Investment Highlights

- We maintain our HOLD recommendation on Globetronics Technology (GT) with a lower fair value of RM1.12/share (previously RM1.53/share), pegged to a rolled forward FY23F PE of 16x. This is 0.5 standard deviation (SD) below its 5-year mean on the account of its lower growth prospects. We make no price adjustment based on our 3-star ESG rating.

- Our FY22F–FY24F earnings have been reduced by 6%–19% as GT’s 1HFY22 core profit continued to disappoint, making up only 34% of our FY22F earnings and 37% of consensus.

- As a comparison, GT’s 1H core profit accounted for 42%–49% of its full-year results over the past 3 years. Our projections also assume that the group’s effective tax rate will revert to 24% (from 6%) following the expiry of its pioneer status on June 2022.

- GT’s 1HFY22 core profit increased 15% YoY to RM90mil despite revenue decreasing by 11%. This is largely due to a better product mix achieved from the discontinuation of lowmargin quartz crystal timing components, which improved the group’s gross profit margin by 8% points YoY to 41%.

- On a QoQ basis, GT’s core profit grew 14%, thanks to improving volume loadings and better economies of scale from key customers. The group also booked a higher forex gain of RM1.3mil in 2QFY22 compared to RM0.5mil in 1QFY22.

- The group declared a dividend/share of 2 sen in 2QFY22, bringing YTD dividend/share to 5 sen, equal to 1HFY21.

- GT has multiple projects in the pipeline, which include nextgeneration optical sensors for advanced driver assistance systems (ADAS) in vehicles as well as robotic systems. However, we do not expect the new products to be commercialised at least until the end of 2022.

- The group’s prospects will highly depend on the timely delivery of next-generation sensors, where the segment is rapidly expanding at a projected compound annual growth rate (CAGR) of 28% from 2021 to 2030, according to Allied Market Research.

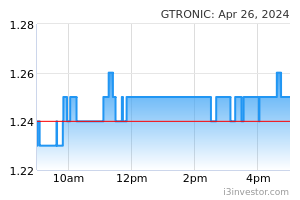

- While GT’s share price has fallen by 28% YTD, we opine that the stock is currently fairly priced at a FY23F PE of 17x (0.5 SD below 5-year mean) given the softer outlook in its sensor business as key customers are still caught in supply chain bottlenecks, potentially leading to lower volume loadings.

Source: AmInvest Research - 27 Jul 2022