Investment Highlights

- We maintain SELL on Econpile Holdings (Econpile) with unchanged fair value of (FV) of RM0.12/share based on 9x FY24F PE, in line with our benchmark for small-cap construction stocks. There is no FV adjustment for ESG based on our 3-star rating.

- Econpile achieved a 1QFY23 core net loss (CNL) of RM5mil, compared to our FY23F net profit and consensus estimates of RM12mil for the full year. In spite of the loss, we deem Econpile’s results to be within expectations as the group’s progress billings are expected to pick up in the coming quarters.

- CNL for 1QFY23 declined 17% YoY to RM5mil despite lower revenue of RM82mil (-5% YoY) due to stabilising building material costs and higher gross profit margin generated from overseas operations. This was offset by losses from 2 completed projects and lower margins from projects nearing completion.

- On a QoQ basis, CNL shrank 38% QoQ in 1QFY23 although revenue was lower by 10%. Recall that there was a provision of RM6mil in respect of onerous contracts in 4QFY22. Management indicated that building material and labour cost changes were flat QoQ, and the company will be receiving 100 foreign labourers by Dec 2022.

- 1QFY23 order book wins amounted to RM108mil, bringing total outstanding order book to RM443mil as at 30 Sep 2022 vs. RM444mil as at 30 Jun 2022. Notable wins included the ICQC @ RTS Link (RM40mil) project.

- In October 2022, Econpile won the Berjaya Residence (RM25mil) and Kota Bahru Medical Centre (RM24mil) projects. Including these projects, we estimate Econpile’s current outstanding order book to be RM520mil, which translates to an unexciting 1.8x FY23F revenue.

- Econpile has an FY23F order book replenishment target of RM300mil (vs. RM200mil-RM250mil previously). Even so, we maintain a lower order book replenishment assumption of RM200mil for FY23F as developers are adopting a wait-and-see approach post-GE15.

- Challenges faced include (i) weaker-than-expected recovery of job flows; (ii) eroding profit margins from rising building material costs and labour shortages; and (iii) delays/cost revisions of mega projects.

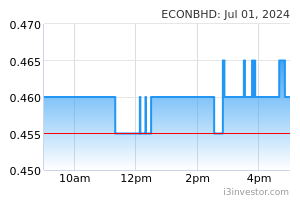

- Econpile is currently trading at a pricey 12.4x FY24F PE, above our benchmark of 9x for small-cap construction stocks, and offers no dividend prospects. Rerating catalysts include major job wins in Cambodia or Malaysia.

Source: AmInvest Research - 29 Nov 2022