Investment Highlights

- Stellar 9MFY22 performance on escalated oil prices. Petronas’ 9MFY22 core net profit (CNP) surged 2.6x YoY to RM72bil (excluding net impairment losses of RM2.8bil) mainly from a 55% increase in average Brent crude oil price to US$106/barrel and a 3% increase in daily production to 2.4mil barrels of oil equivalent (boe) from 2.3mil boe in 9MFY21, which partially mitigated higher operating costs. For 3QFY22, revenue increased 6% QoQ to RM99bil, which together with better operating profit margins coupled with a 9%-point decline in effective tax rate to 21%, drove CNP by an impressive 27% QoQ to RM28.7bil.

- Sustainable crude production. Petronas’ 3QFY22 average daily production was flattish QoQ, but remained well within the 2019 average output of 2.4mil boe. This was mainly driven by higher production from domestic and international operations. QoQ, 3QFY22 gas production contracted slightly by 1% to 1.5mil boe/day from lower international production following the disposal of Azerbaijan assets while crude oil production slid marginally to 852k barrels/day.

- Higher 9MFY22 capex. With the stronger earnings performance, Petronas also bumped up 9MFY22 capex spending by 35% YoY to RM27bil from RM20bil in 9MFY21, mainly from a 78% increase in allocation for upstream projects and 24% expansion for downstream segment. The 9MFY22 capex was almost comparable with the RM29bil spent in 9MFY19, which is fairly in line with the group’s target to achieve pre-pandemic spending levels in 2022.

Notably, the 9MFY22 capex represented 69% of its FY22F capex target of RM40bil (excluding the RM20bil sum earmarked for Petronas Chemicals Group’s acquisition of Perstorp Holding AB), in which upstream accounts for 62%, gas & new energy 15%, downstream 12% and corporate/others 11%. As a comparison, 9M historically accounted for 60%–67% of group capex in 2019-2021.

Recall that Petronas planned to spend half of the annual capex allocation on domestic investments with the remainder on international investments. Thus, domestic oil and gas players are anticipated to reap the benefits of higher job flows over the coming quarters. Petronas also remains committed towards achieving its net-zero carbon emission targets as shown by planned investments in the clean and renewable energy segments. The group will also allocate 10% of FY22F capex or RM4bil for non-traditional investments such as specialty chemicals and solar energy.

- No dividend was declared for 3QFY22. Petronas did not declare any interim dividend following the RM25bil interim dividend back in 2QFY22. Despite the absence of any dividends in the current quarter, recall that Petronas has already paid out a total dividends of RM50bil (including RM25bil declared for 4Q2021) so far this year, doubling from RM25bil in 2021.

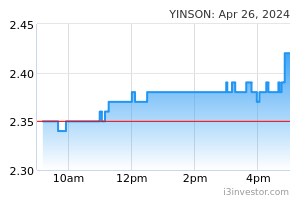

- Better prospects of selected segments. We expect selected segments in the value chain to be better positioned to benefit from higher oil prices and projects sanctioned by national oil companies. Oil and gas operators directly exposed to upstream production such as Hibiscus Petroleum should enjoy still-elevated oil prices while the floating production, storage and offloading (FPSO) sub-sector stands to benefit given the decimated number of operators during the previous downturn in 2015–2017.

- Softer yet still-elevated oil price. Despite the recent pullbacks in oil prices amid expectations of disrupted demand from a slowdown in global economic growth, we maintain our view that crude oil prices will remain elevated at US$80-90 per barrel over an extended period in 2023. This stems from the uncertain geopolitical impact from the Russia-Ukraine conflict that has triggered cascading sanctions, voluntary shunning of investments by international oil companies, substantive global supply chain disruptions and heightened risk premiums for commodities.

Besides voluntary corporate sanctions on Russia, supply shortfall risks are escalating with major oil-exporting nations unable to ramp up production to pre-pandemic levels due to chronic under-investment over the past 5 years amid investors’ persistent energy transition-driven prerogatives. Another potential catalyst would be further production cuts by OPEC+, which could continue to support oil prices.

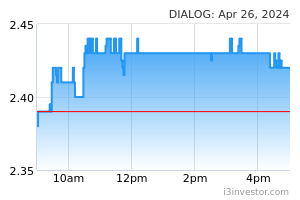

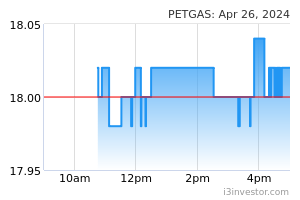

- Maintain OVERWEIGHT on the sector. We continue to like Dialog Group for its resilient non-cyclical tank terminal and maintenance-based operations, as well as Yinson Holdings for its niche exposure in the exceptionally thriving FPSO subsector. We also like Petronas Gas, which offers highly compelling dividend yields from its optimal capital structure strategy and resilient earnings base.

Source: AmInvest Research - 1 Dec 2022