Investment Highlights

- Mixed 2QCY22 report card. 2QCY22 earnings of 8 companies under our coverage came in mixed as 2 companies outperformed while 3 were in line and 2 disappointments. Hibiscus Petroleum recorded multifold earnings growth of 7x QoQ and 4x YoY in 4QFY22 from higher realised oil prices and full quarterly contribution from recently acquired Repsol assets while Bumi Armada reported better-than-expected results on the back of lower operating expenses and finance costs.

Meanwhile, underperformers include MISC with 2QFY22 core net profit (CNP) dropping substantially by 26% QoQ to RM277mil, weighed down mainly by its offshore business division which suffered from escalated construction costs for its ongoing conversion of FPSO Mero-3 as a result of China’s Covid lockdowns and supply chain disruptions. Petronas Chemicals Group’s (PetChem) 2QFY22 earnings declined by 13% QoQ due to lower sales volume from heavy turnaround and shutdown activities coupled with heightened operating expenses that more than offset higher product selling prices.

- Slightly lower sector earnings QoQ. The sector’s flattish 2QCY22 EBITDA stemmed from PetChem’s weaker performance being mostly negated by robust growth recorded by the majority of the other companies within our coverage, particularly Hibiscus Petroleum with 4QFY22 EBITDA more than doubling to RM432mil from RM154mil in 3QFY22. The lower earnings from PetChem and MISC caused the 2QCY22 sector CNP to slide slightly by 3% QoQ.

- Domestic job flows to gain traction on higher Petronas’ capex. As highlighted earlier, 2QCY22 contract awards to Malaysian oil & gas companies were up by 49% QoQ to RM3bil compared to RM2bil in 1QFY22 (Exhibit 2), largely attributable to: (i) Sapura Energy’s award of 6 major contracts collectively worth RM2.7bil from the Asia Pacific and Atlantic regions; and (ii) Coastal Contract’s award of RM252mil contracts for a vessel charter and the extension of an existing liftboat contract.

We continue to anticipate a subsequent improvement in domestic job flows given the 31% YoY 2022 capex allocation increase from Petronas. Recall that Petronas earlier announced its 2022 capex guidance of RM40bil (excluding a RM20bil sum earmarked for PetChem’s acquisition of Perstorp Holding AB), and it is on track with a total investment expenditure spent of RM19bil as of 1HFY22.

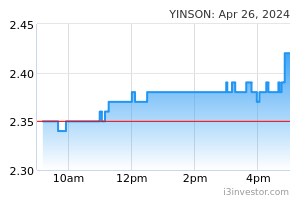

- Better prospects of selected segments. Oil and gas operators directly exposed to upstream production such as Hibiscus Petroleum have been benefitting from higher oil prices. Moreover, the floating production, storage and offloading (FPSO) subsector also stands to benefit given the decimated number of operators during the previous downturn in 2015–2017. Over the near term, we see a number of FPSO projects due to be awarded soon including Eni’s deep-water Agogo project in Angola and Total Energies’ Cameia project in Angola and Suriname project in Maka. Yinson Holdings recently became the sole qualified bidder for the Agogo project and is expected to receive a contract award by the end of 2022. Meanwhile, we gather that Bumi Armada and MISC are among active contenders for the upcoming Cameia project in Angola which is likely to entail only engineering, procurement, construction, installation and commissioning packages.

On the other hand, the outlook for other subsectors such as drilling rigs and offshore support vessels (OSVs) was relatively dull despite better industry prospects. In 2QFY22, daily charter rates for Velesto Energy’s jack-up rigs rose by 10% to US$75K/day compared to US$68K/day in FY21 while rig utilisation rate dropped to 41% from 48% in 2021 (significantly lower than Southeast Asia jack-up rig utilisation rate of above 80%) due to lower drilling activities in Malaysia. Meanwhile, Icon Offshore alongside other offshore support vessel players also continued to see minor improvements vessel daily charter rates.

On a positive note, Petronas earlier said that it is working to revise rates for existing contracts with domestic oil and gas service providers to ease contractors’ rising cost pressures. This implies potential earnings improvements ahead with potentially higher daily charter rates for the likes of Velesto Energy and Icon Offshore.

- Maintain Brent oil price projection at US$90–100/barrel for the remainder of 2022 and US$80–90/barrel for 2023. We expect crude oil prices to remain elevated in the US$90–100/barrel range for the rest of 2022 in spite of heavy downward pressures driven by dampened oil demand from slower global economic growth prospects following multiple aggressive rate hikes in major economies. This is premised on prolonged supply shortfalls due to: (i) uncertain geopolitical impact from Russia’s Ukraine invasion that has triggered cascading sanctions; (ii) chronic under-investment by international oil companies over the past 5 years amid investors’ persistent energy transition-driven prerogatives; and (iii) substantive global supply chain disruptions and elevated risk premiums for commodities.

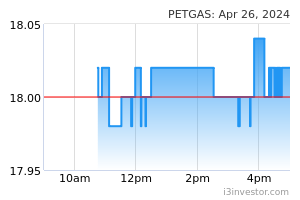

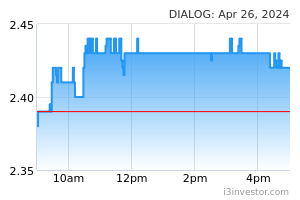

- Reiterate OVERWEIGHT on the sector. Our top picks for the sector include Dialog Group, backed by resilient noncyclical tank terminal and maintenance-based operations at its strategically located Pengerang development, which has multi-year investment opportunities. We also like Yinson’s commendable earnings growth, underpinned by robust outstanding order book, ample tender prospects and the likely addition of the Agogo project to its portfolio, as well as Petronas Gas, which offers highly compelling dividend yields from its optimal capital structure strategy and recurring earnings base.

- Key downside risks include: (i) further deterioration in oil demand amid the rising likelihood of a global economic downturn following the aggressive rate hikes by major central banks; (ii) slower domestic oil and gas contract flows; (iii) potential rise in oil production due to fresh investments in the sector; (iv) continued de-rating of oil and gas companies’ valuation due to ESG concerns.

Source: AmInvest Research - 14 Sept 2022