Investment Highlights

- Industry loan growth accelerated to 5.6% YoY in June 2022. This was supported by A higher household loan growth of 5.9% YoY and non-household loans of 5.3% YoY. Lending for working capital loans picked up pace. By segment, this was driven by stronger expansion of loans to the agriculture, wholesale, retail, restaurants and hotels as well as the transport, storage and communication sectors. YTD, the industry’s annualised loans have grown by 5.4%, within our expectation of a 5–6% expansion for 2022 supported by GDP growth of 5.6%.

- Good traction for loan applications and approvals in June 2022. June 2022 saw stronger growth in applications and approvals for both household and non-household loans.

- CASA growth improved slightly to 8.8% YoY in June 2022. The sector’s CASA ratio remained stable at 32%. LD ratio for the sector was sustained at 86.7% while LCR slipped slightly to 148%.

- Continued uptick in GIL ratio as borrowers exit loan repayment programmes leading to the tapering of the percentage of loans under repayment assistance. The sector GIL ratio inched higher to 1.7% in June 2022 vs. 1.6% in May 2022 while NIL ratio was stable at 1.0%.

- Total provisions for the sector continued to increase marginally by 0.6% MoM or RM223mil in June 2022. Comparing June 2022 to the end of March 2022, the increase in the industry’s total provisions was modest at only 1.8% or RM627mil.

- We see a more stable MGS yield in 2H22 vs. 1H22. In 1H22, banks non-interest income was impacted by the negative marked-to-market revaluation on securities following the more volatile movements in yields. With a stable MGS yield after the acceleration of US Fed rate hikes of 75bps in both June and July 2022, we expect banks’ earnings from the treasury segment (trading and investment income) to improve in 2H22 compared to 1H22.

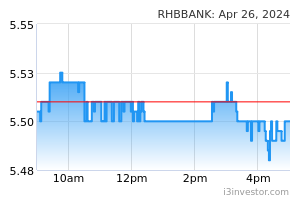

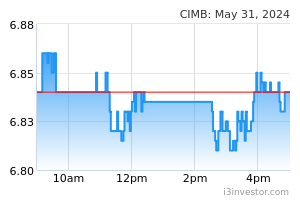

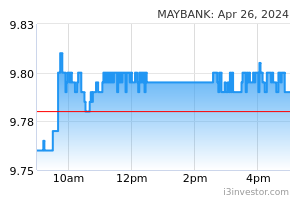

- Retain our OVERWEIGHT stance on the sector with our top BUYs of RHB Bank (fair value RM7.40/share), CIMB Group (FV RM6.60/share) and Maybank (FV RM10.30/share). Our economist expects another 1 to 2 OPR hikes of 25bps each for the remainder of 2022, lifting the benchmark interest rate to 2.5–2.75%.

Source: AmInvest Research - 1 Aug 2022