Investment Highlights

- We maintain HOLD on LPI Capital (LPI) with a slightly lower fair value of RM12.70/share from RM12.80/share previously. Our revised fair value is based on FY23F P/BV of 2.1x, supported by ROE of 14.1%. No changes to our neutral 3-star ESG rating.

- We cut FY22F/23F/24F earnings marginally by 1.5%/1.6%/1.6% after lowering our growth estimates for gross written premium (GWP).

- 9MFY22 core earnings were within expectations, making up 72% of our and 74% of consensus estimate.

- For 9MFY22, the group’s core earnings of RM201mil declined 26% YoY driven by lower net earned premium (NEP), investment income and higher net claims. 9MFY22 saw an increase in claims from the motor, medical and engineering insurances.

- For 9MFY22, GWP grew modestly by 5% YoY, supported by higher premiums from fire, motor, marine, aviation, transit and the miscellaneous segments.

- Nevertheless, LPI’s NEP contracted by 4.6% YoY in 9MFY22 due to higher net unearned premium reserving (UPR). LPI’s retention ratio was marginally higher at 62.5% in 9MFY22 vs. 62.3% in 9MFY21.

- Underwriting margin for 9MFY22 fell from 37% to 26% due to higher claims for key segments, particularly motor which normalised after the reopening of the economy.

- Higher repair cost and awards by the courts for third party bodily injury claims have contributed to the increase in motor claims. Also, we saw a drop in underwriting profits before management expenses for fire insurance.

- LPI recorded an improved 3QFY22 net profit after tax of RM75mil (+31.2% QoQ). This was largely attributed to stronger investment income and lower net claims.

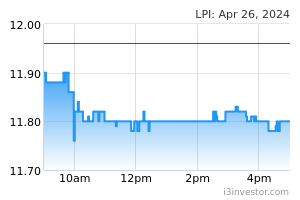

- The stock is currently trading at a fair P/BV of 2x with a decent dividend yield of 5.7% for FY23F.

Source: AmInvest Research - 18 Oct 2022