Investment Highlights

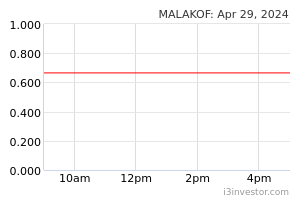

- We maintain BUY on Malakoff Corporation with an unchanged fair value of RM0.79/share (WACC: 7.5%) and neutral ESG rating of 3 stars.

- Malakoff’s targets are to achieve renewable energy (RE) capacity of 1,000MW by FY26F and 1,400MW by FY31F. Currently, Malakoff has RE capacity of 40MW.

- To meet the RE targets, Malakoff plans to bid for LSS and waste-to-energy (WTE) projects, focus on rooftop solar projects in Malaysia and de-carbonise its coal power plants.

- Also, Alam Flora would be developing Port Reception Facilities (PRF) at various ports in Malaysia. Currently, Alam Flora is developing an Integrated Eco-Recovery Waste Complex (IERC) in Port Klang. The group is in the process of completing more PRFs nationwide, in addition to Northport.

- To de-carbonise its coal operations, Malakoff is exploring co-firing options using ammonia/hydrogen and biomass. Malakoff has signed a MoU with Itochu Corporation to carry out a study on the utilisation of ammonia/hydrogen at its coal plants in Johor. Upon the completion of the study, Malakoff will undertake a pilot project at its plants in Johor.

- Alam Flora’s IERC in Klang will be completed in FY23F. Upon completion, the complex will handle and process waste oils left by vessels at the ports. The processed lubricant oils will then be sold to automobile companies. Alam Flora commenced operations at its first construction and demolition waste facility (17 tonnes per day) in Kuantan, Pahang in September 2022.

- We do not expect earnings from the IERC in Klang to be significant in FY23F as it will take time to ramp up production. At full capacity, the IERC can handle 5,000 tonnes of waste oil per month.

- In 1HFY22, Alam Flora handled 585,700 tonnes of waste under the concession business and 459,400 tonnes of waste under the non-concession unit. Alam Flora accounted for 37% of Malakoff’s net profit in 1HFY22.

- Malakoff is currently trading at an attractive FY23F PE of 10x, which is lower than its 2-year average of 14x. Also, Malakoff’s dividend yields are compelling at 8% in FY22E and 9% in FY23F.

Source: AmInvest Research - 21 Oct 2022