Investment Highlights

- Mixed 1Q2022 report card as 25% of the stocks under our coverage were outperformers, 48% in line and 27% below expectations. Amongst all the sectors, plantation stood out as 6 out of 7 stocks in our current coverage outperformed due to higher-than-expected crude palm oil prices. This was followed by REITs due to stronger rental revenue and a pick-up in the retail sector. Other companies which outperformed were in the oil & gas, automobile and consumer sectors.

- Raised 2022 earnings estimates. Post-1Q2022 results review, our FBMKLCI’s 2022F EPS has turned around to a growth of 1.1% from an earlier 5.6% contraction due to higher earnings revisions mainly from the plantation and oil & gas sectors. For the oil & gas sector, the upward earnings revision stemmed largely from Petronas Chemicals which benefited from elevated product prices. The higher 2022 EPS base also moderated our FBMKLCI 2023F EPS growth from an earlier 14.9% to 8.3%. Even so, this will be the second highest growth since 2017, coming in after the 30.7% rebound in 2021 in the wake of the 2020 initial pandemic lockdowns.

Similar to our FY22F EPS growth revisions, we expect positive adjustments to FY23F earnings cycle moving towards the year-end as reopened borders and supply chain normalisation will underpin a stronger economic outlook together with the tapering impact of a higher interest rate regime and the absence of 2022 Prosperity Tax.

- Amid regional PE discounts. In terms of valuations, the FBMKLCI’s 2022 PE of 14.9x currently implies a significant 9% discount to its 5-year median of 16.4x. Within the ASEAN region, the Philippine index’s YTD drop of 4.9% now translates to a widest 22% discount to its 5-year PE median, followed by Indonesia at 13.2%. Outside ASEAN, most of the other countries are at discounts to their 5-year PE medians with Taiwan at 20.2%, China 14.6%, Japan at 11.7% and Hong Kong 9.7%.

- Hesitant net foreign buying. Foreign investors, who have been net sellers over the past 4 years and switched to buying positions earlier this year, were more hesitant buyers in May. Net purchases sank 91% MoM to only RM77mil as foreigners were net sellers for 8 trading days last month compared to 5 days in April 2022. 2022 YTD, foreigner equity investors have remained in net buying positions with a total of RM7.4bil, raising foreign shareholding to 20.4% as at May 2022 from 20.1% in Feb this year.

Supported by robust oil prices and 2022 GDP growth of 5.6%, our in-house base-case view the ringgit strengthening against the USD from RM4.39 currently to RM4.25 in 4Q2022 with up to 2 rate hikes in 2H2022, gradually normalising to RM4.12 in 2023. Under this relatively contained currency risk outlook, we still expect foreign investors to continue gravitating towards Malaysian equities.

- Looking towards year-end recovery. We still expect a largely range-bound FBMKLCI over the next quarter at 1,500 to 1,600 as domestic liquidity could partially cushion any negative earnings revisions amid a potentially slower economic growth outlook dampened by elevated crude oil prices above US$100/barrel and ongoing supply chain disruptions. Even so, regional markets could begin to brighten as Shanghai has begun to ease a range of Covid-19 restrictions.

Towards the end of the year, we believe a long-awaited semblance of normalcy will underpin a market inflection point as local institutions reposition on likely window-dressing activities amid clearer visibility to our revised FBMKLCI 2023 EPS growth recovery. This will be the fastest expansion since 2017, excluding the 2021 sharp rebound of 31% YoY from unprecedented Covid-19 lockdowns in 2020.

- Maintain base-case end-2022 FBMKLCI target at 1,745, pegged now to a 5% discount to its 5-year median, from no discount earlier, as the reopening of international borders may be mitigated by the recent slower foreign equity inflows, earnings volatility amid commodity price swings, further supply chain shocks from Russia being shunned by the global economy, potential GST reintroduction and political noises running up to the 15th general election (GE15).

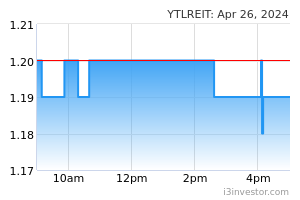

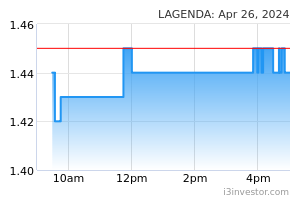

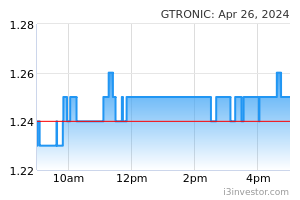

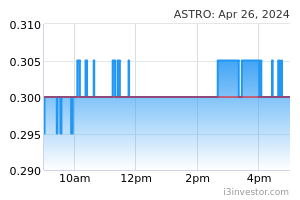

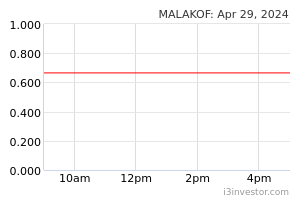

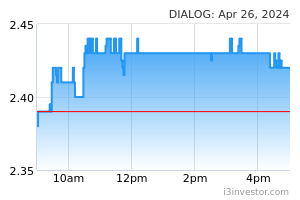

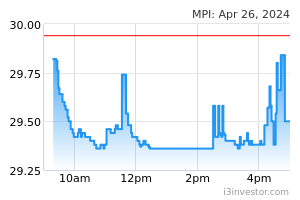

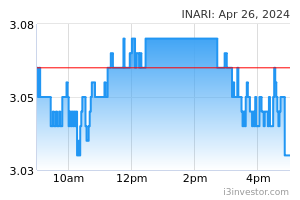

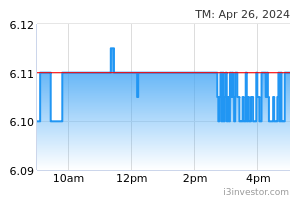

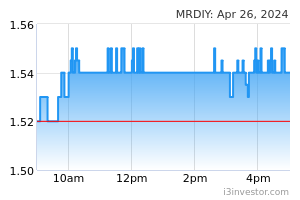

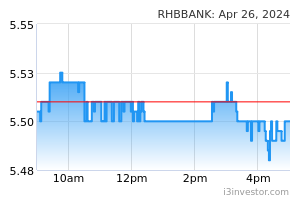

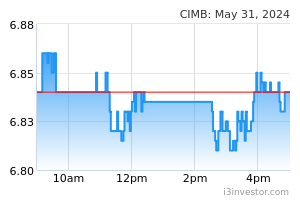

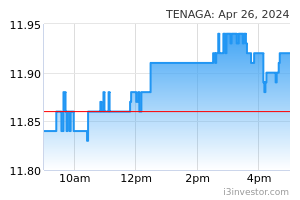

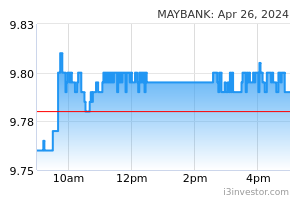

- Maintain OVERWEIGHT on the automobile, banking, media, oil & gas, ports, power and technology sectors with top BUYs being Maybank, Tenaga Nasional, CIMB Group, RHB Bank, MR D.I.Y., Telekom Malaysia, Inari Amertron, Malaysia Pacific Industries, UMW Holdings and Dialog Group. Sectors with NEUTRAL rating are gloves, healthcare, insurance, property, REITS, telecommunications, EMS, consumer and construction. For dividend stocks, our top 5 picks with yields of over 6% are Malakoff, Astro, Globetronics, Lagenda Properties and YTL REIT.

Source: AmInvest Research - 2 Jun 2022