Investment Highlights

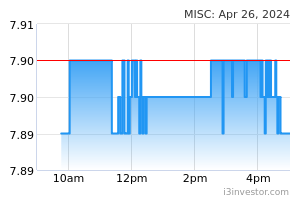

- We upgrade MISC to BUY with a lower sum-of-parts-based (SOP) fair value (FV) of RM7.95/share (from RM8.21/share previously) as the share price has retraced by 11% over the past 3 months. Our FV also reflects a premium of 3% for our unchanged 4-star ESG rating.

- It also implies an FY22F EV/EBITDA of 11x, 1 standard deviation above its 3-year average of 9x.

- We cut our FY22F core net profit (CNP) by 11% to factor in a lower profit margin for the offshore business division in view of the increased construction costs of Mero 3. Likewise, we slightly lower FY23–24F earnings by 5–6%.

- MISC’s 1HFY22 CNP of RM650mil (excluding net impairments of RM300mil for 10 liquefied natural gas carriers and unrealised forex gain of RM8mil) came in below expectations, accounting for only 35–36% of our FY22F net profit and consensus. To put into perspective, 1H accounted for 51–65% of FY18–21 CNP. The group also declared a second interim dividend of 7 sen, bringing 1HFY22 DPS to a total of 14 sen, which was flat YoY.

- The group’s 2QFY22 CNP fell 26% QoQ to RM277mil, no thanks to the lower operating profit from gas assets & solutions and offshore business operations. The operating profit decline in the offshore business division was mainly due to higher construction costs of floating, production, storage and offloading vessel (FPSO) Mero 3 arising from global supply chain delays and recent lockdowns in parts of China.

- This caused the Mero 3 FPSO’s construction progress to reach only 48% by end-2QFY22. The group expects the project completion to be delayed by 6 months (compared to its earlier guidance of 3 months). MISC also estimated that Mero 3’s total construction costs will be 8–9% higher than original estimated capex of US$2bil, which reduces the project IRR from 9.4% to 8.3% and NPV by 28% to RM1.8bil.

- The group’s QoQ earnings decline was further impacted by gas assets & solutions earnings decrease of 16% due to higher drydocking days. The gas assets & solutions segment remained the biggest earnings contributor at 72% of 2QFY22 group EBIT, followed by petroleum & product shipping (25%) and offshore business (9%).

- On a brighter note, the petroleum & product shipping division’s operating profit escalated by a whopping 3.6x QoQ mainly from higher freight rates in the mid-sized tanker (Suezmax and Aframax) segment coupled with additional earnings days. The marine and heavy engineering division also remained in the black with 2QFY22 operating profit surging by 4.1x mainly from higher revenue and post-sail-away reversal of warranty provisions for heavy engineering projects.

- The longer term outlook for MISC remains promising given the group’s fleet expansion plans backed by improved spot rates in LNG and petroleum tankers as well as healthy demand for FPSOs amid elevated oil prices, with gas assets and solutions enjoying a robust EBIT margin of 47% in 1HFY22.

- MISC currently trades at a compelling FY23F EV/EBITDA of 8x, 11% below its 3-year average of 9x.

Source: AmInvest Research - 19 Aug 2022