end engineering and design (Pre-FEED) works done in the quarter. Yinson, on the other hand, posted positive earnings surprise supported by FPSO Maria’s higher conversion progress coupled with higher dayrates achieved by FPSOs John Agyekum Kufuor, Abigail-Joseph and Adoon amid the elevated oil prices.

- Flattish sector earnings growth QoQ. The sector’s 3QCY22 EBITDA and core net profit were flattish QoQ mainly stemming from the better performance from Yinson and MISC which had more than offset the decline in contributions from Hibiscus Petroleum and Petronas Chemicals Group amid the lower crude oil prices in the quarter.

- Higher growth in contract awards in 4QCY22. 3QCY22 contract awards to Malaysian oil and gas companies declined by 66% QoQ to RM1.04bil compared to RM3.02bil in 2QCY22 (Exhibit 2), given the non-repeat of lumpy contracts from Sapura Energy (6 major contracts collectively worth RM2.7bil from the Asia Pacific and Atlantic regions) and Coastal Contract (RM252mil contracts for a vessel charter and the extension of an existing liftboat contract) in 2QCY22. Nevertheless, we foresee a sharp rise for contract awards in 4QCY22 given that the value of the contracts which have already been awarded in the quarter have surpassed that of 3QCY22. Thus far, the contracts awarded were: (i) RM4.5bil to Malaysia Marine and Heavy Engineering’s for the engineering, procurement, construction, installation and commissioning works at the Kasawari Carbon Capture & Storage project, off the coast of Sarawak; (ii) RM640mil to Velesto Energy’s for an integrated rig, drilling works and completion; as well as (iii) RM558mil to Wah Seong for the supply of a FPSO topside module.

- Petronas on track to the targeted capex spend in 2022. We continue to anticipate a subsequent improvement in domestic job flows given the 31% YoY increase in capex allocation from Petronas in 2022. Recall that Petronas earlier announced its 2022 capex guidance of RM40bil (excluding a RM20bil sum earmarked for PetChem’s acquisition of Perstorp Holding AB). It is on track to the targeted capex with a total investment expenditure spent year-to-date of RM27bil (+35% YoY compared to RM20bil in 9MFY21).

- Vast opportunities within the FPSO sub-sector. As highlighted earlier, we expect selected segments in the value chain to ride on the tailwinds of higher oil prices and projects sanctioned by national oil companies. Oil and gas operators directly exposed to upstream production such as Hibiscus Petroleum should enjoy higher oil prices while the floating production, storage and offloading (FPSO) sub-sector stands to benefit with the decimated number of operators in the 2015–2017 downturn. Yinson is on track to secure the long-awaited Agogo project in the coming months given the recent contract win for preliminary activities from Azule Energy while Bumi Armada has becomed the front-runner in the Cameia project after outbidding its competitors earlier.

- Softer yet still elevated oil price. Despite the recent pullbacks in oil prices amid expectations of disrupted demand for oil from a slowdown in global economic growth, we maintain our view that crude oil prices will remain elevated at US$80- 90 per barrel over an extended period in 2023. This stemmed from the uncertain geopolitical impact from the Russia’s Ukraine invasion which has triggered cascading sanctions, voluntary shunning of investments by international oil companies, substantive global supply chain disruptions and elevated risk premiums for commodities. Besides voluntary corporate sanctions on Russia, supply shortfall risks are escalating with major oil-exporting nations unable to ramp up production to pre-pandemic levels due to chronic under-investments over the past 5 years amid investors’ persistent energy transition-driven prerogatives. Other potential catalysts would be the further production cuts by OPEC+ as well as China’s latest relaxation of Covid-19 restrictions, which would provide upward momentum to oil prices.

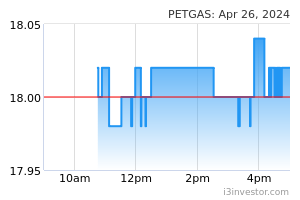

- Maintain OVERWEIGHT on the sector. We continue to like Dialog Group on the back of its resilient noncyclical tank terminal and maintenance-based operations, as well as Yinson Holdings for its niche exposure in the exceptionally thriving FPSO sub-sector. We also like Petronas Gas, which offers highly compelling dividend yields from its optimal capital structure strategy and resilient earnings base.

Source: AmInvest Research - 9 Dec 2022